NerdyLeather

Members-

Posts

26 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

NerdyLeather's Achievements

Member (2/4)

-

How Did You Start Your Business?

NerdyLeather replied to DavidL's topic in Marketing and Advertising

On the business side, since you’re in New York and may expand in the future, it’s important to understand the legal requirements for operating in other states. A helpful resource that explains “foreign qualification” - and when a company must register to do business outside its home state - can be found here: https://www.incorp.com/resources/knowledge-base/foreign-qualification -

How Did You Start Your Business?

NerdyLeather replied to DavidL's topic in Marketing and Advertising

I started small and avoided big loans, reinvesting early profits back into the business. At first, I sold locally and online, testing what worked. One beginner mistake was underpricing and not fully calculating expenses. A major breakthrough came when I began treating it like a real business -tracking costs, building supplier relationships, and focusing on branding and customer trust. -

Seeking highly skilled leather worker for boxing gloves

NerdyLeather replied to OnslaughtSports's topic in Help Wanted

Boxing gloves are a whole different beast compared to normal leather projects. The patterning, the curved seams, the padding placement, and the break in feel all take a lot of trial and error. Even experienced makers get intimidated by them. You might have better luck finding someone who has worked on motorcycle gloves or heavy sports gear. Those folks already understand layered padding and tight curves, so the jump isn’t as huge. With clear patterns and a training period like you mentioned, it’s doable, just not something most casual leatherworkers will touch. -

This looks like a solid project for someone who’s already comfortable with structured builds. Having the salpa mockup and full tech pack ready will make the prototype stage a lot smoother since the big decisions are already mapped out. If you haven’t yet, you might get good responses from small independent studios too. Plenty of makers who usually take on bag commissions enjoy doing one off prototypes, especially when the specs are clear and the communication is organized.

-

These 246 clones can be surprisingly decent once you clean out the shipping oil and sort the timing. The casting looks pretty normal for this tier. I still lean toward lighter new models because they hold their settings better and you don’t end up fighting worn parts or mystery fixes from previous owners. When I wanted a clear reference point for how the originals are built, I bought from Lords Sewing and their Brother lineup made it a lot easier to understand what a proper spec should look like and what a clone needs to match.

-

Some batches of pure neatsfoot can smell pretty rough, especially if it’s closer to the old style stuff that isn’t overly filtered. Cloudiness and thickening in cooler temps can happen too, since real neatsfoot isn’t always perfectly clear or stable like the more refined brands. That said, what you’re describing sounds stronger than normal. Most leatherworkers avoid anything with a heavy rancid odor because it usually means oxidation or mixed fats. I wouldn’t put it on good leather either. You probably didn’t get scammed on purpose, but it might be a low grade or poorly stored product. I’d stick with the brands you’ve had good results with and keep this one away from your projects.

-

Help Wanted: Leather Tooling Artist

NerdyLeather replied to BaroqueLeatherGal's topic in Help Wanted

This sounds like a solid opportunity for someone who already does detailed tooling. The mix of fantasy and western styles is a fun range and having materials provided takes a lot of stress out of the setup. Shipping the pieces also makes it workable for people who aren’t anywhere near California. If you post a few examples of past projects here, you’ll probably get some interest. Leatherworkers like seeing the style expectations before reaching out. -

You might have luck checking with small upholstery shops or independent leatherworkers around Tacoma and Seattle. A lot of them have industrial machines and are used to patterning off existing items. Even if they can’t take on the full teaching part, many are open to doing the pattern and a sample build. Local makerspaces can also be a good lead. People there often know someone who does leather full time and is open to commission work plus walkthroughs.

-

So you want a scanned to pdf file of all of the pages?

-

Each sheet is 11x17 so 22x17 folded in half. That would be a difficult size to print or scan.

-

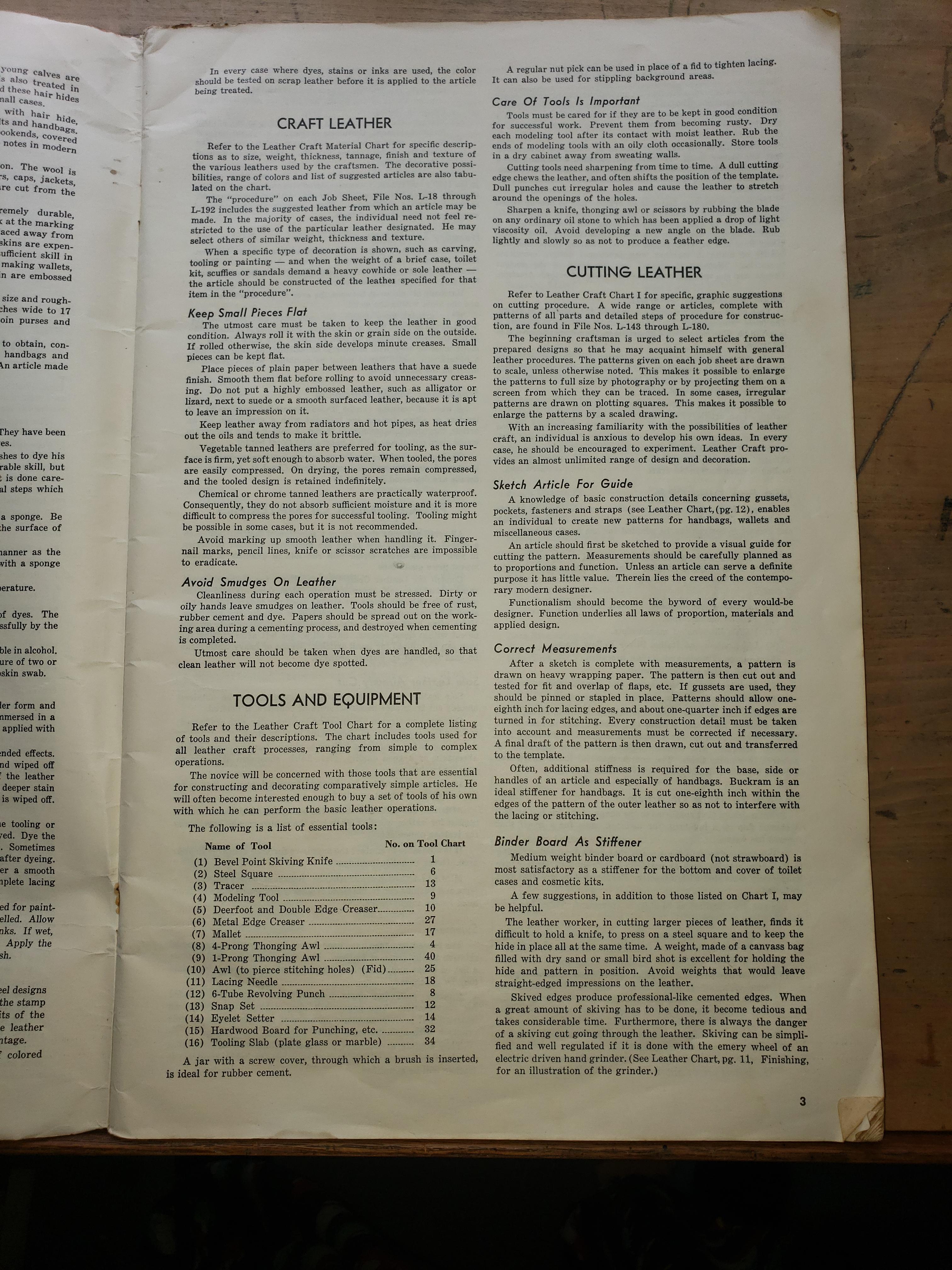

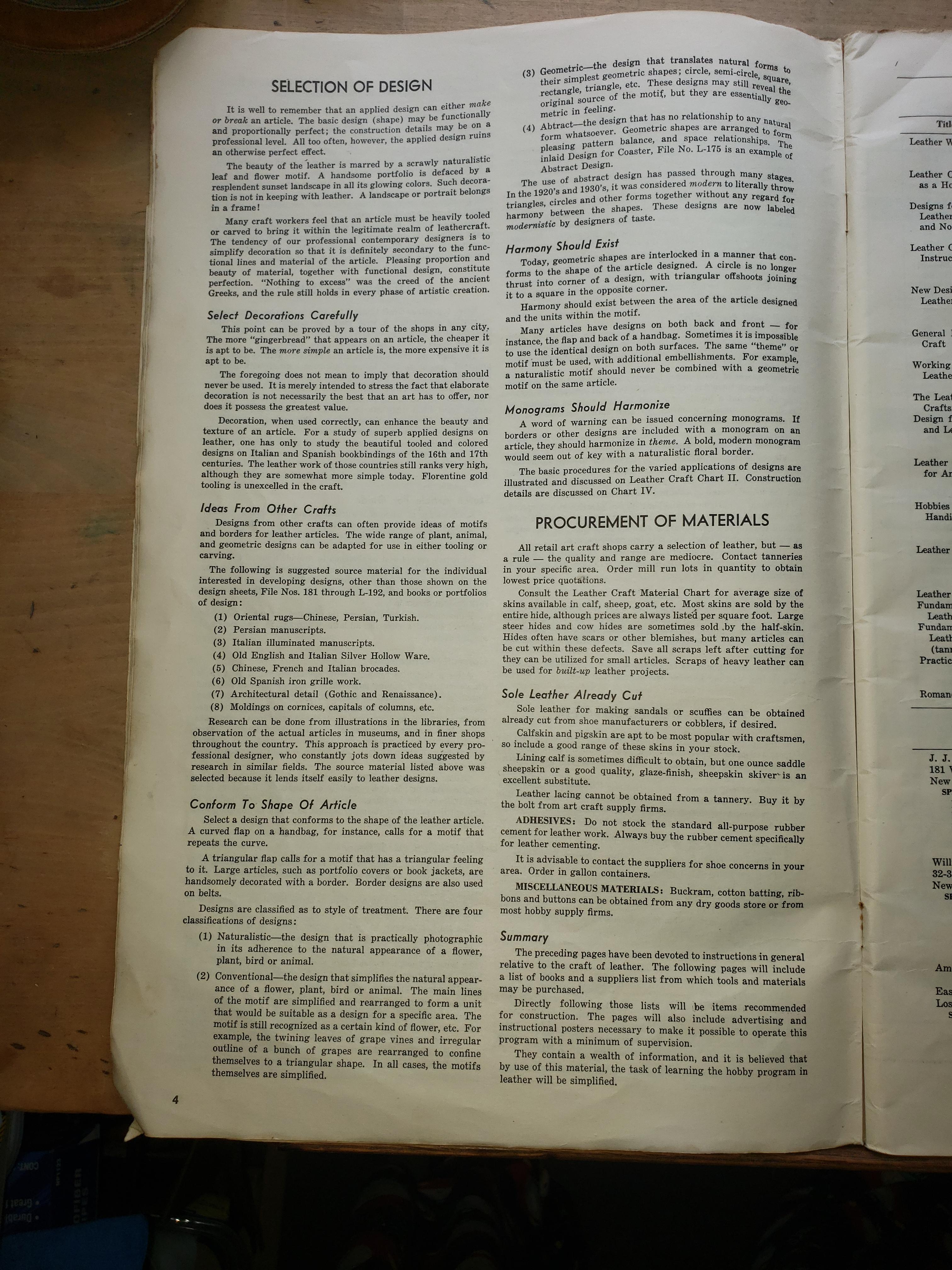

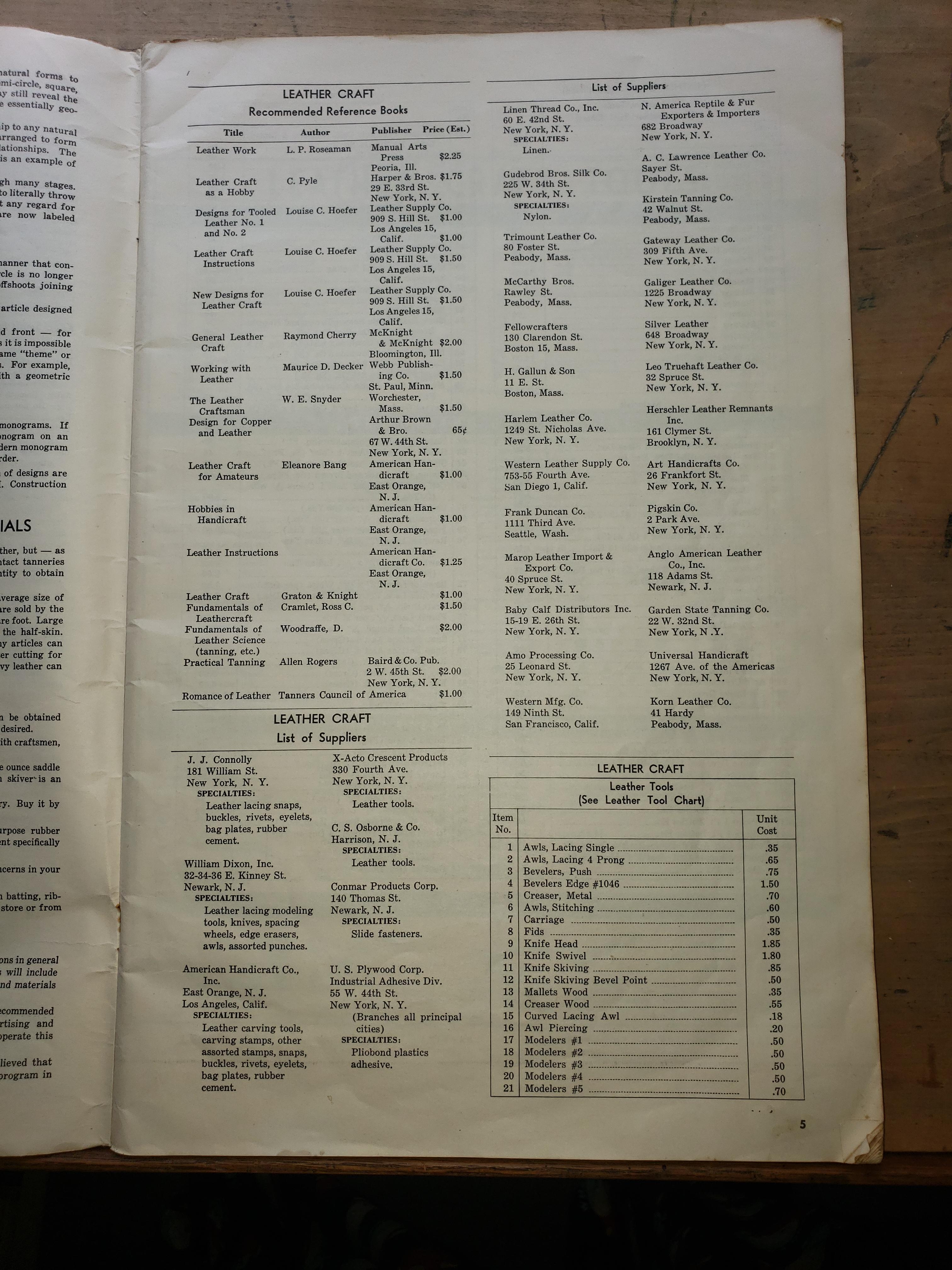

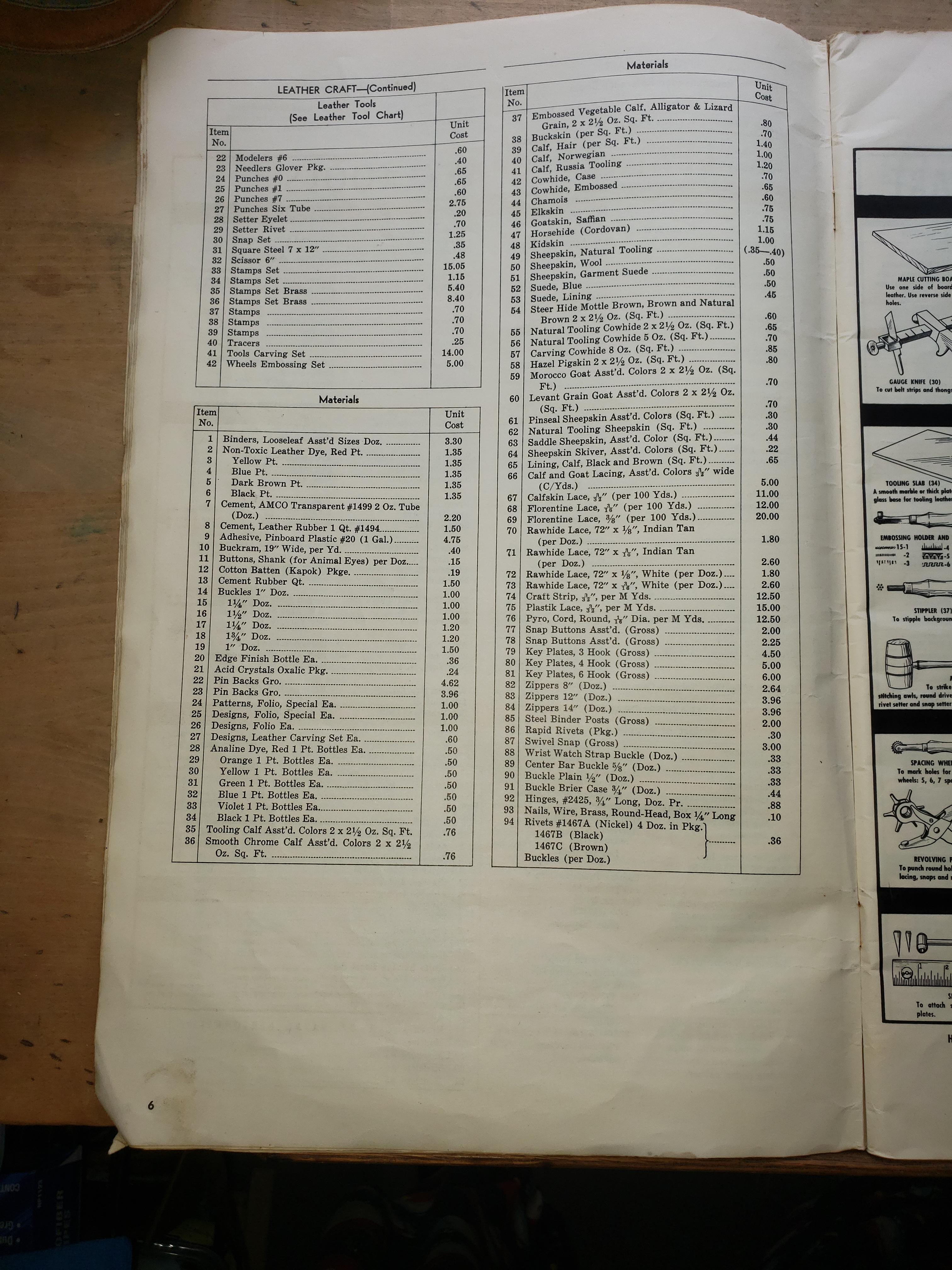

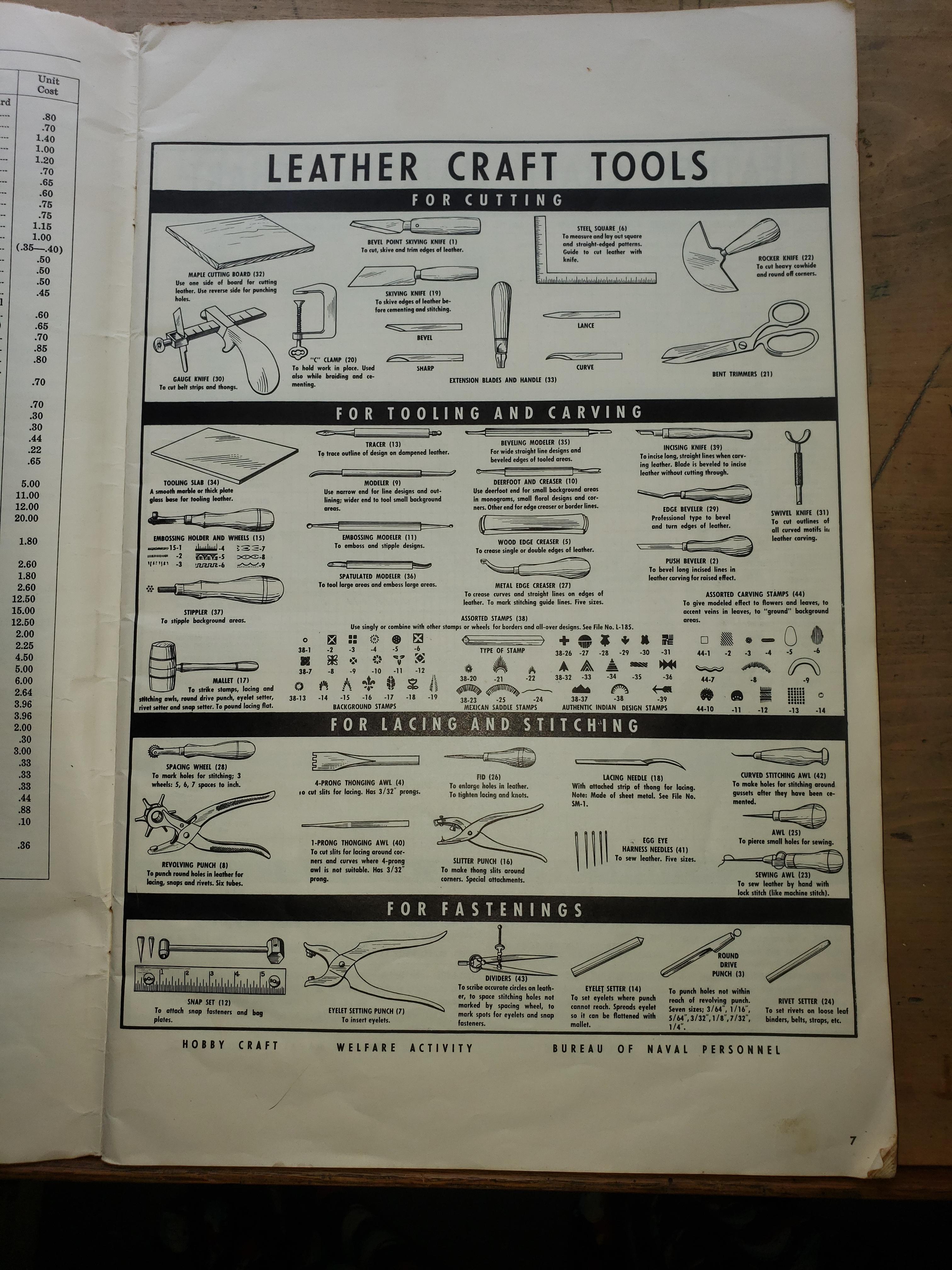

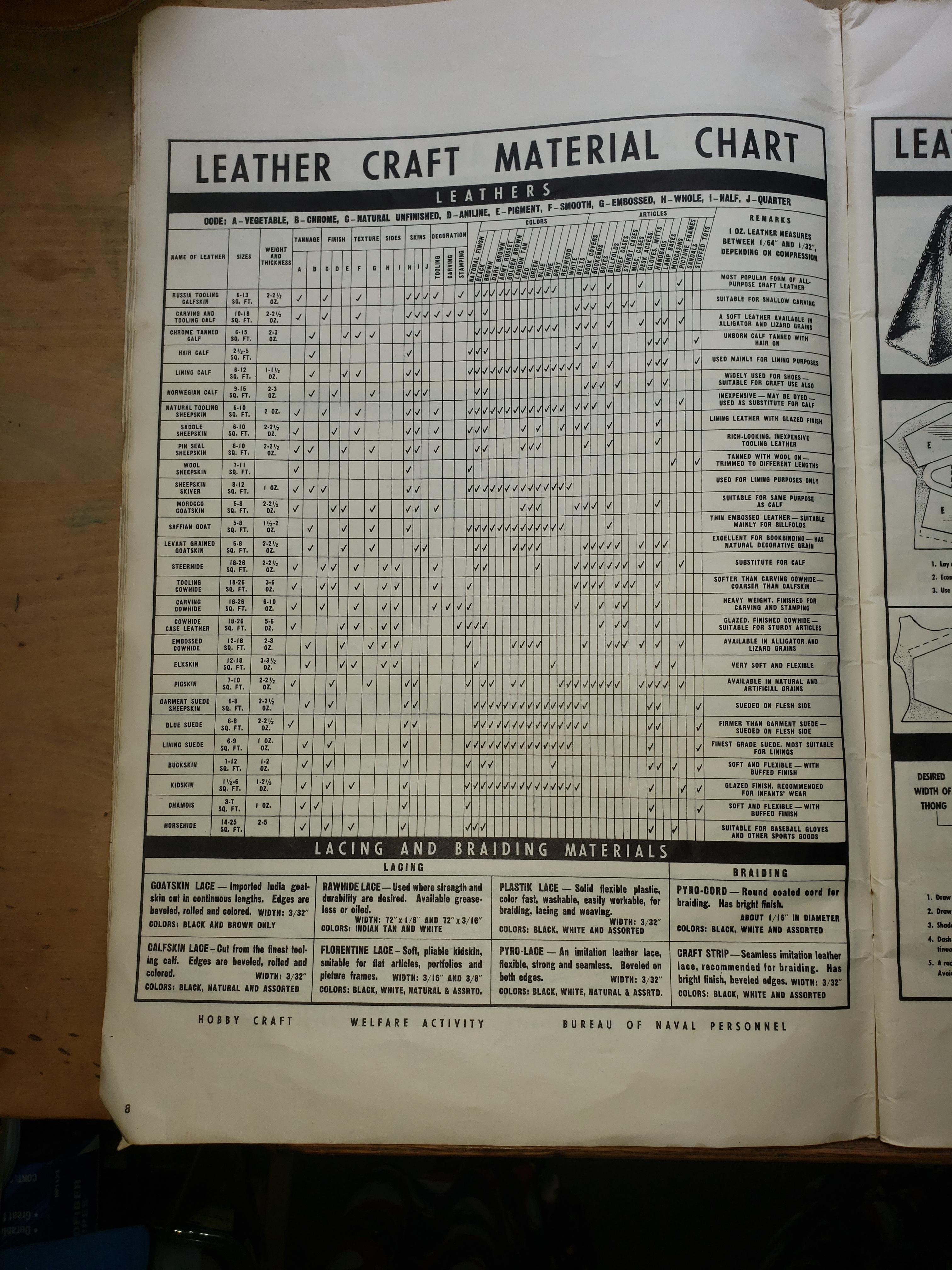

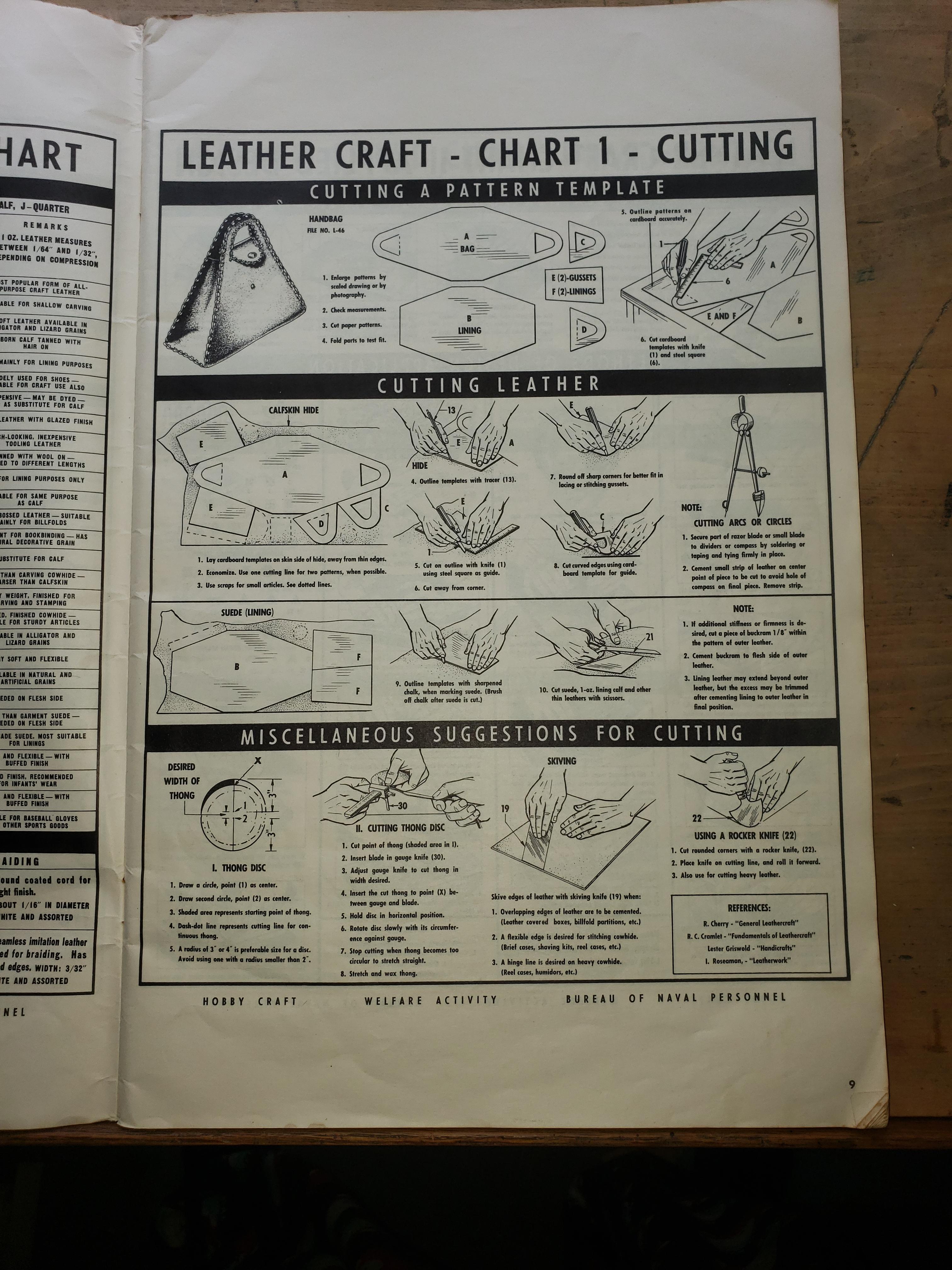

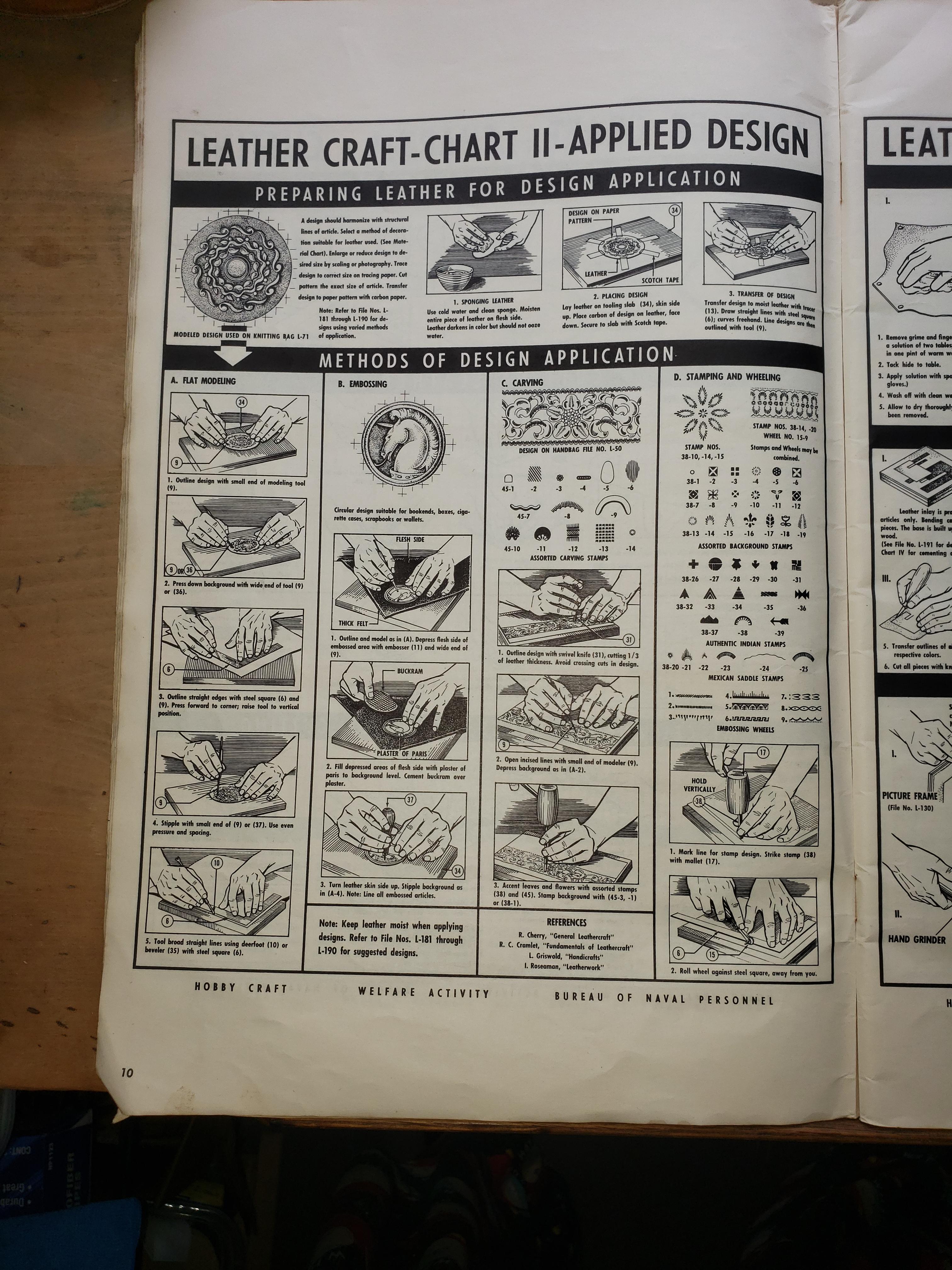

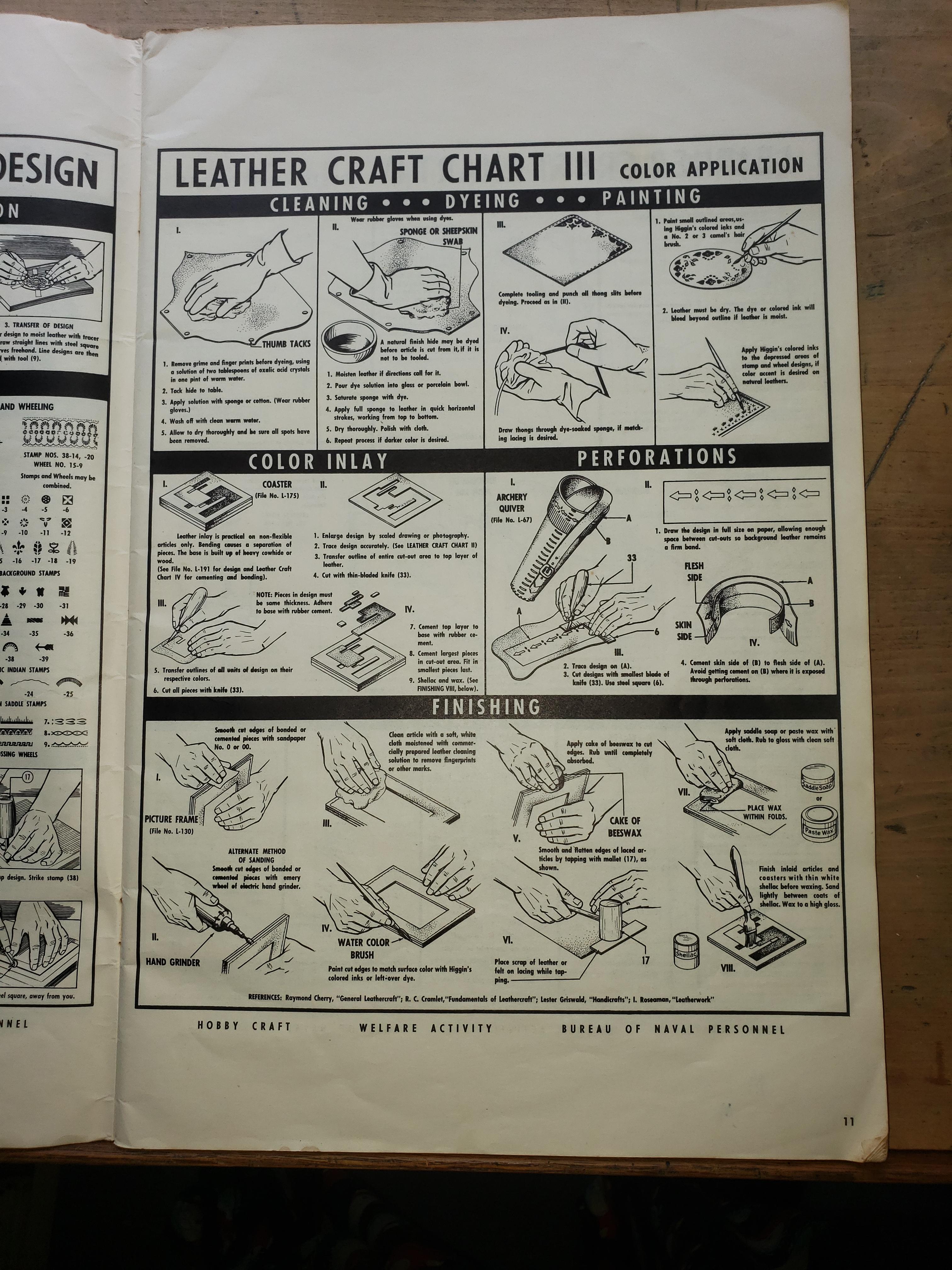

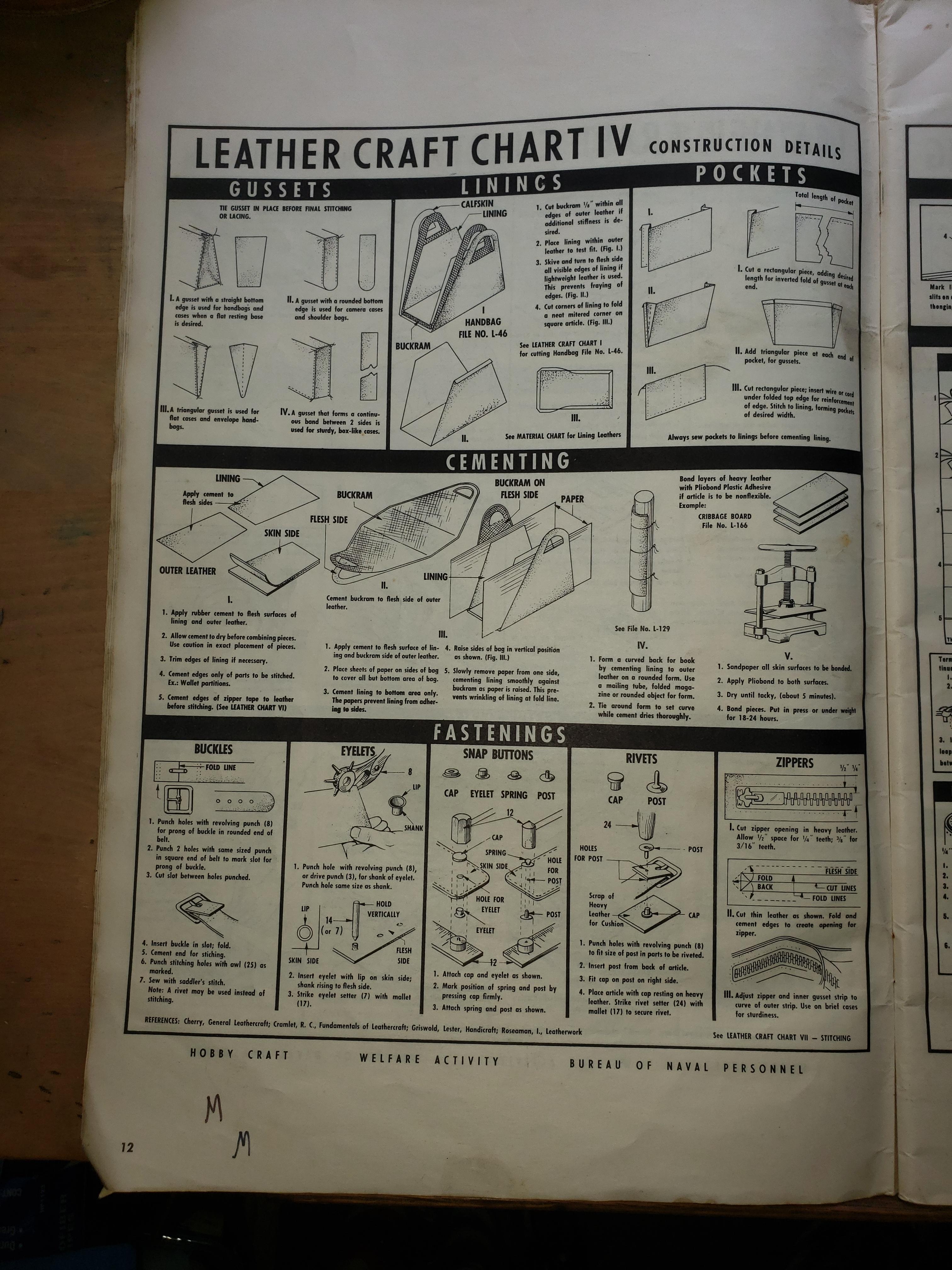

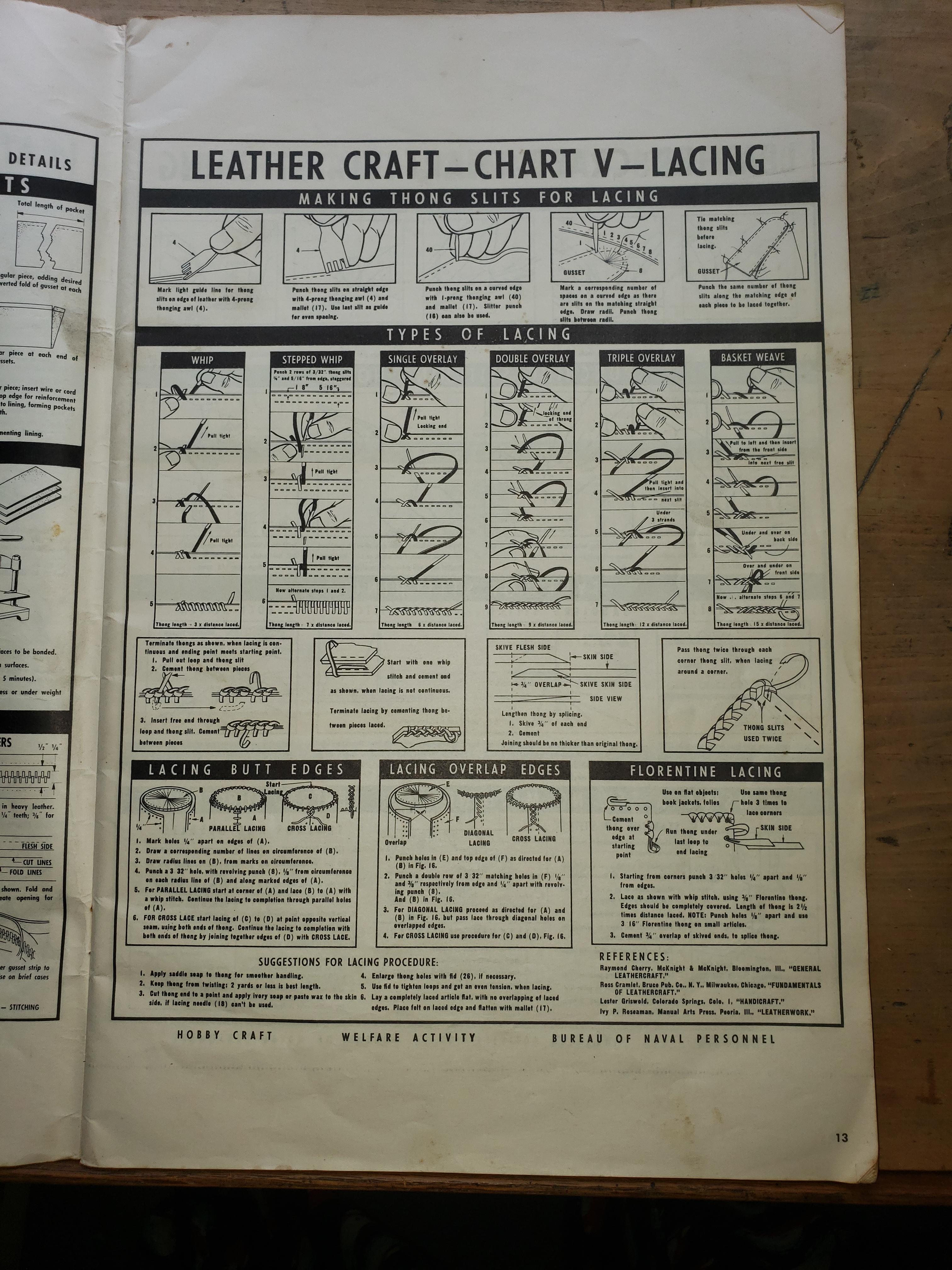

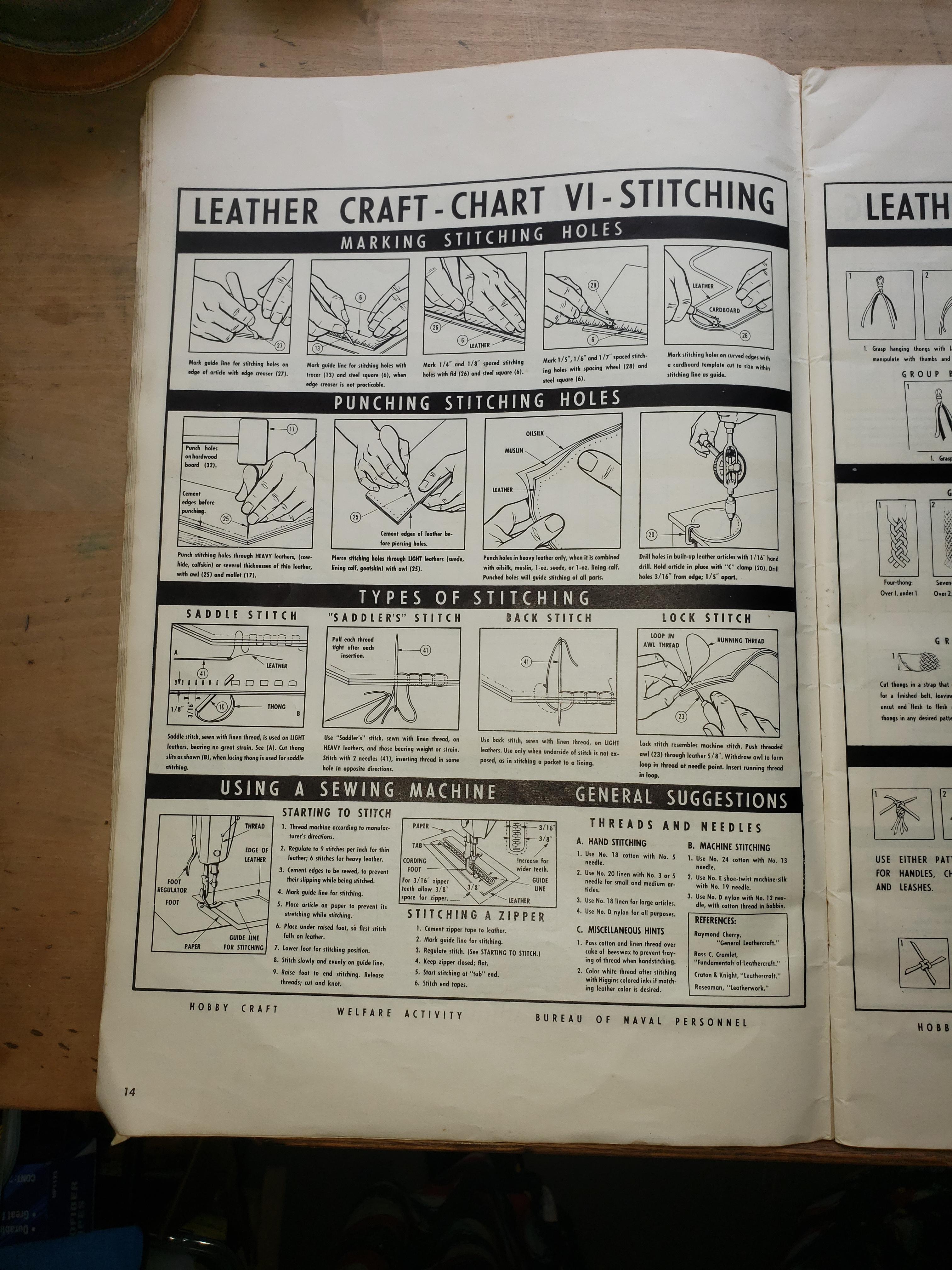

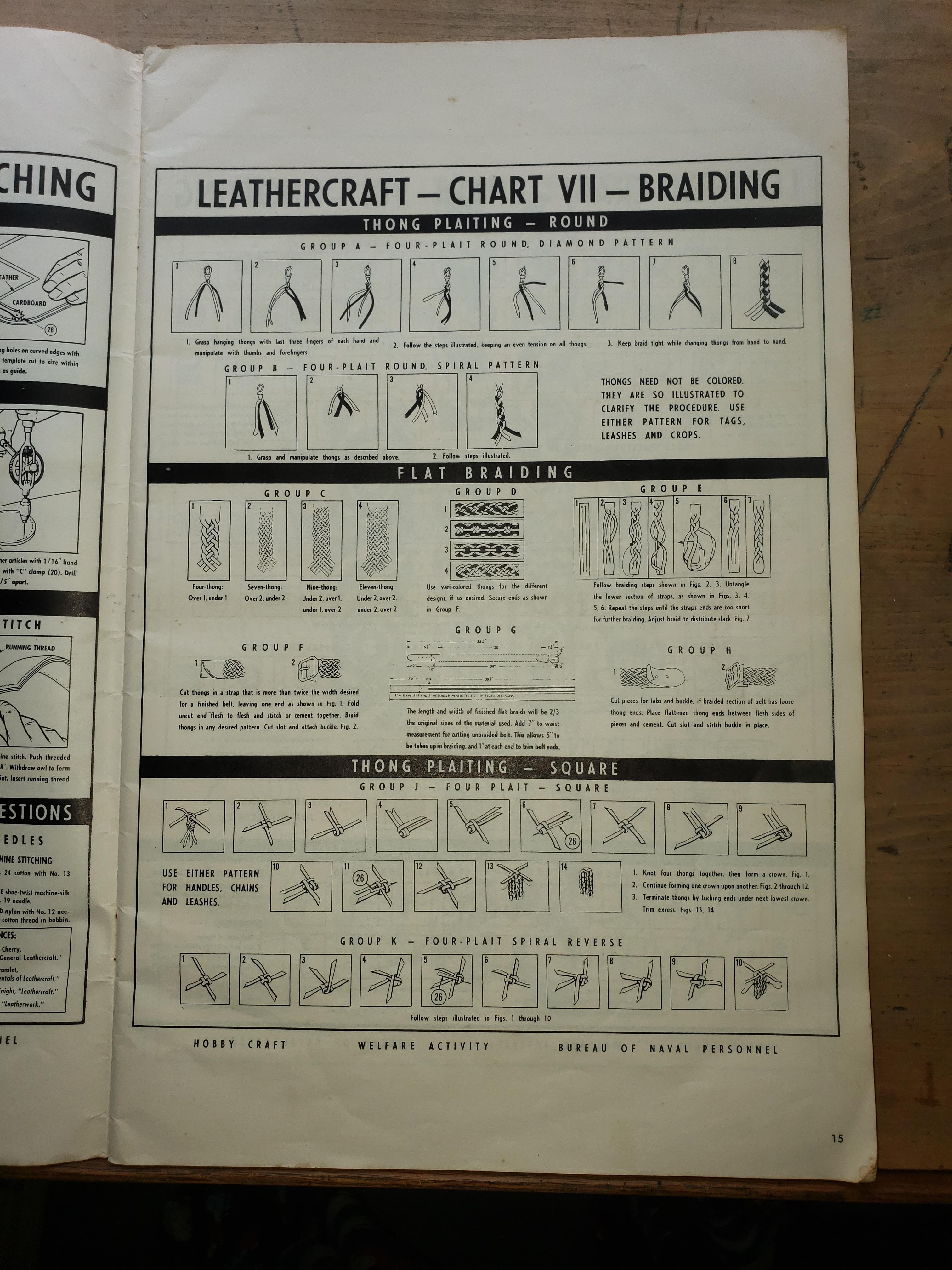

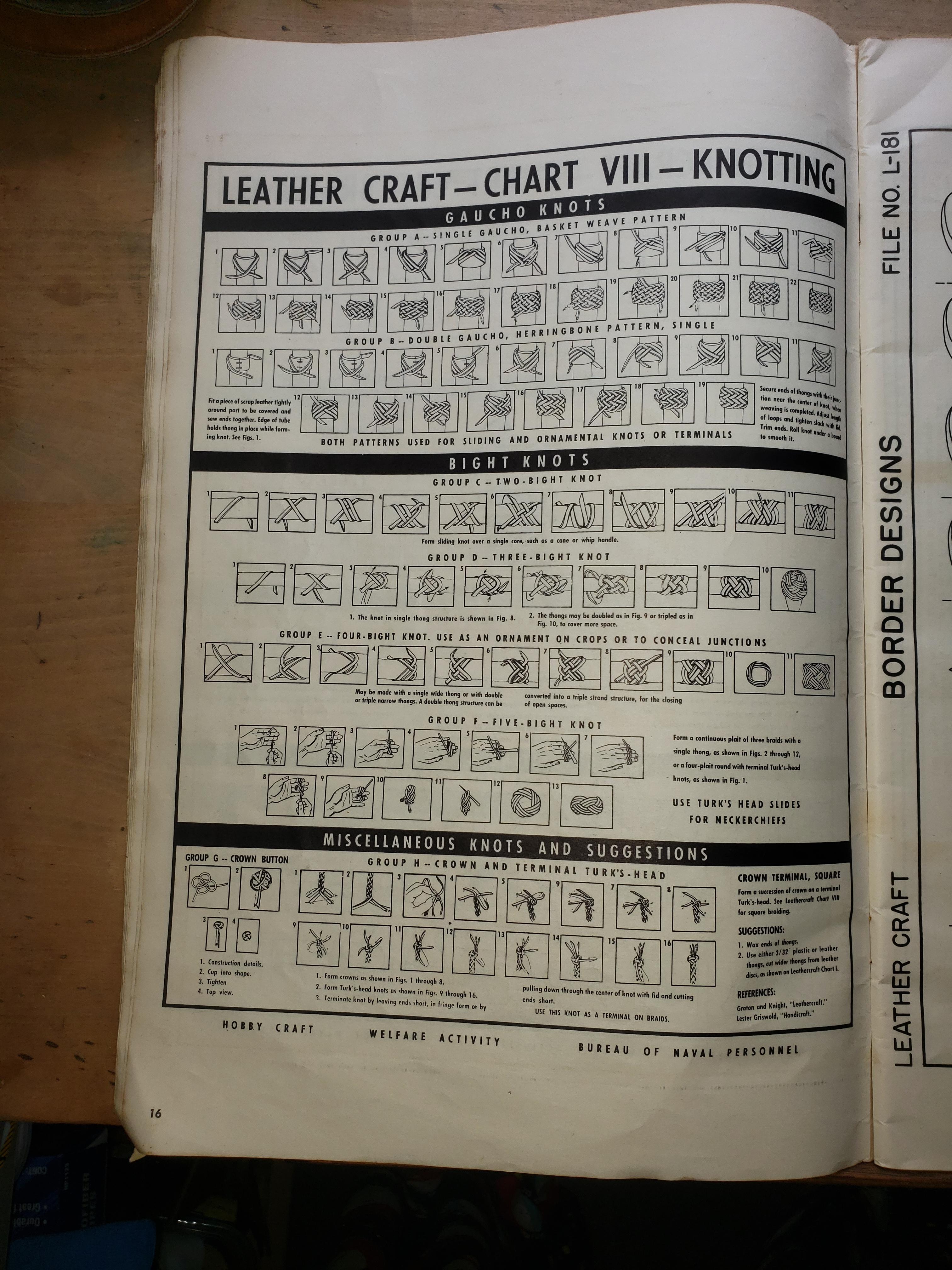

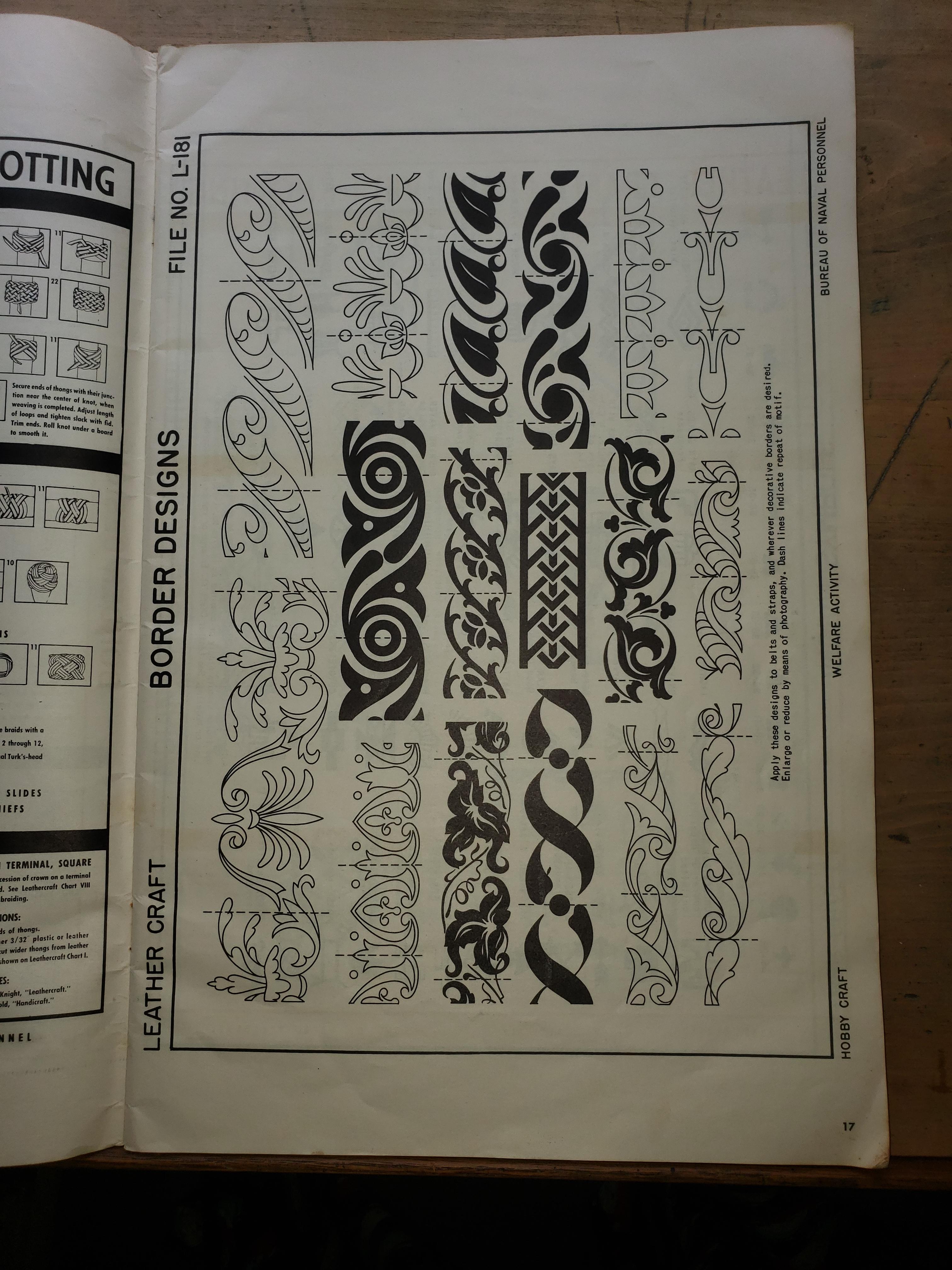

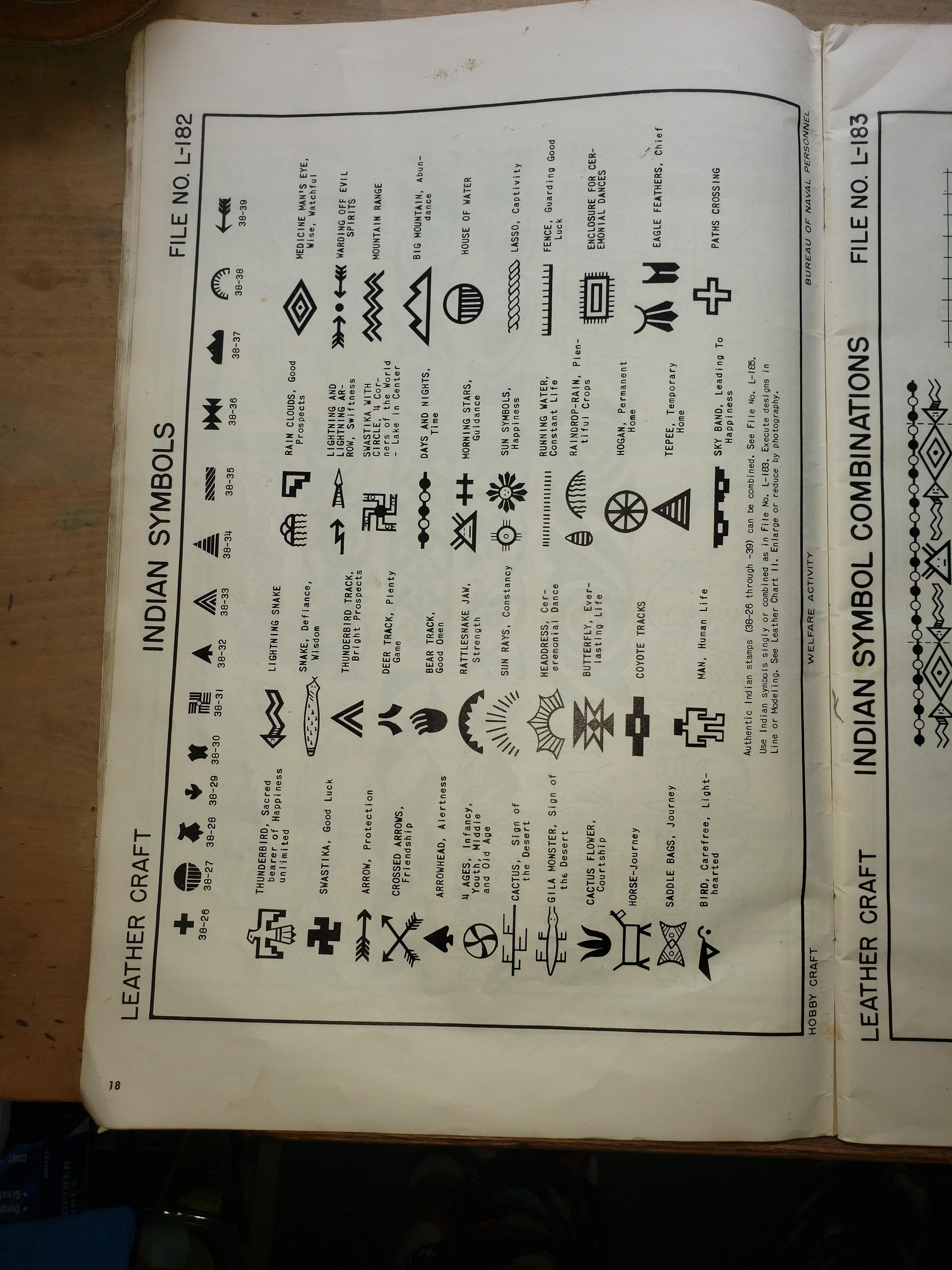

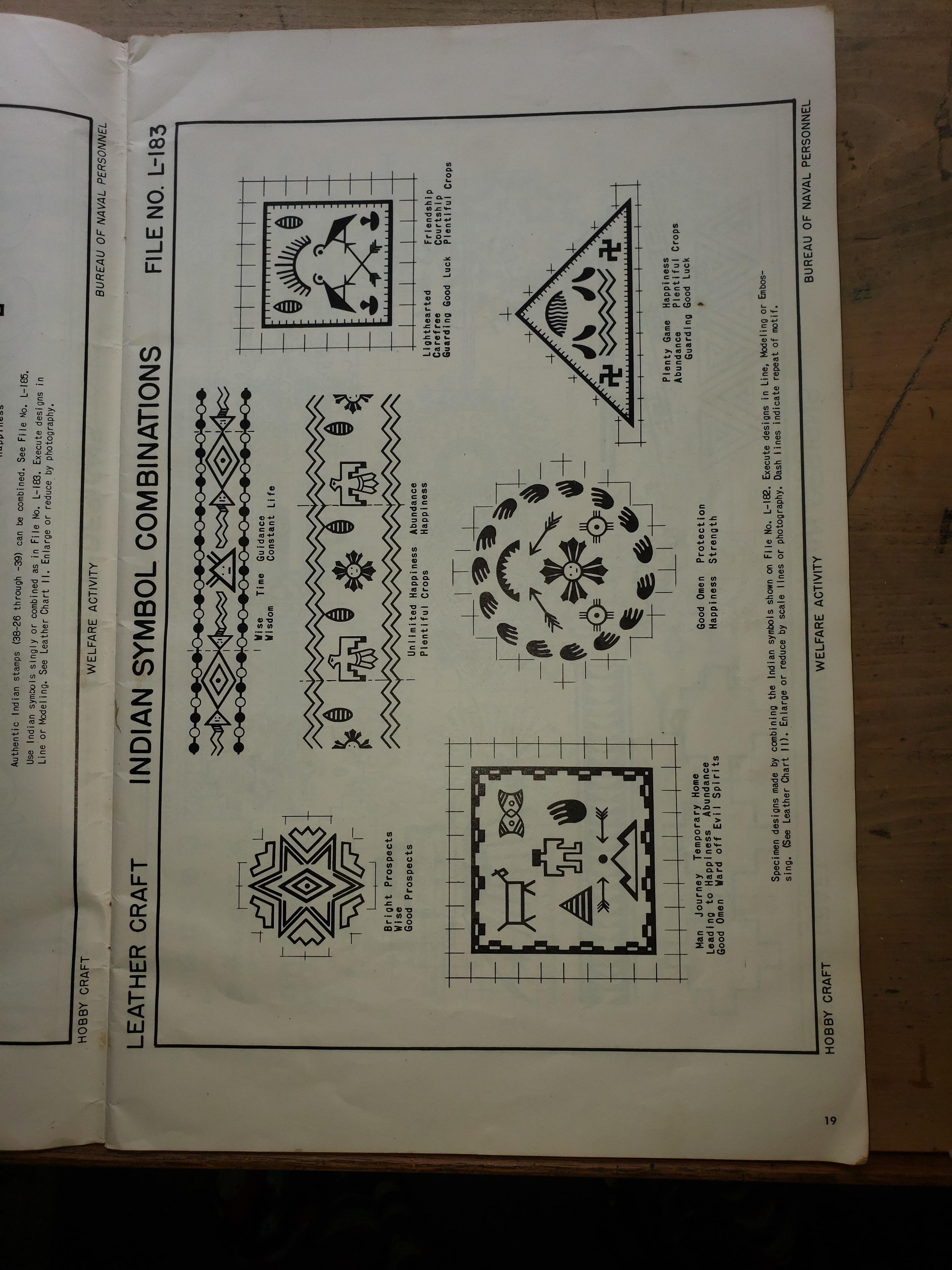

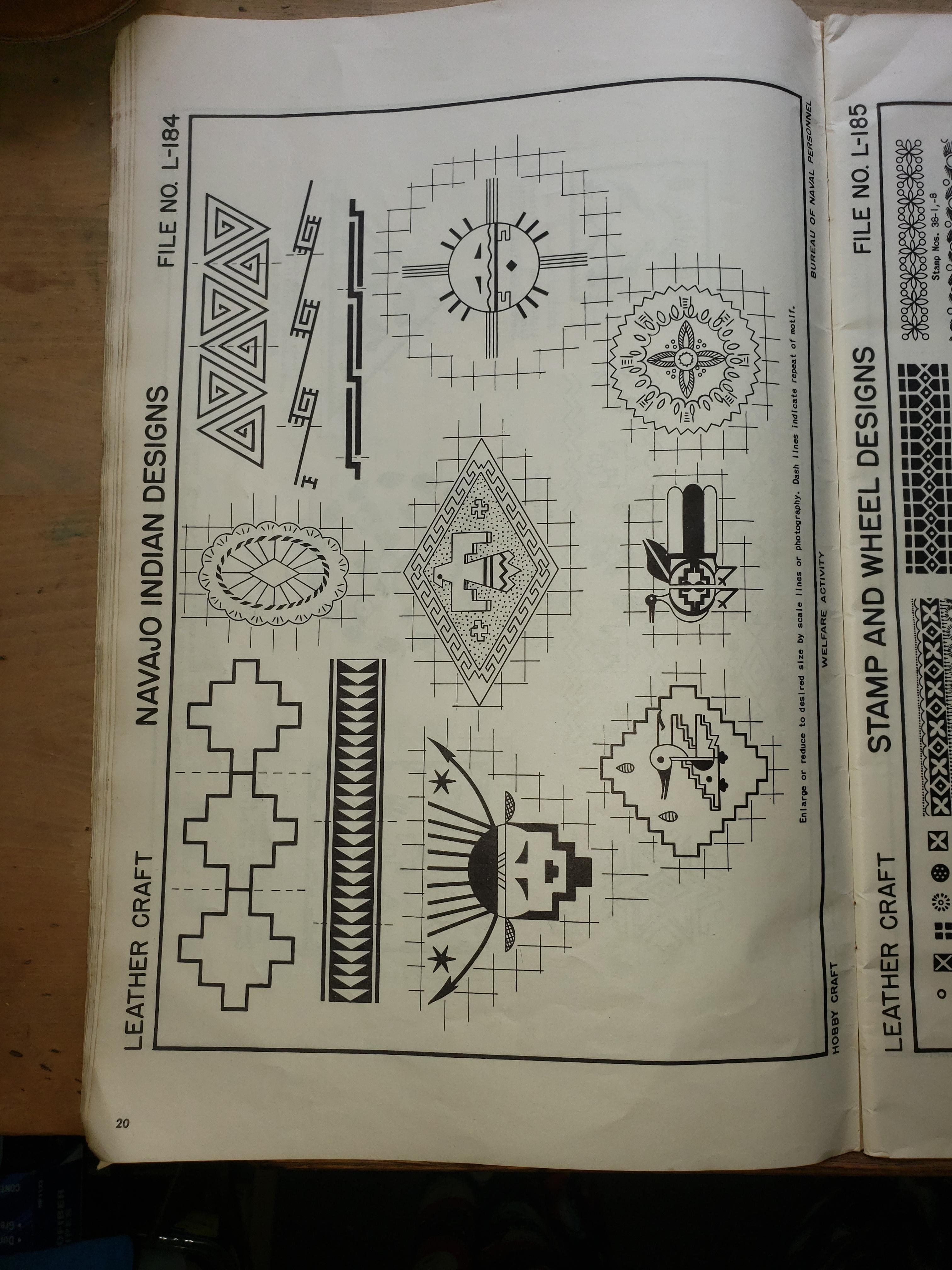

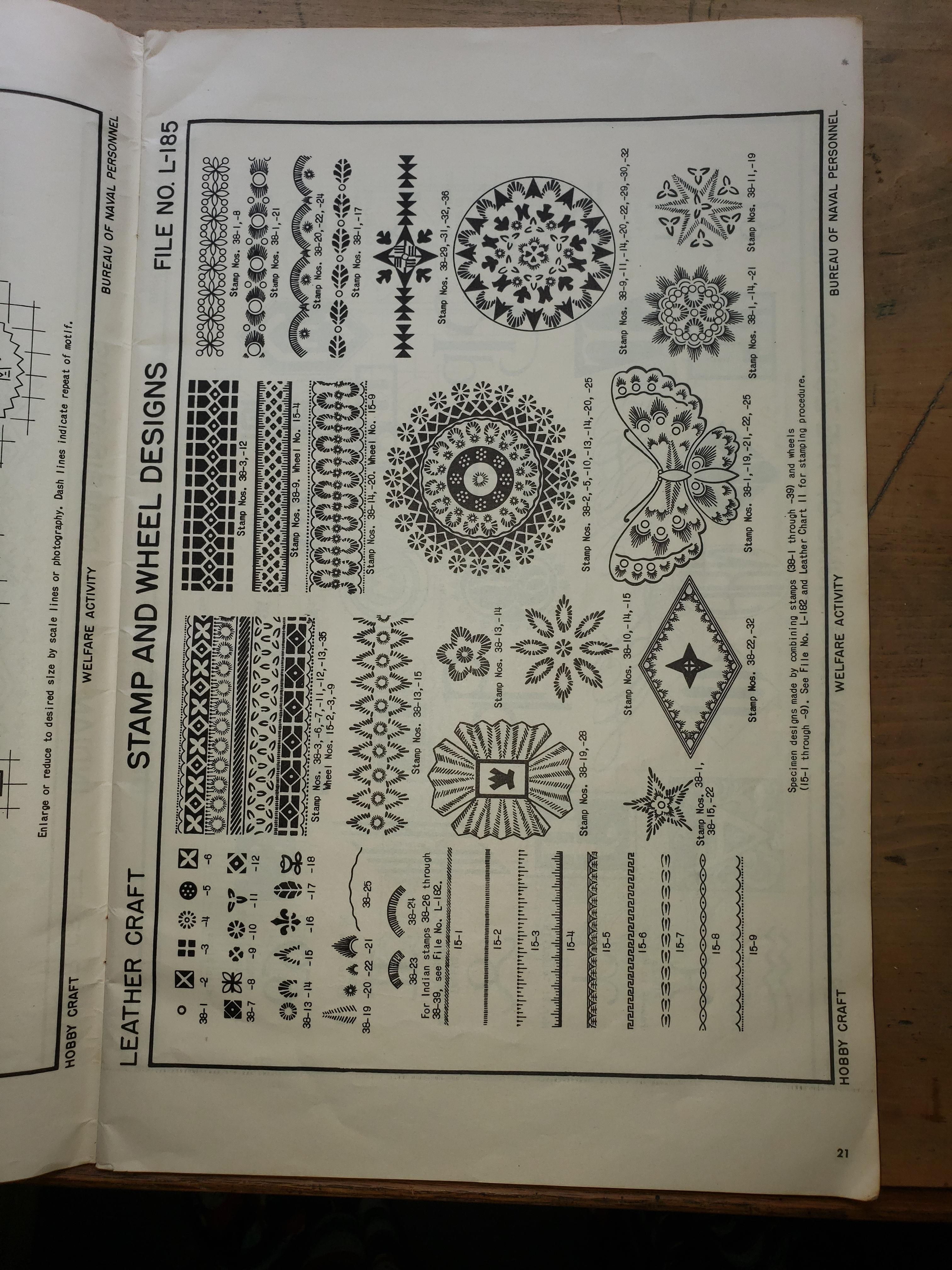

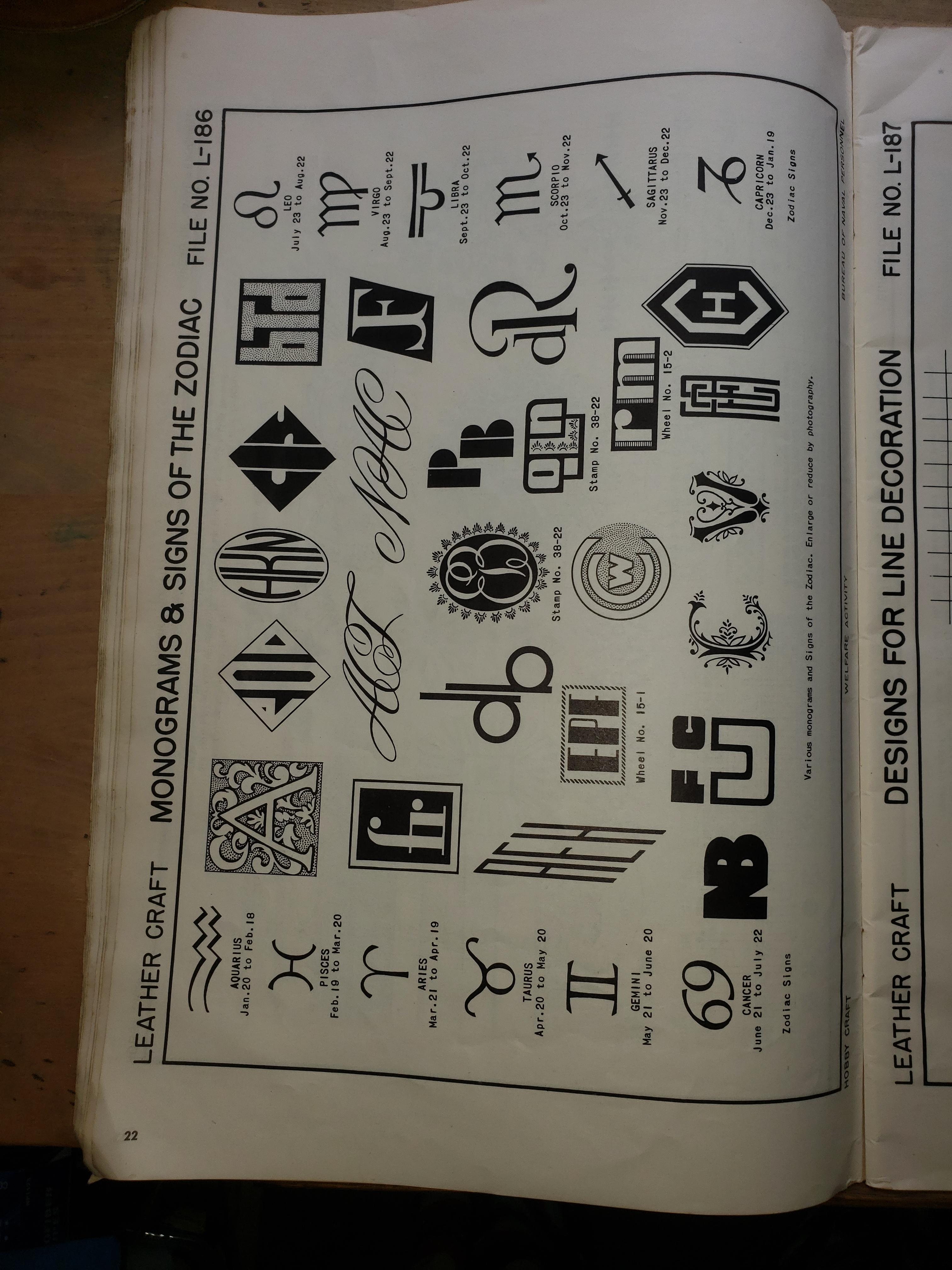

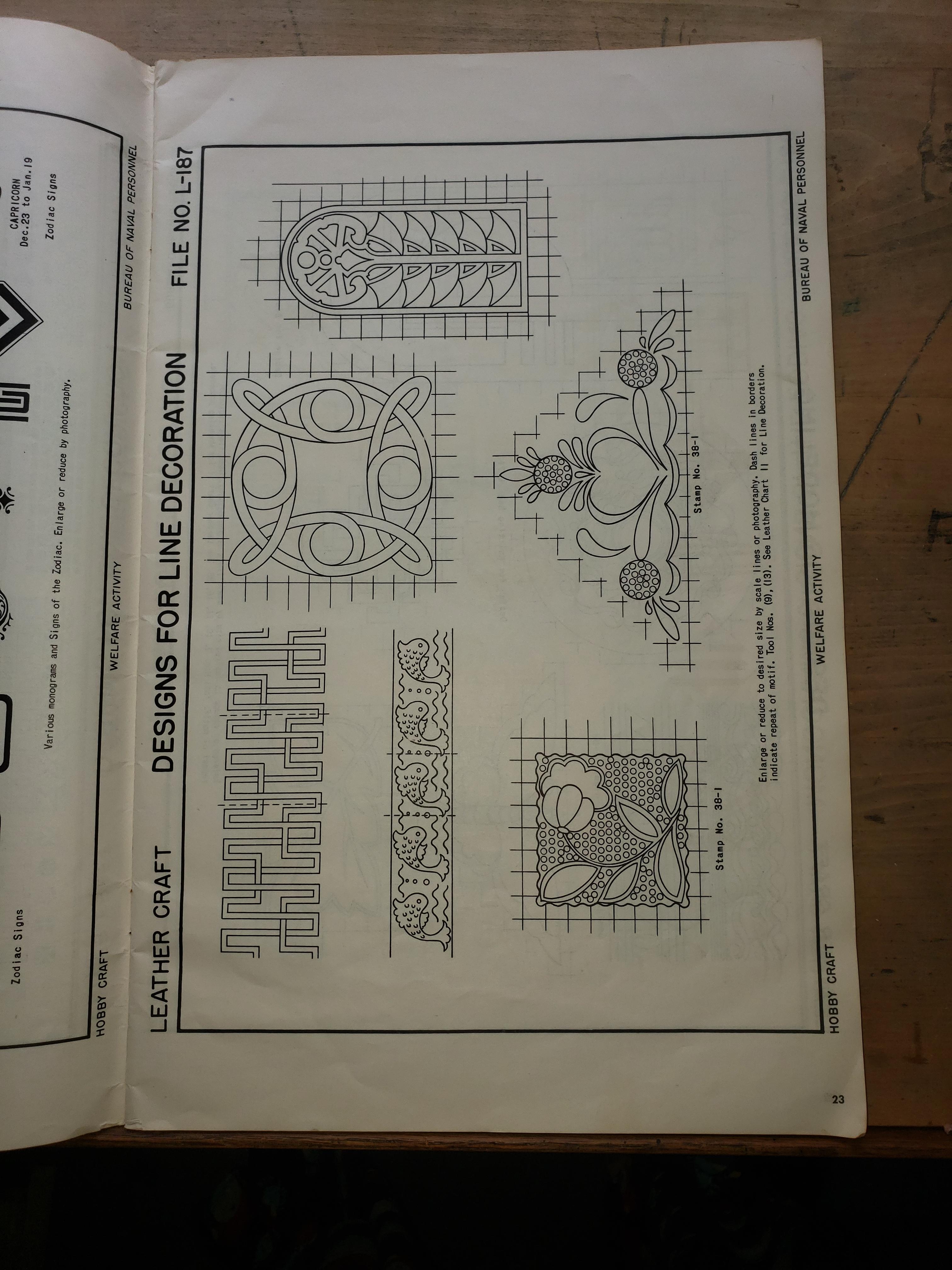

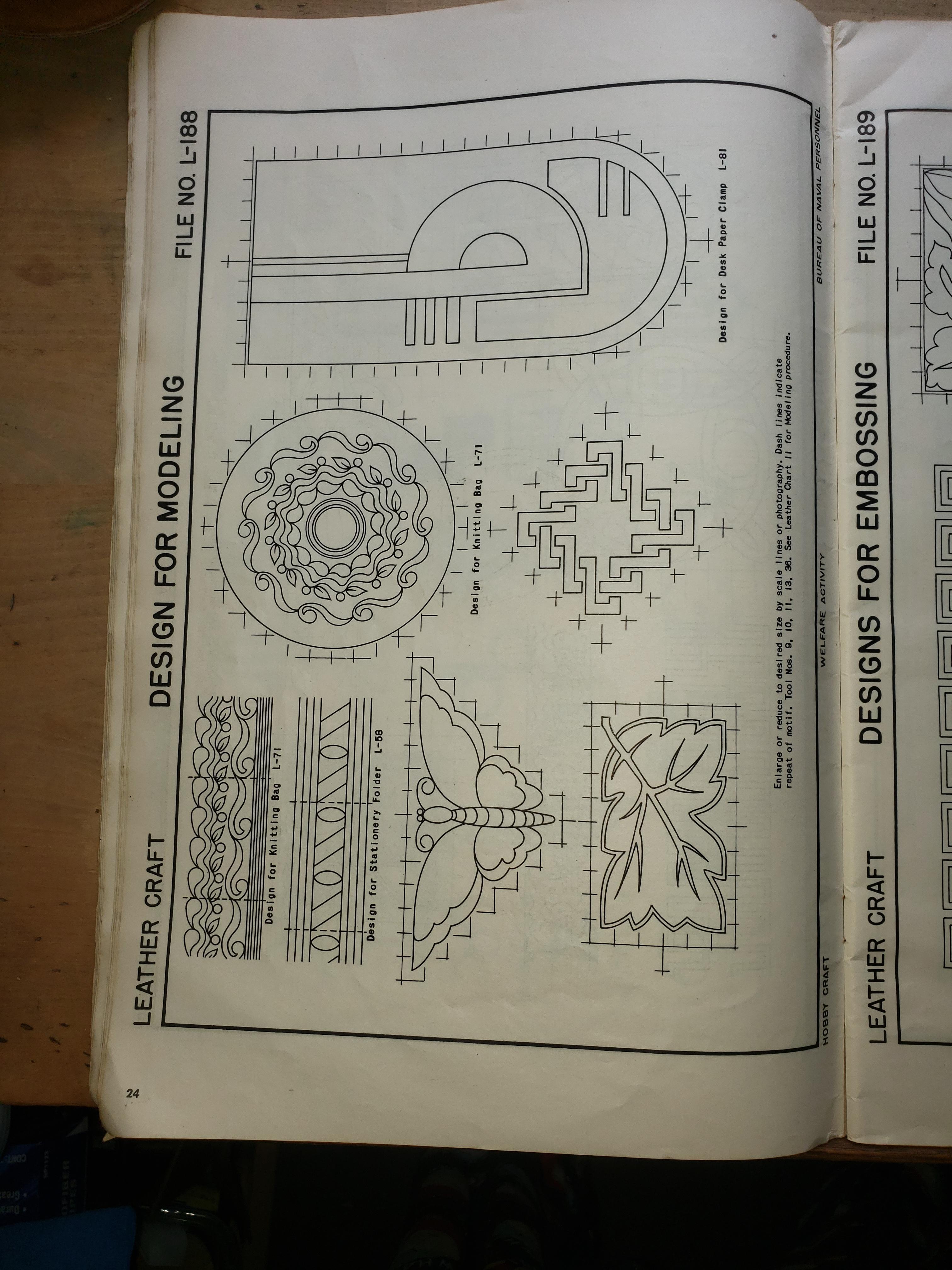

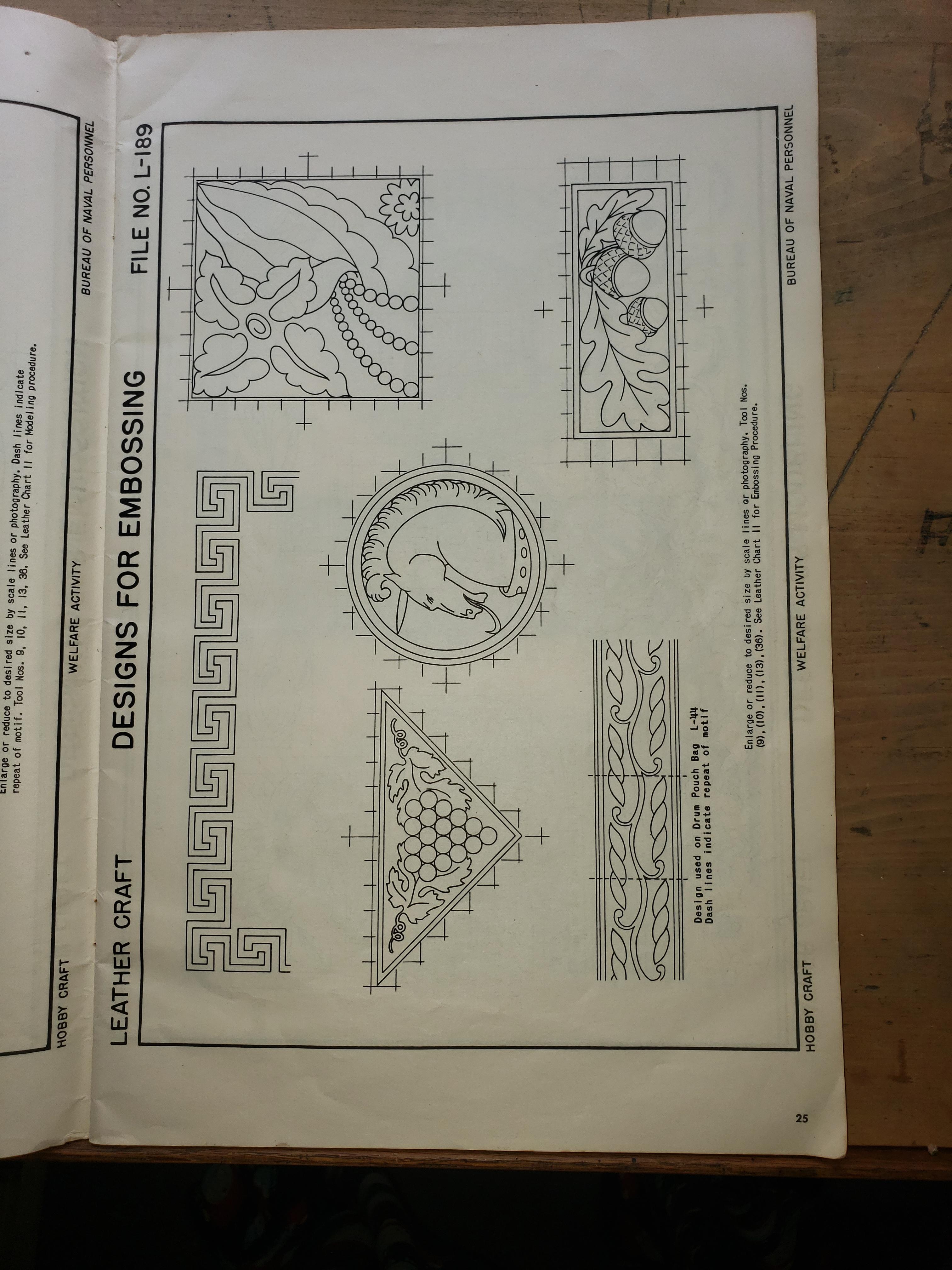

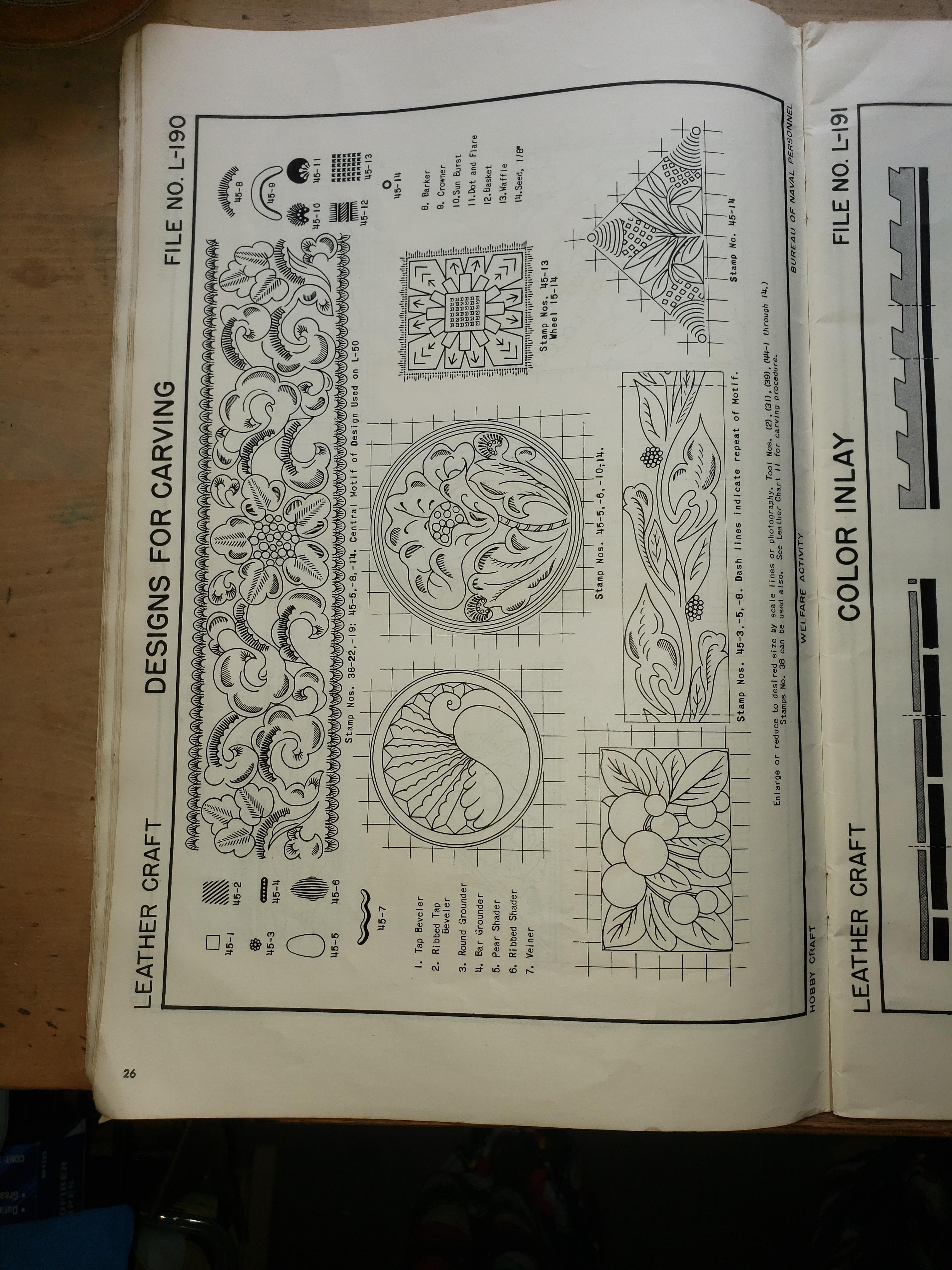

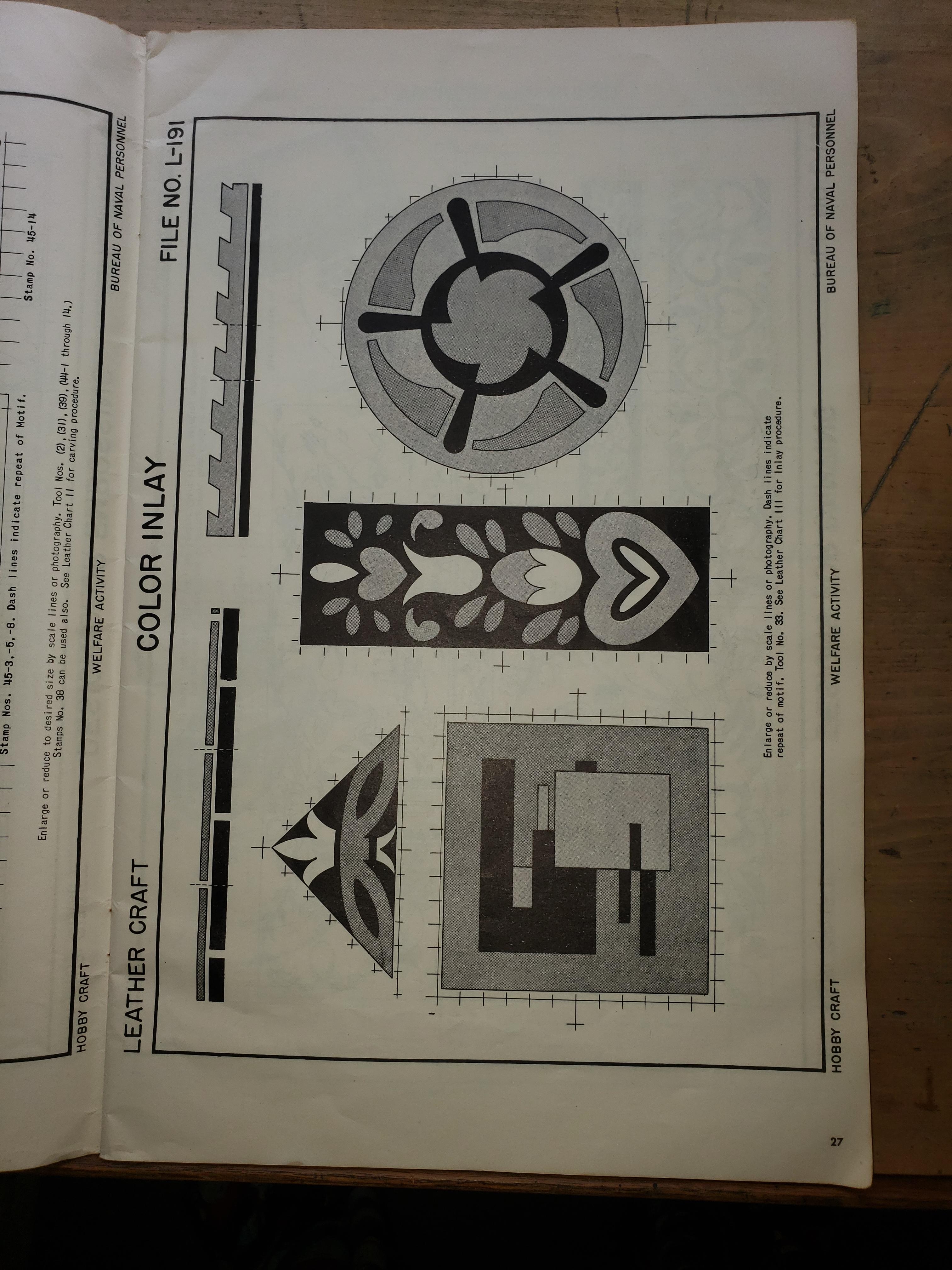

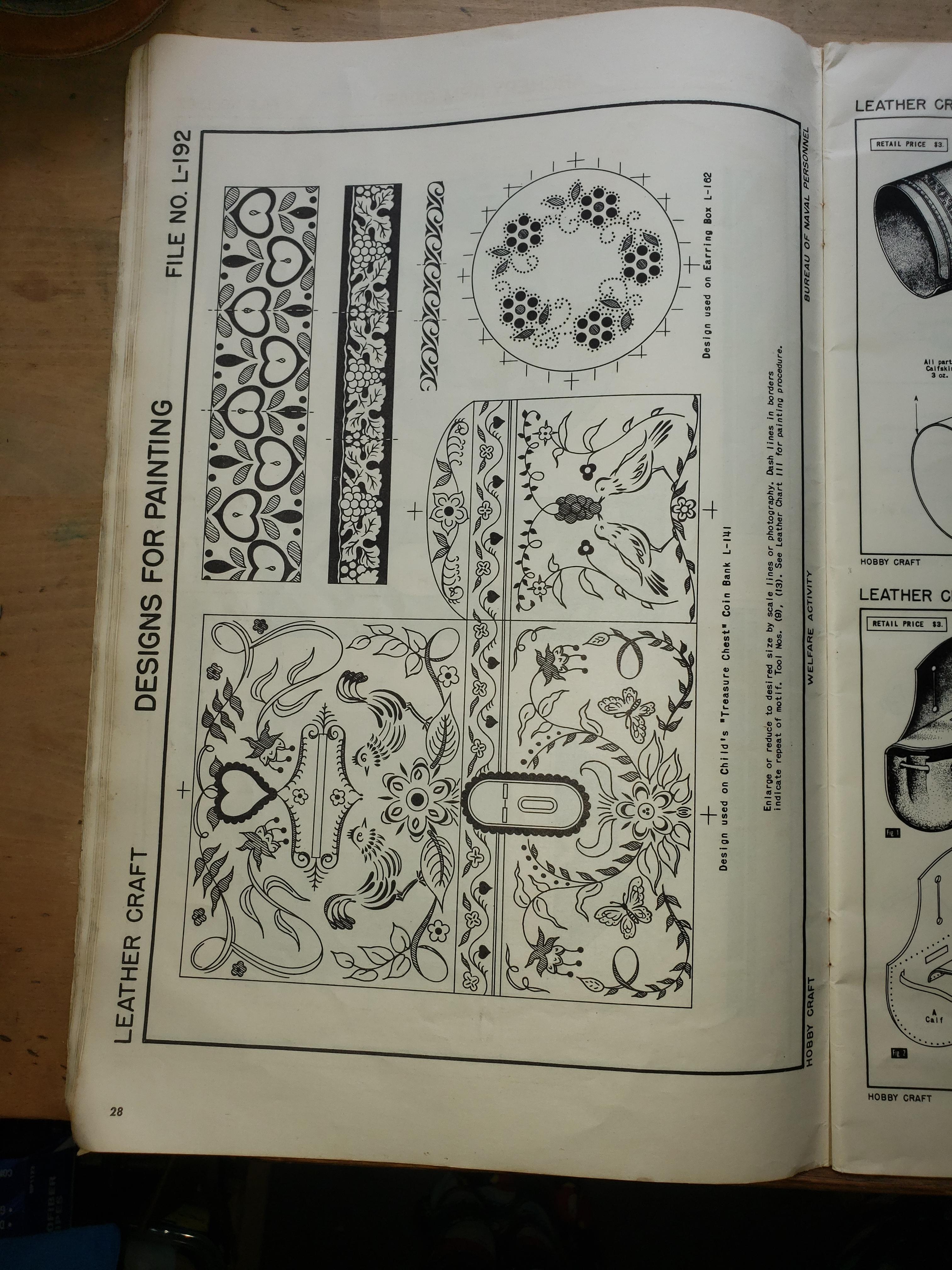

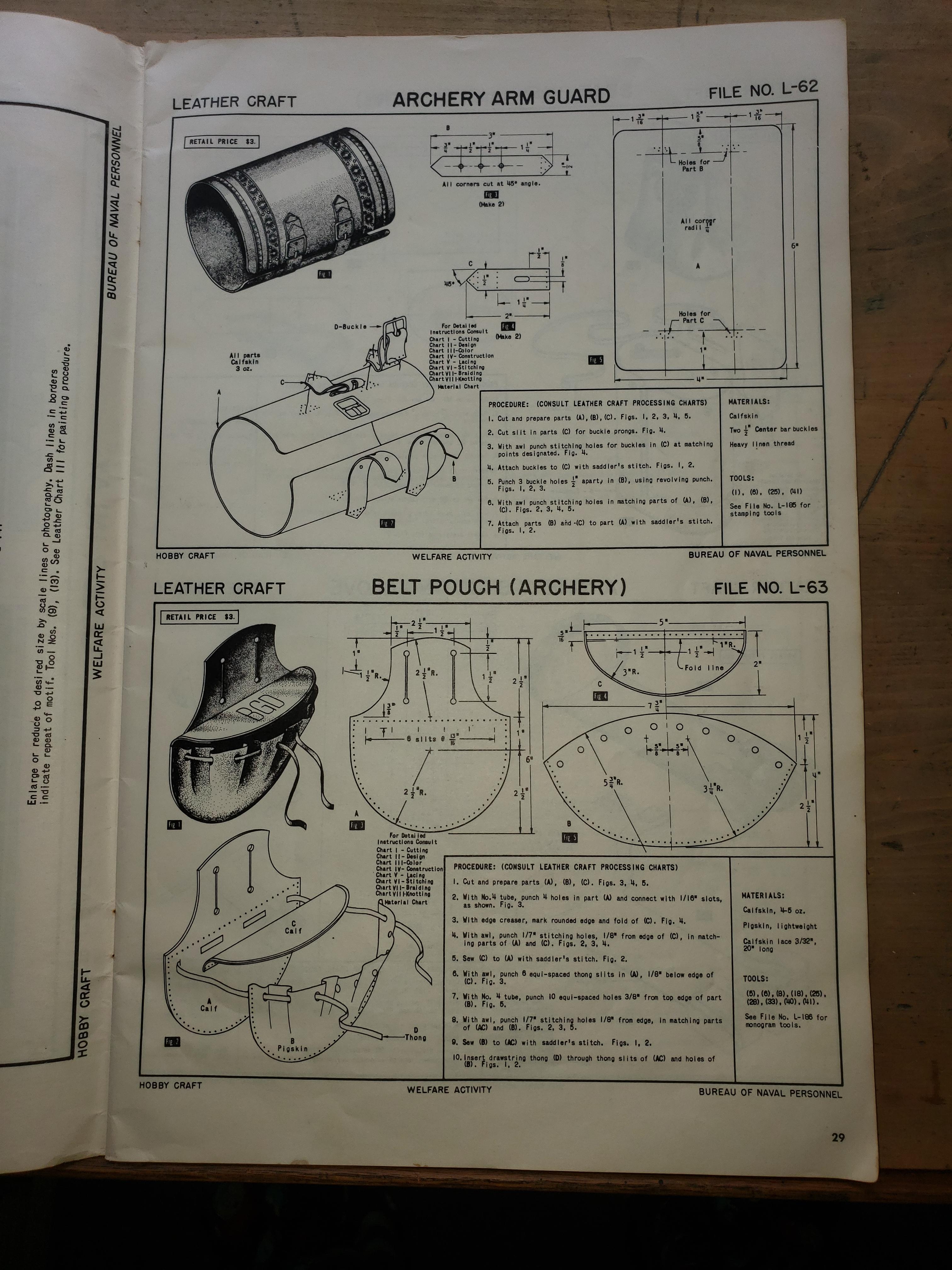

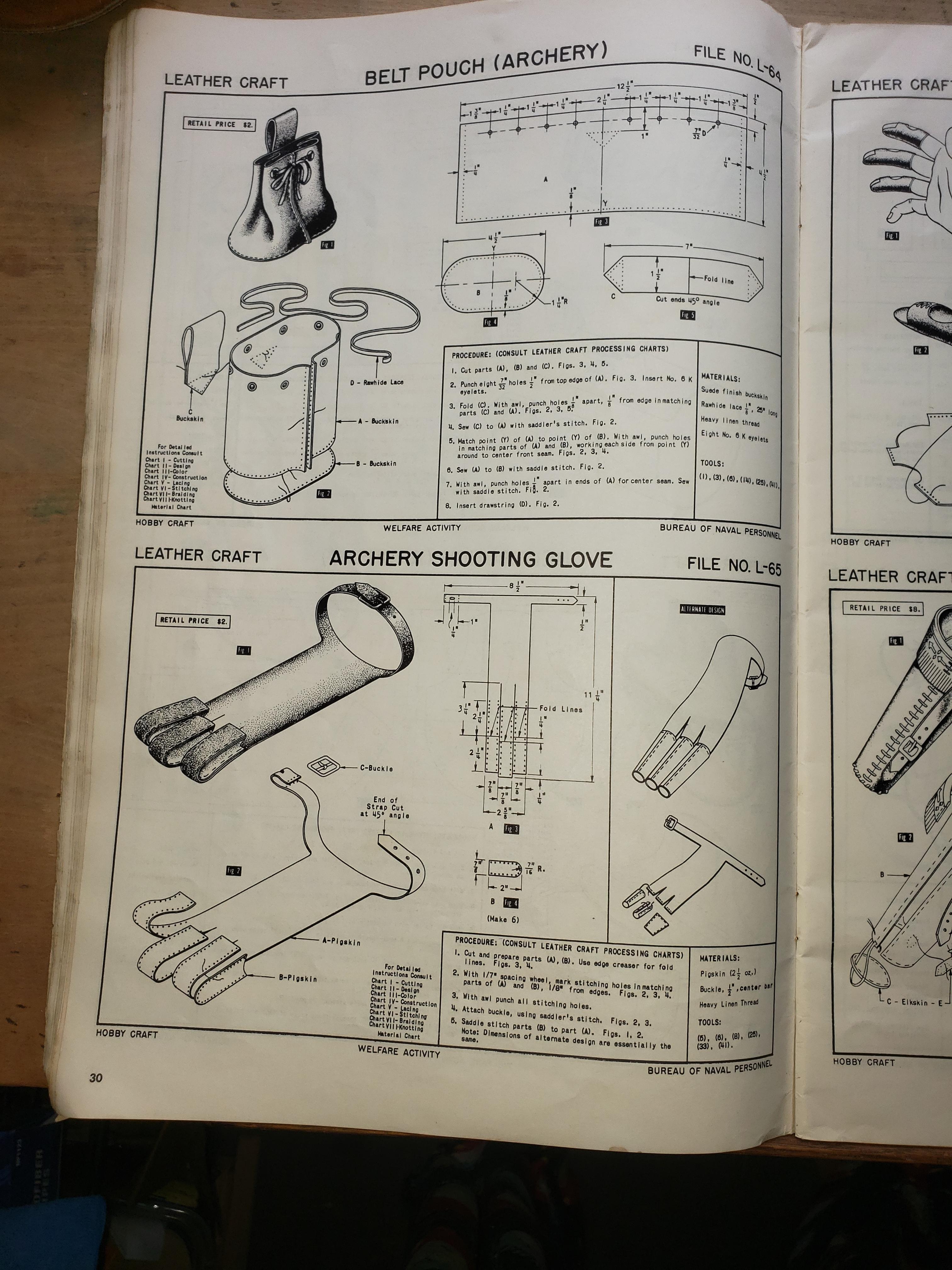

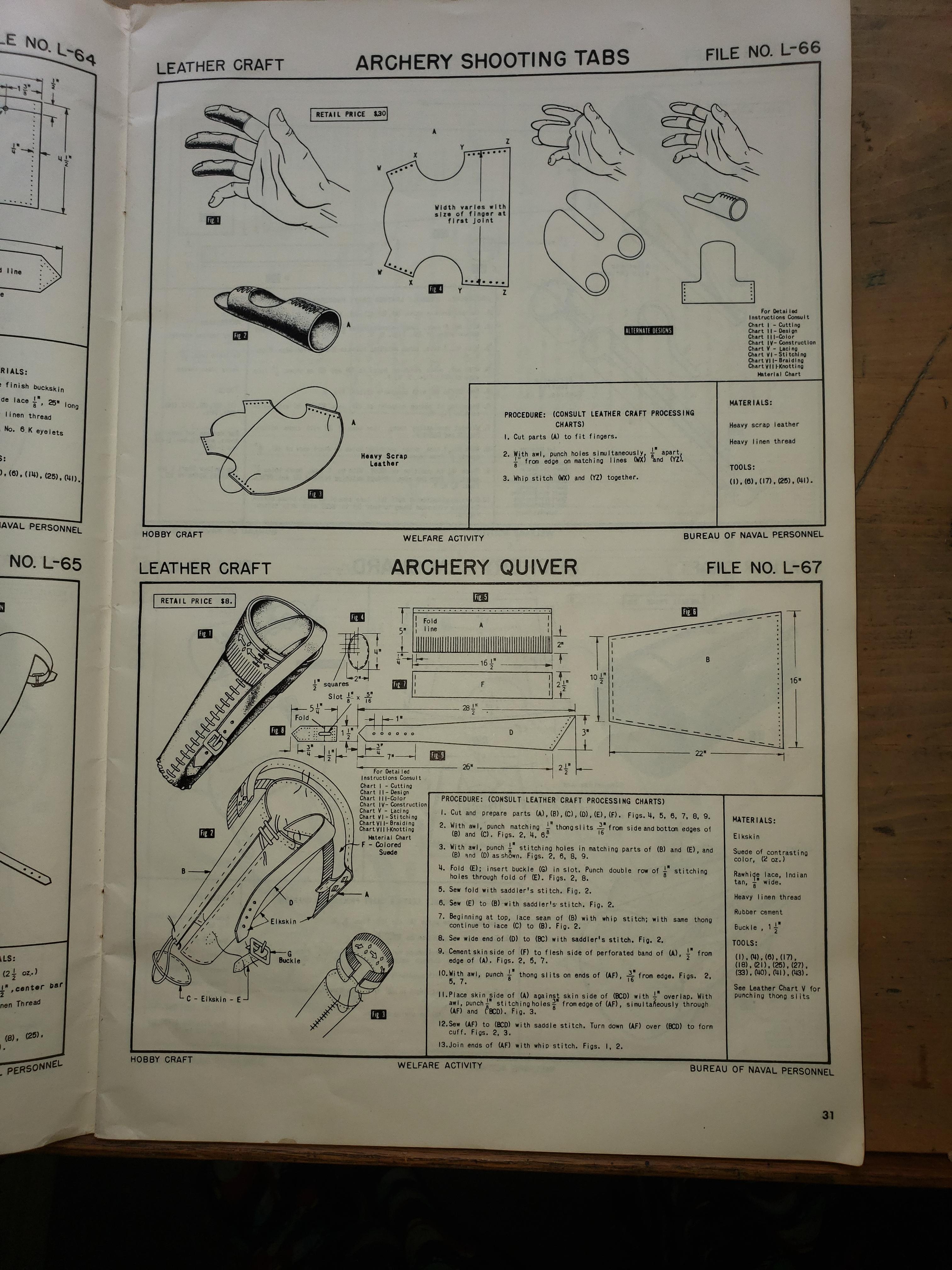

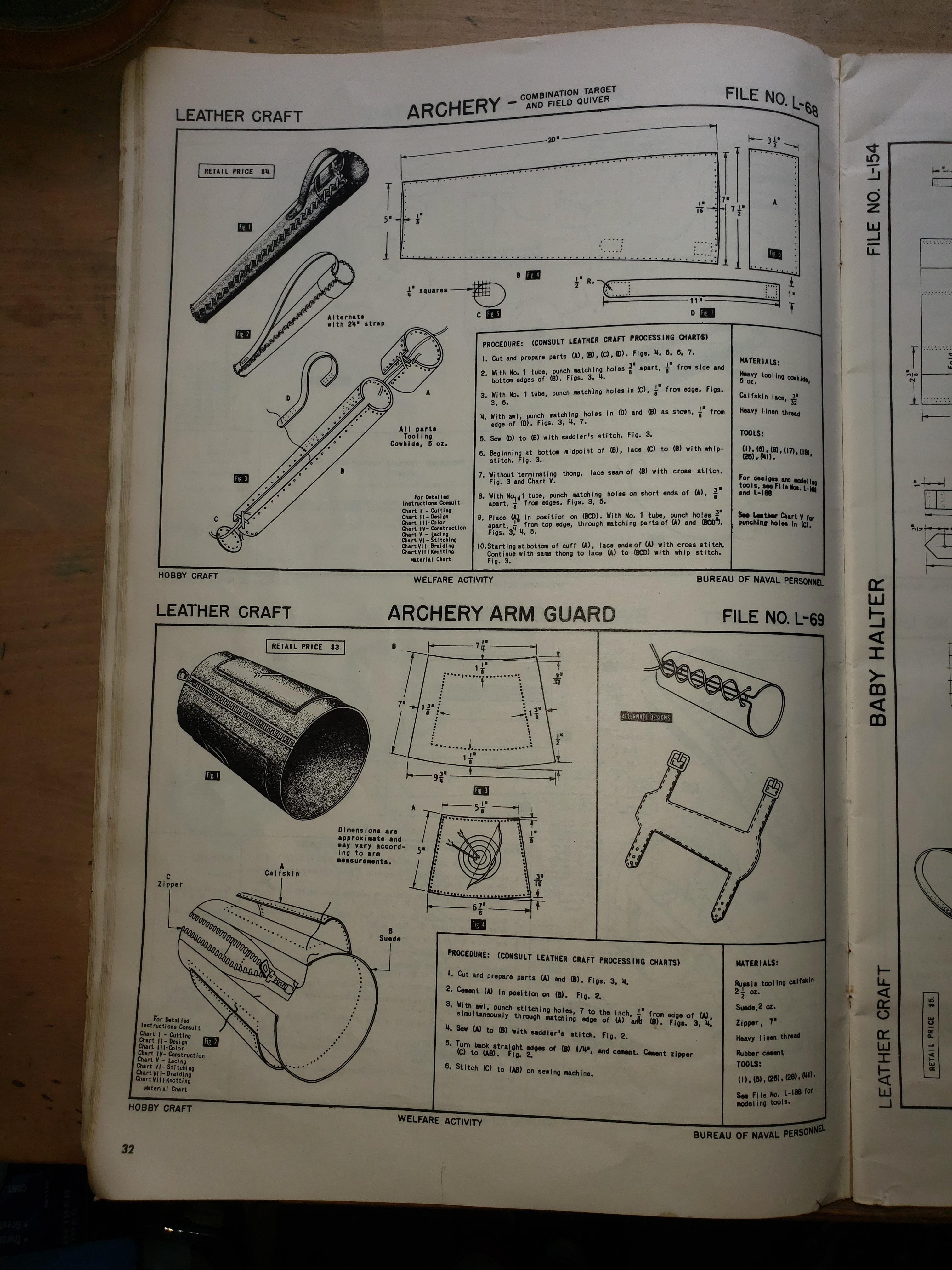

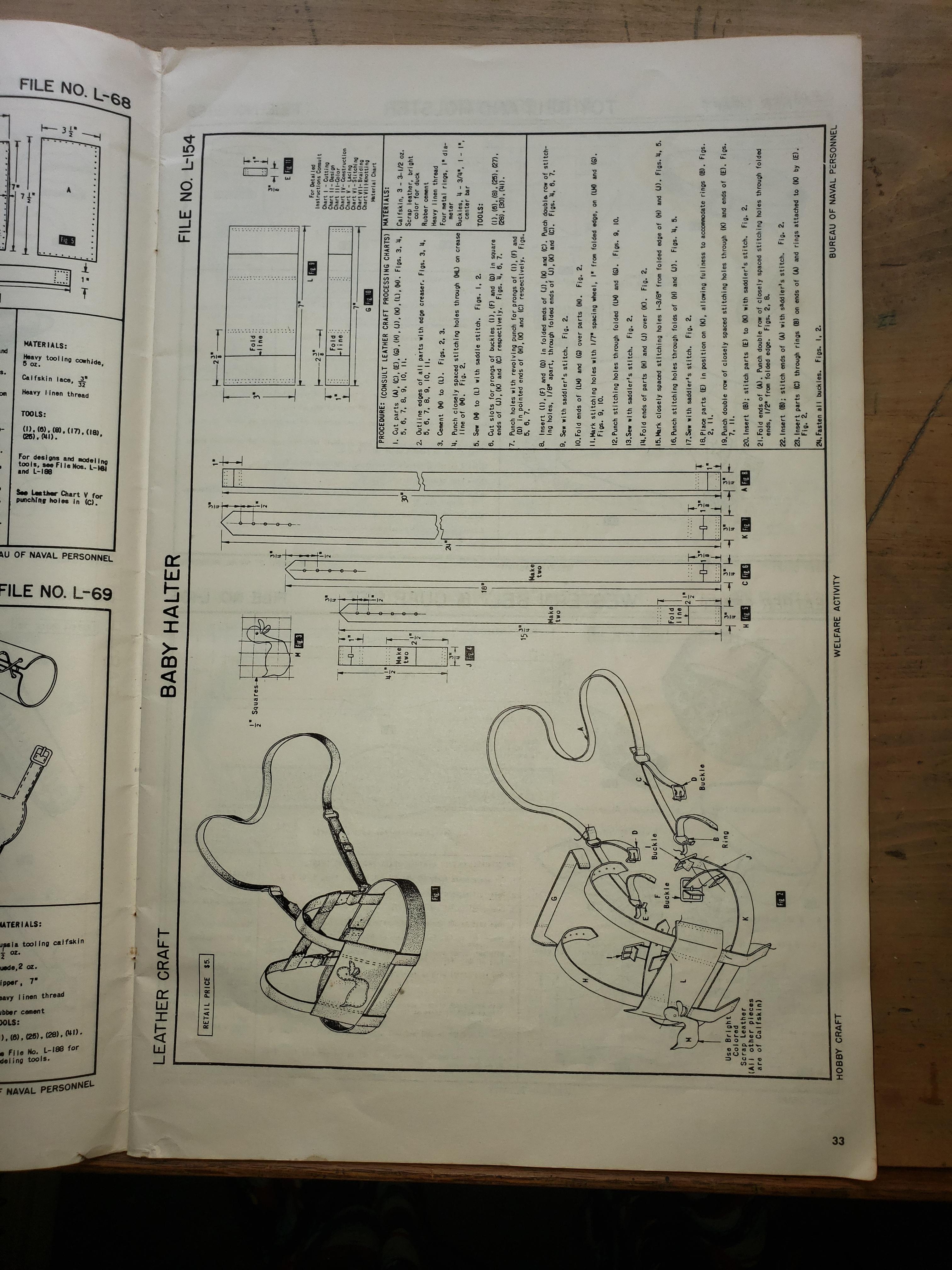

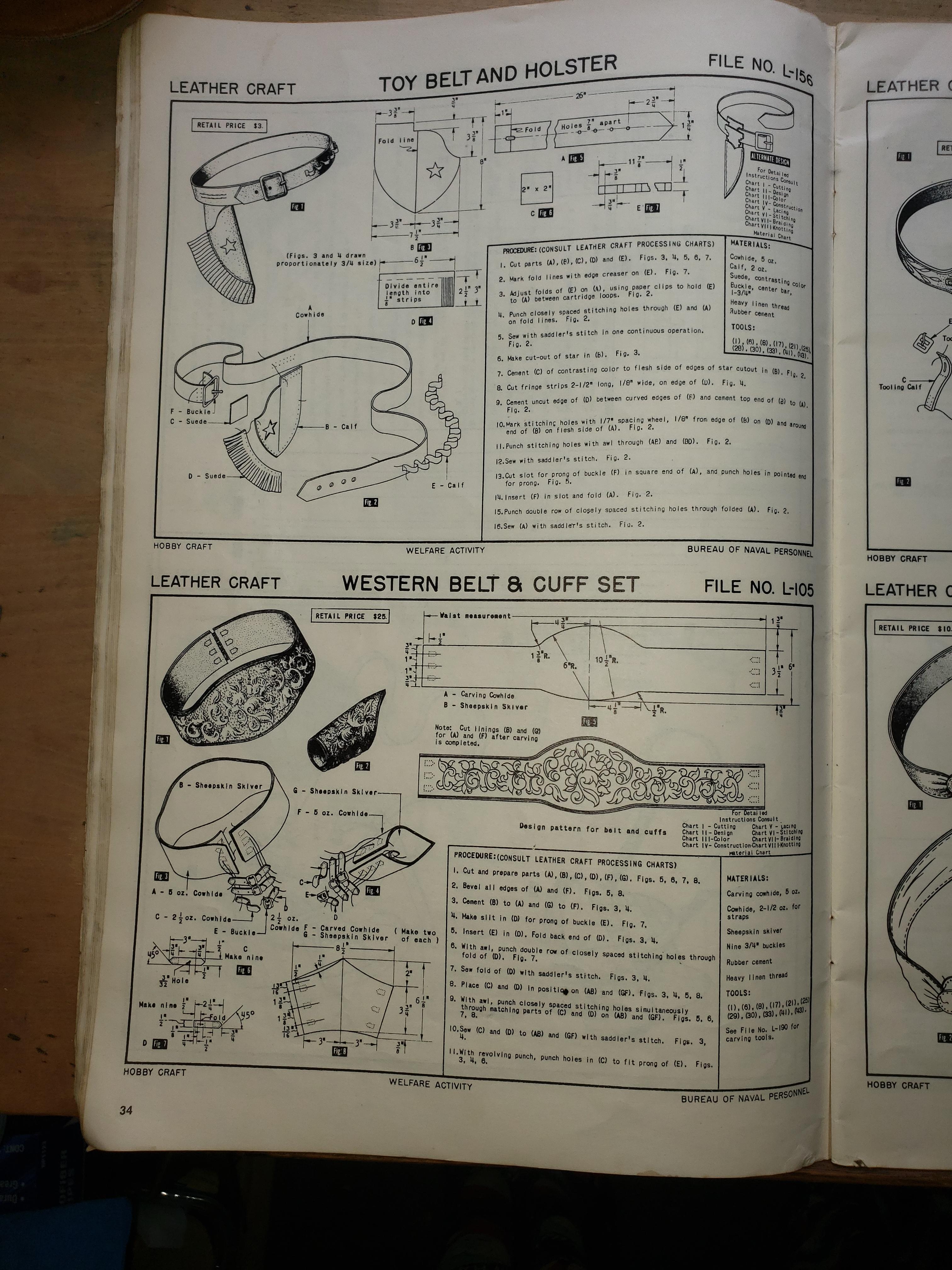

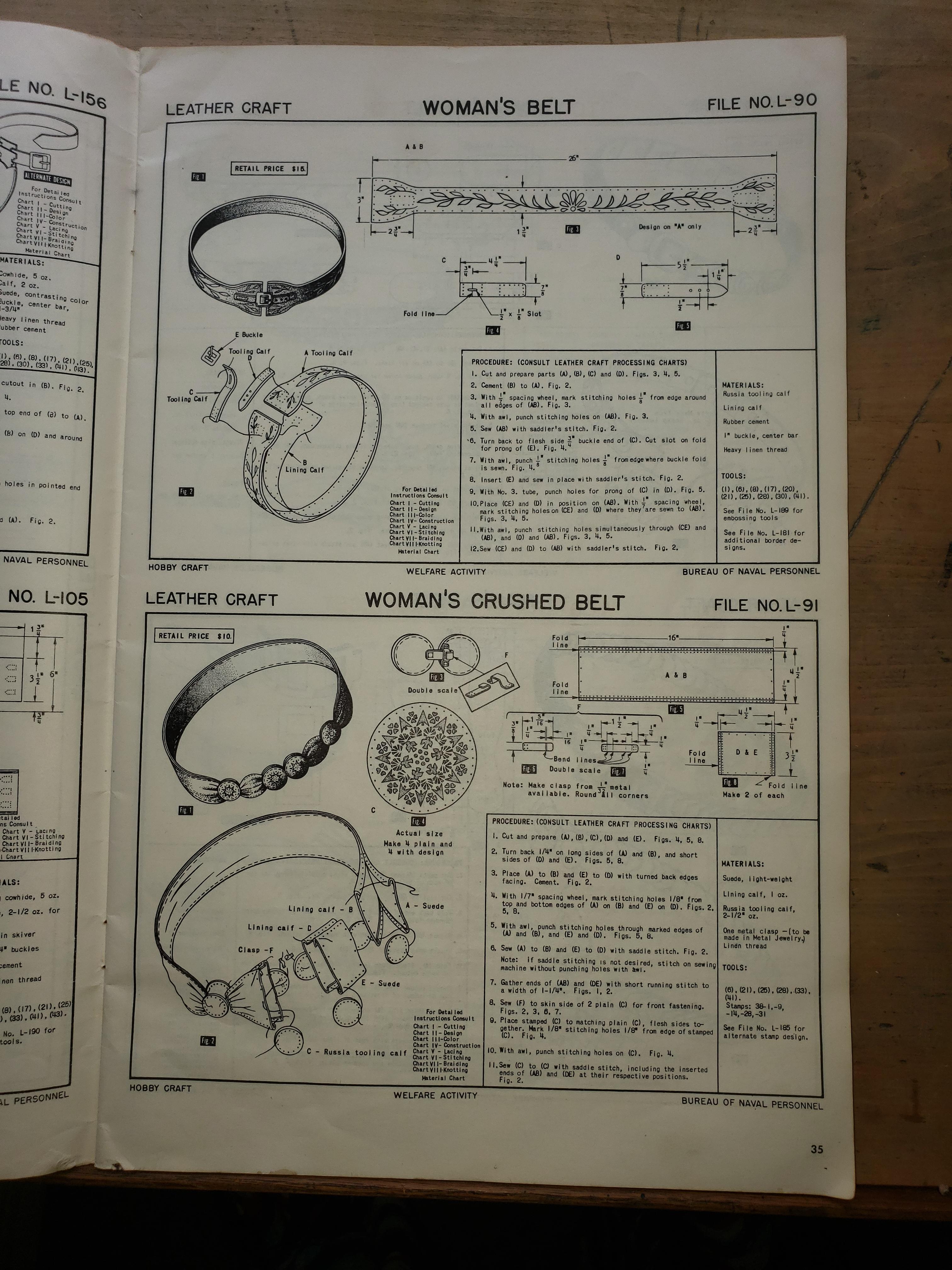

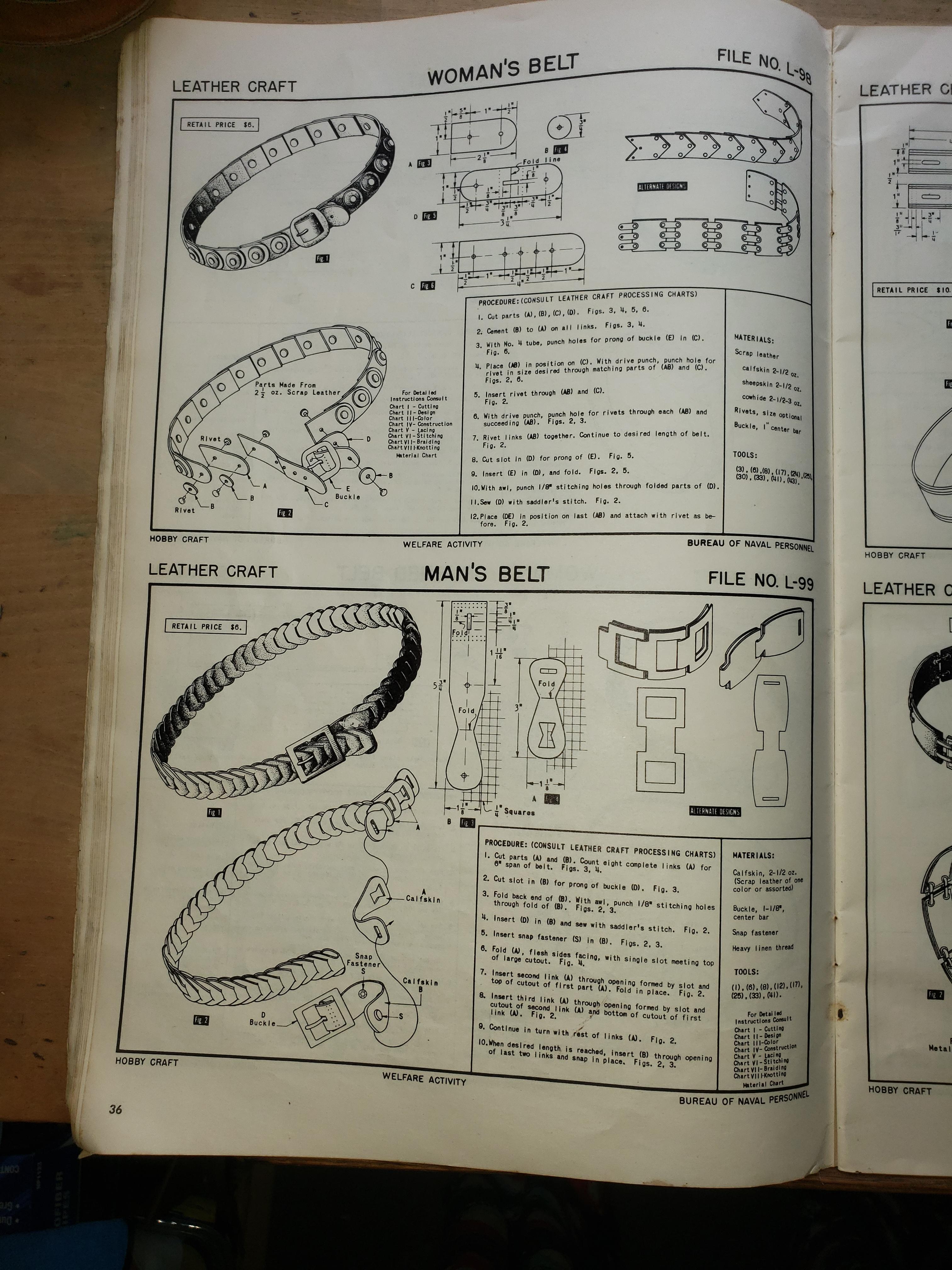

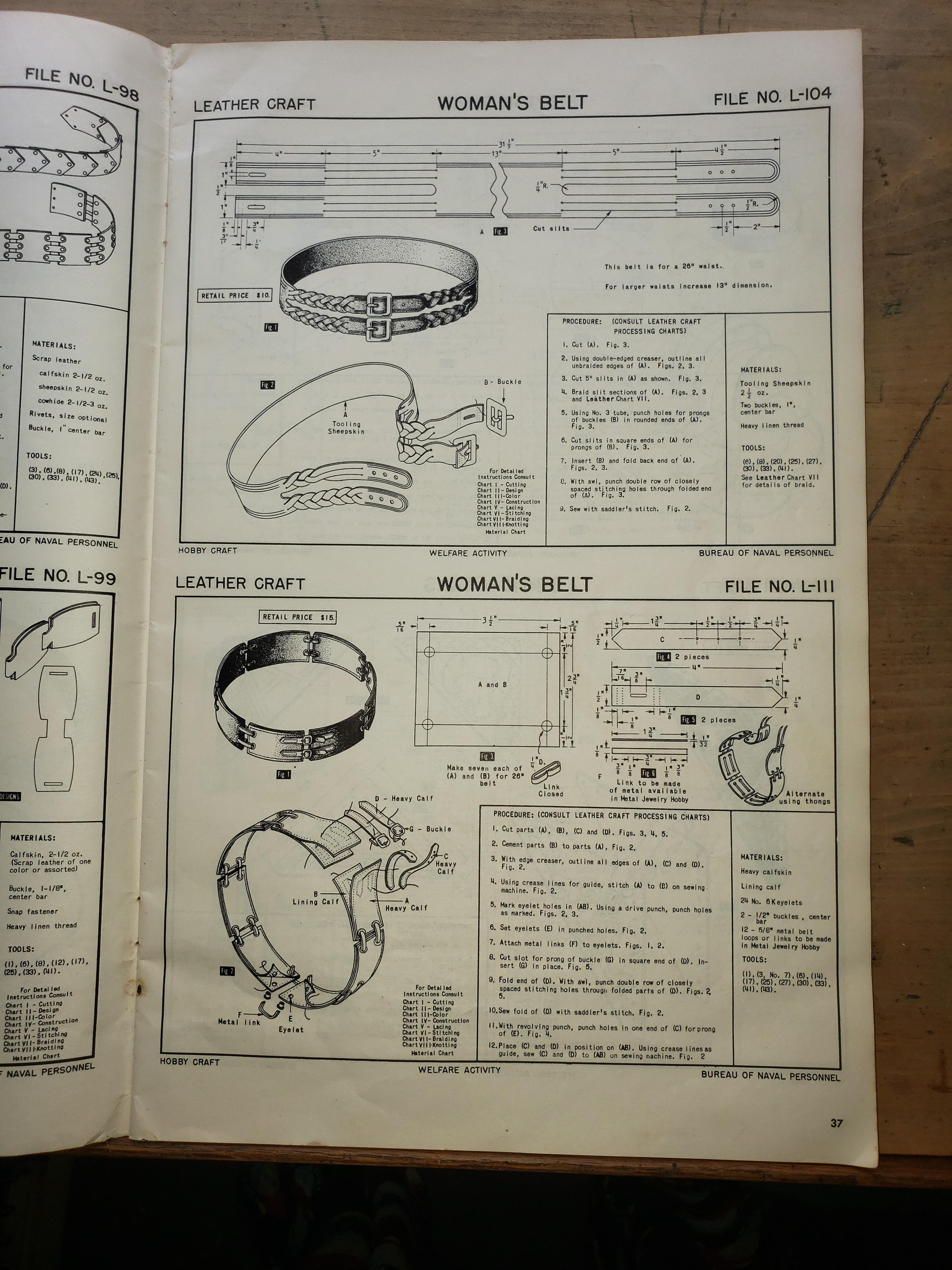

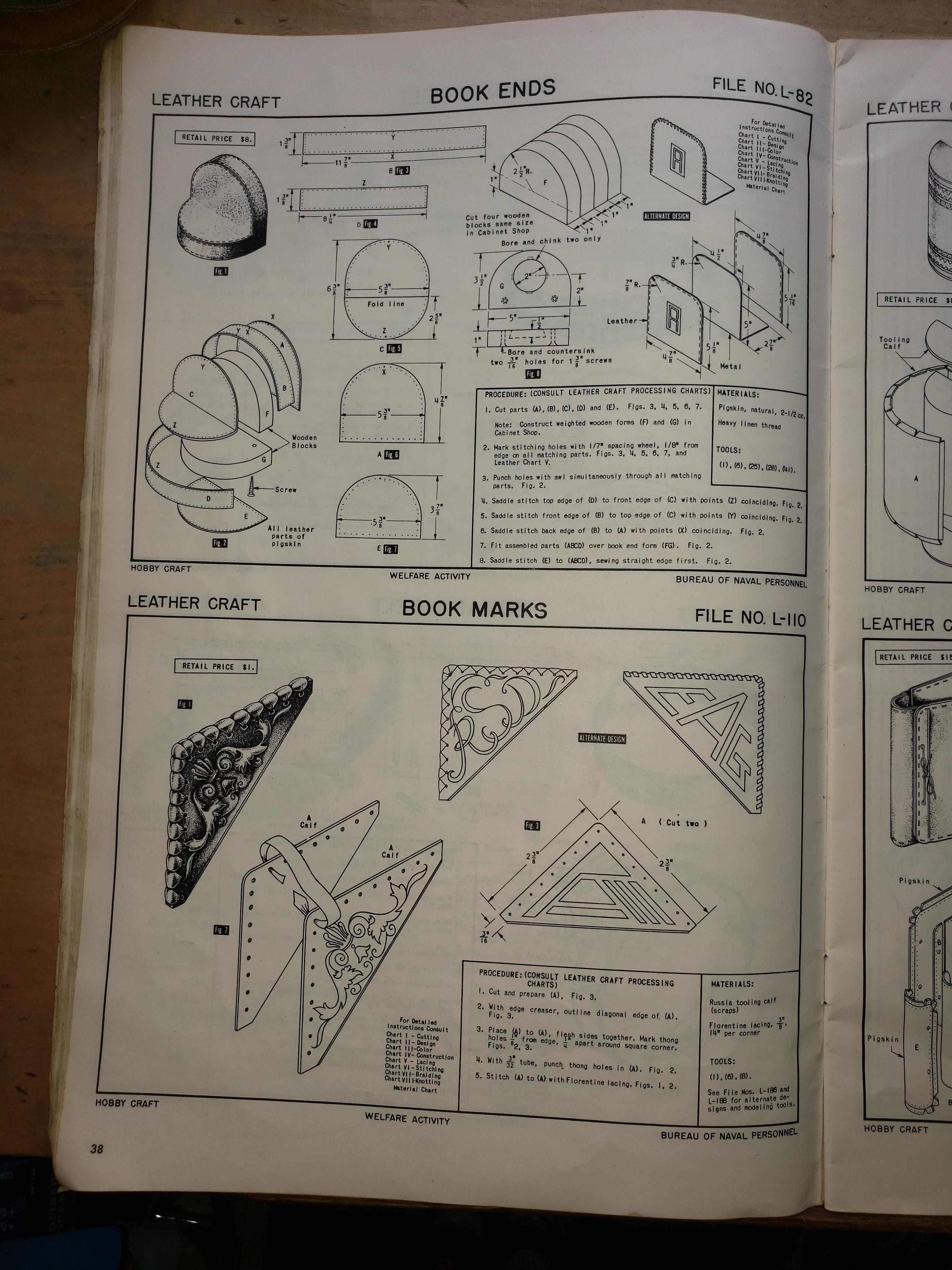

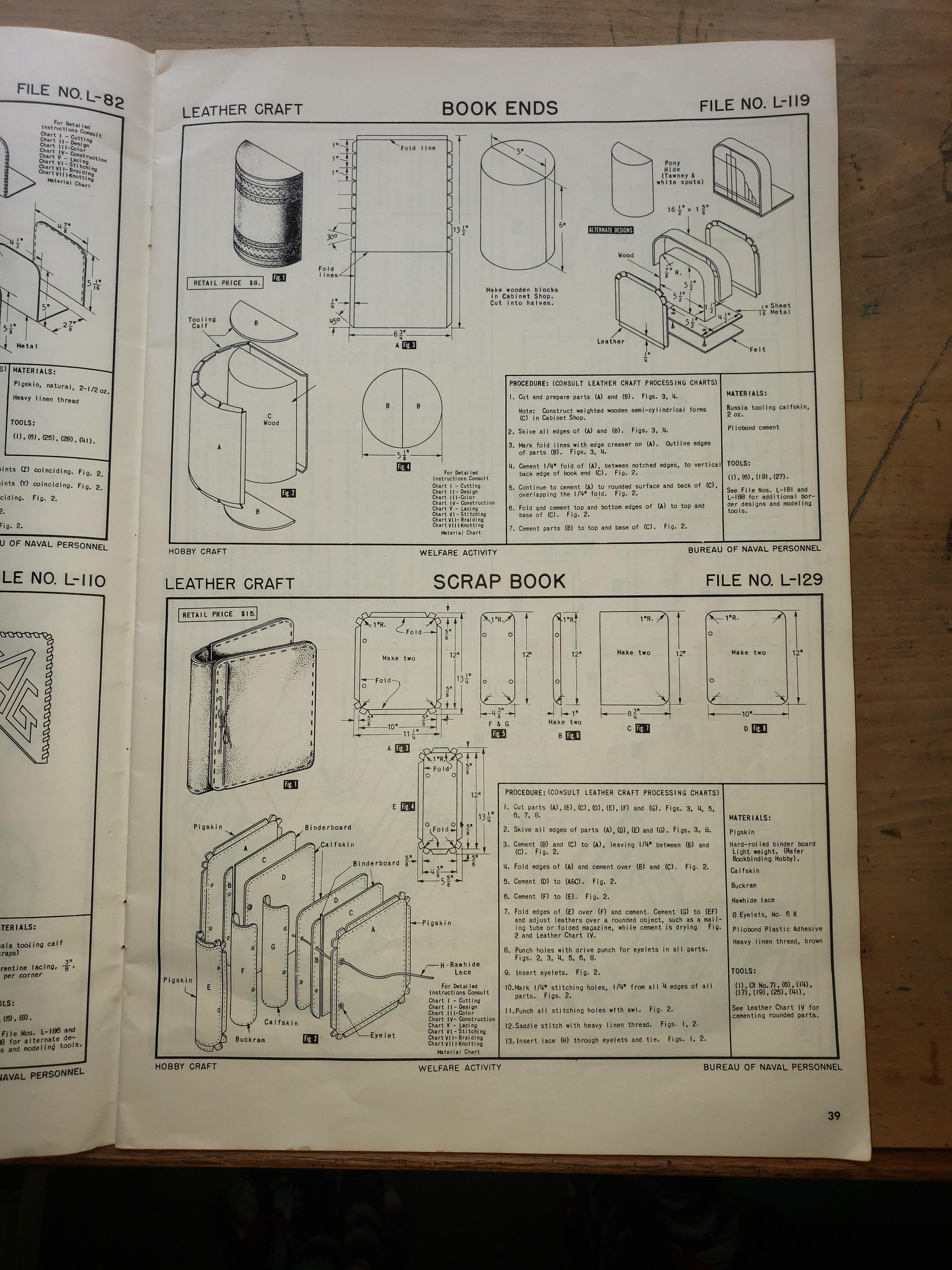

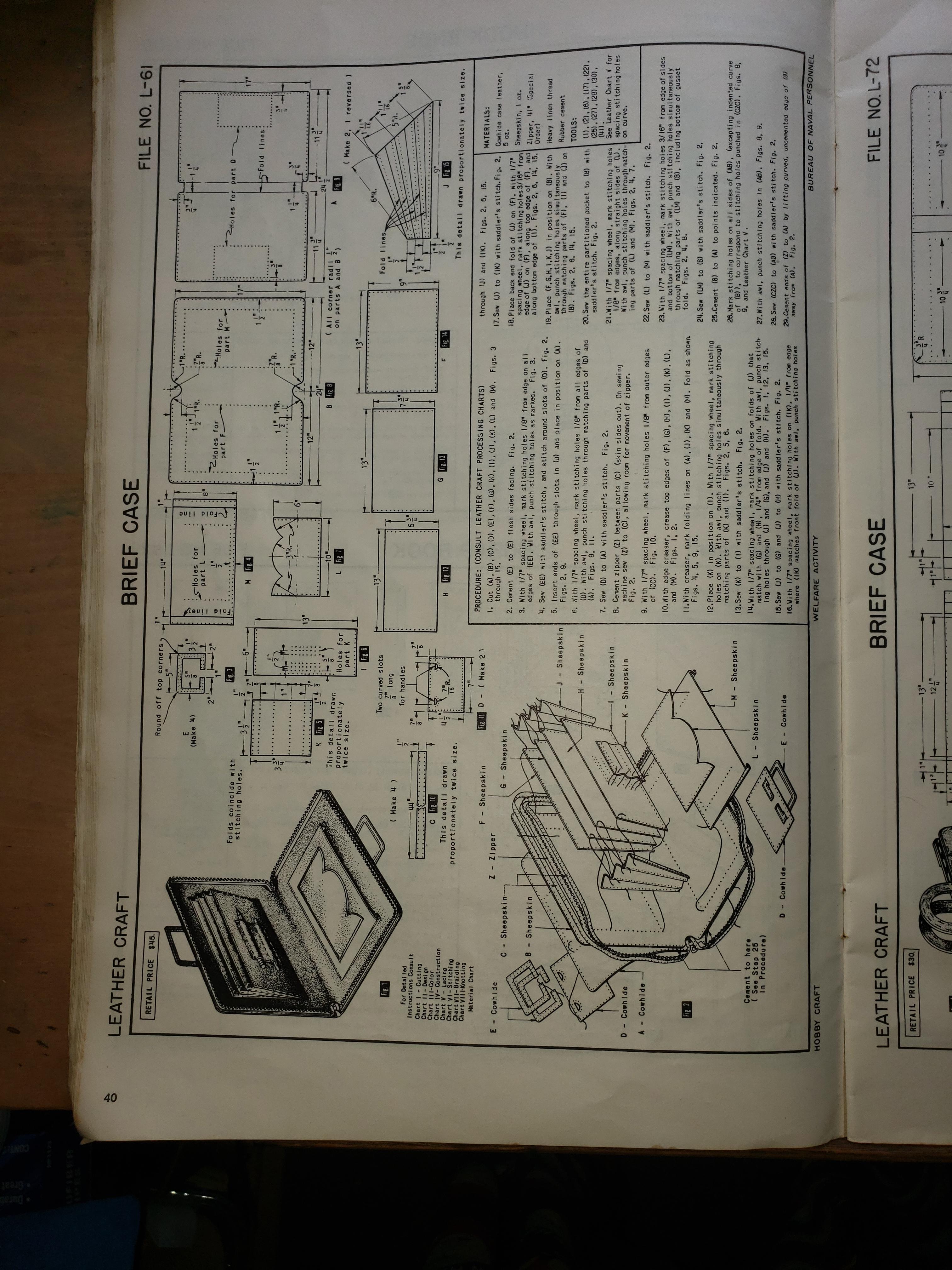

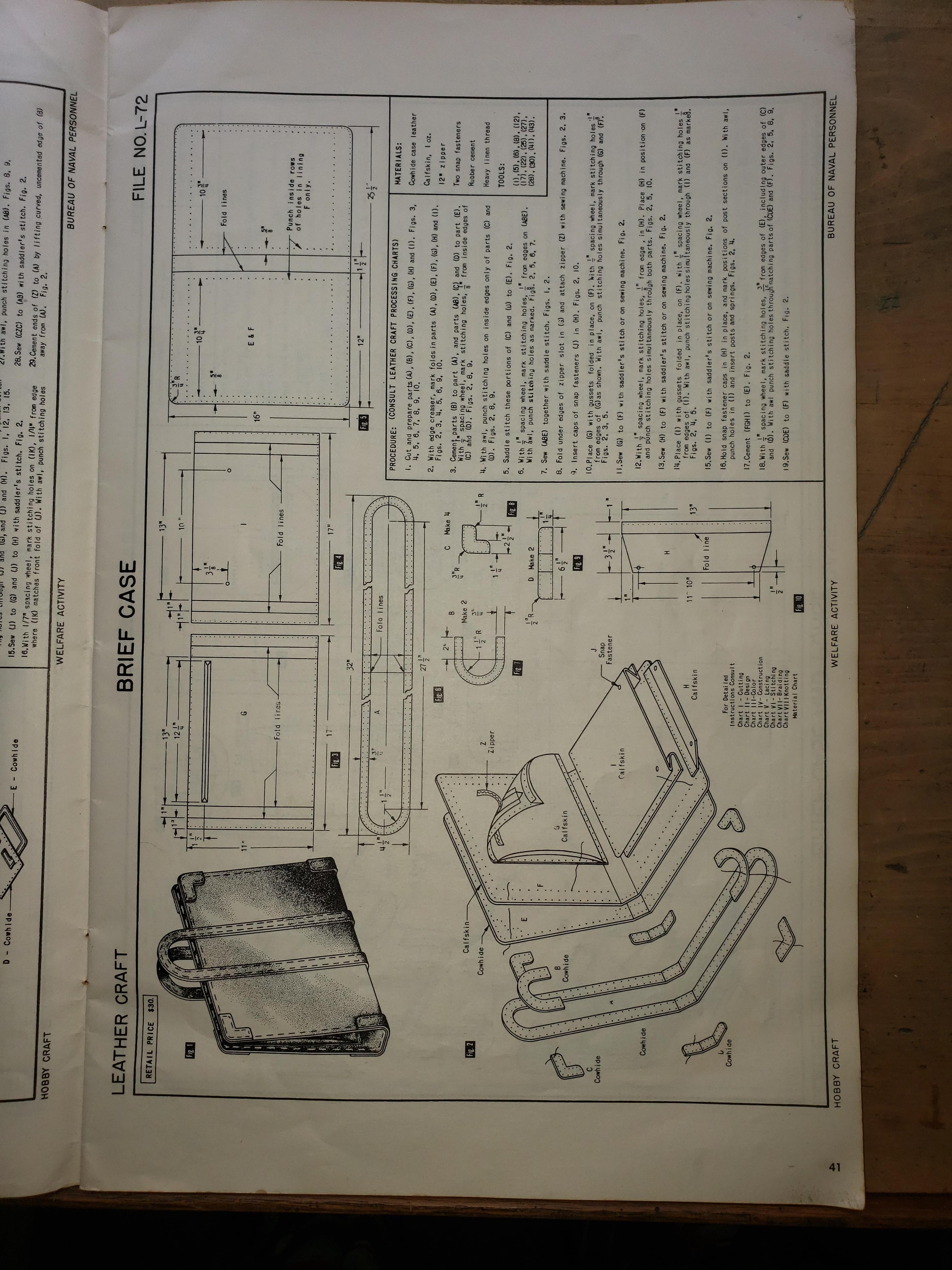

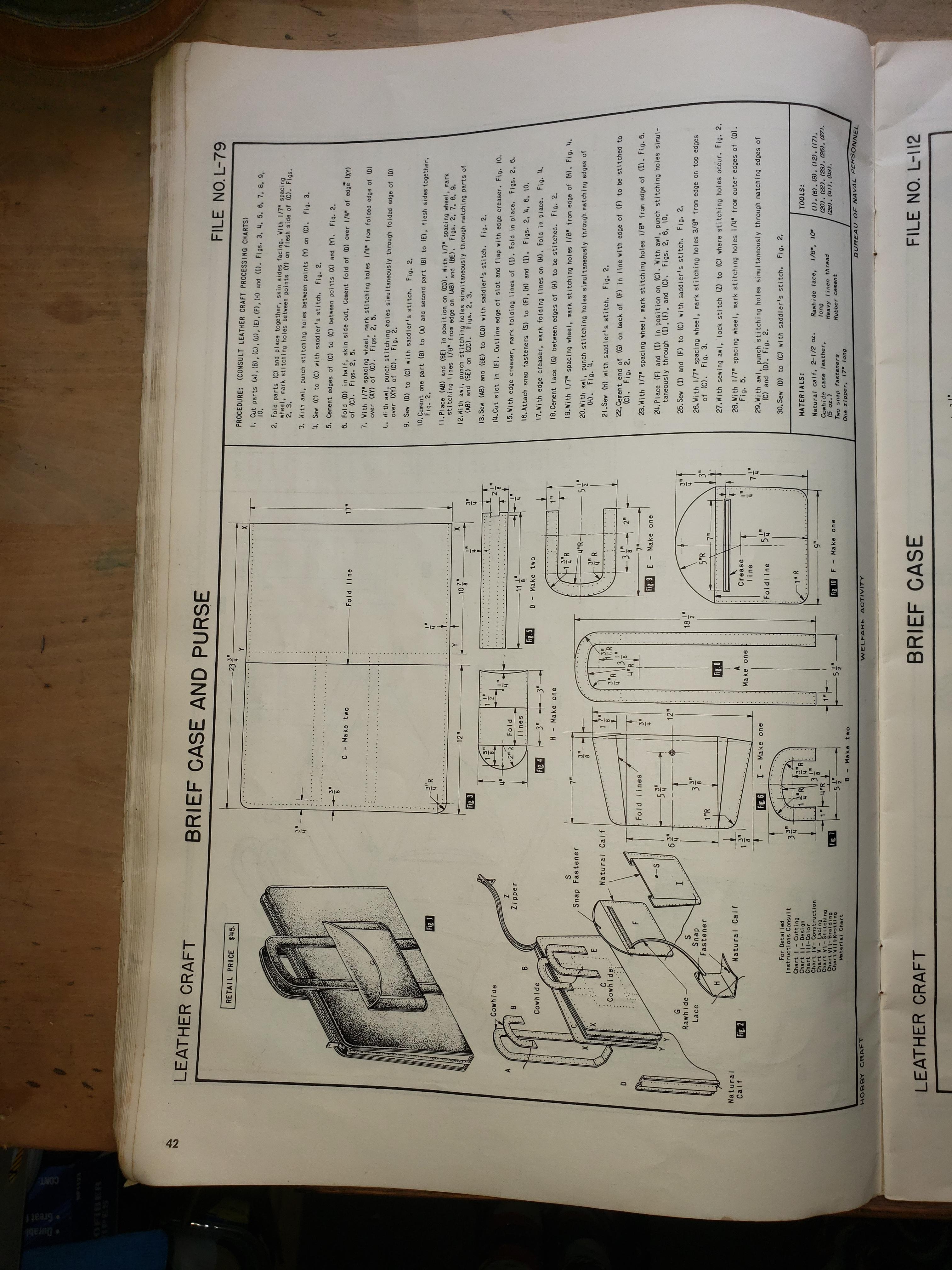

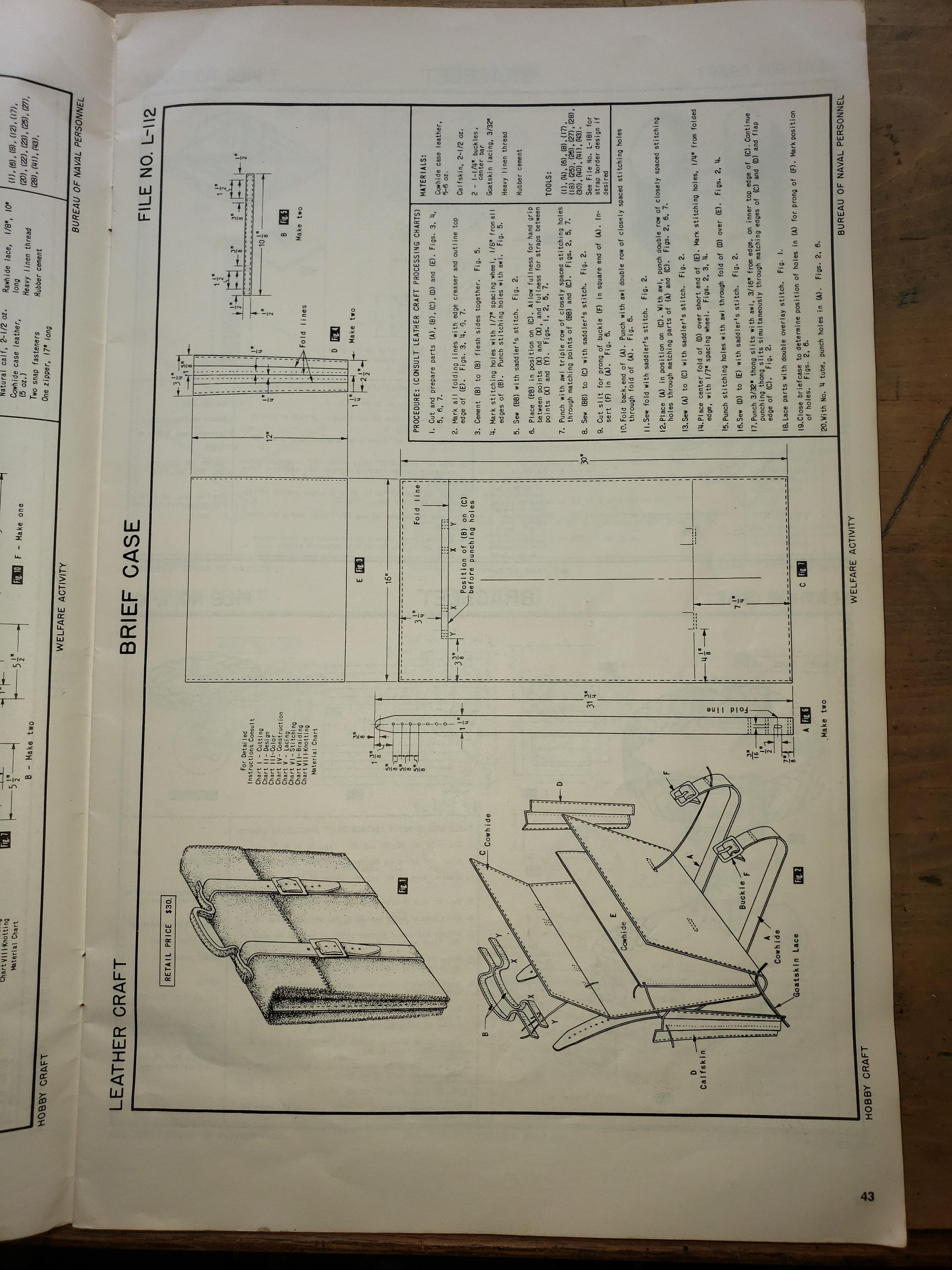

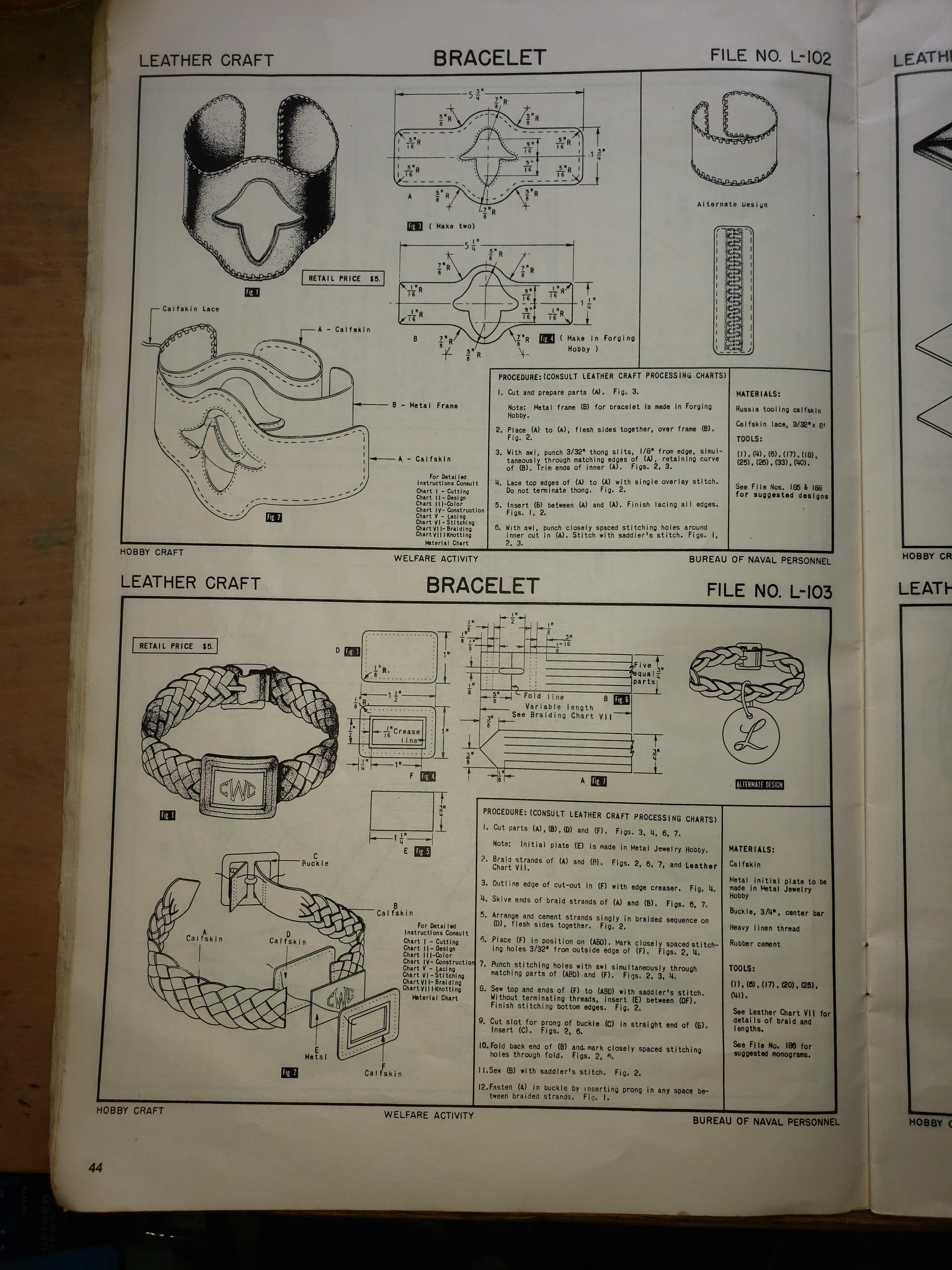

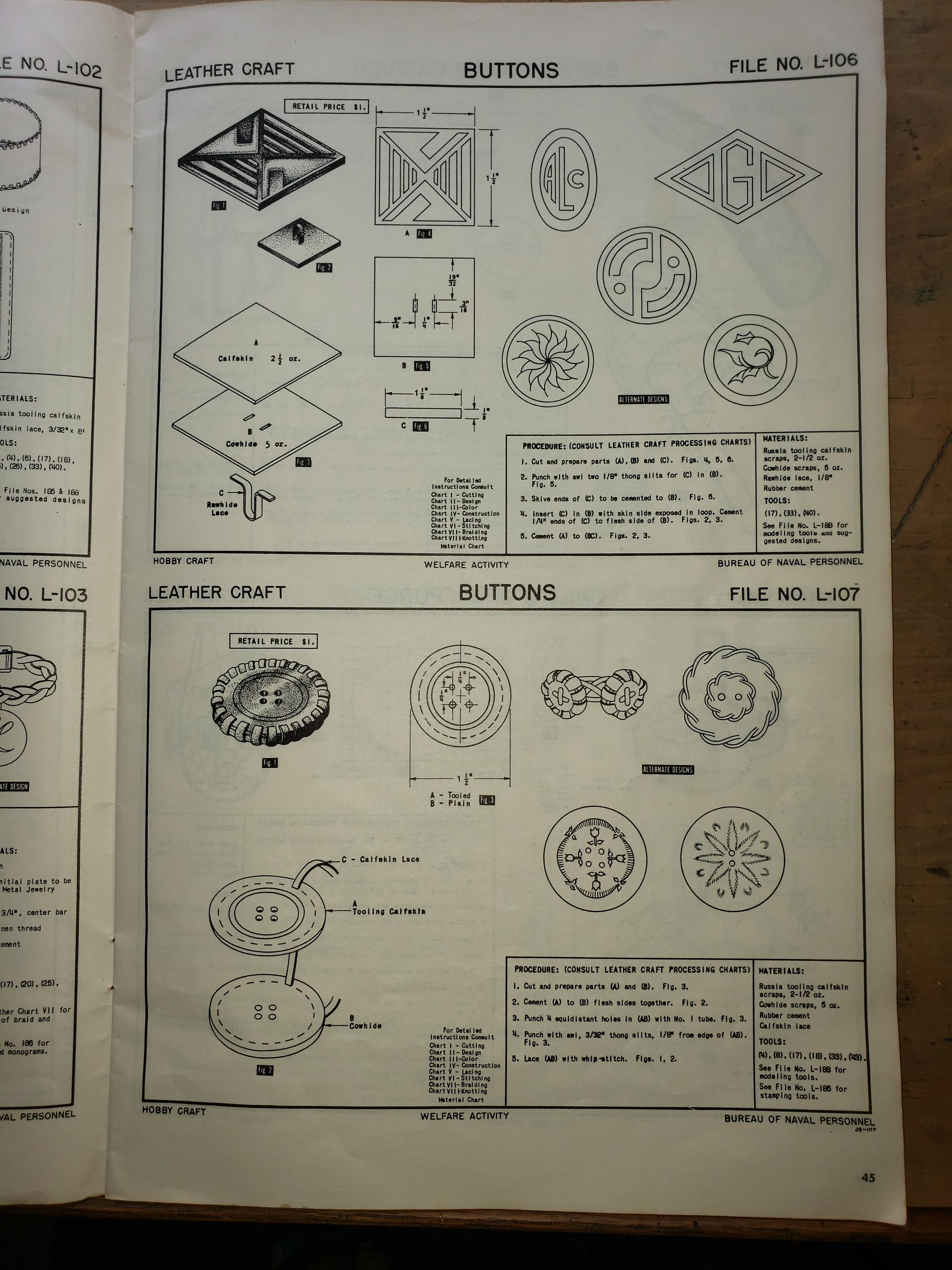

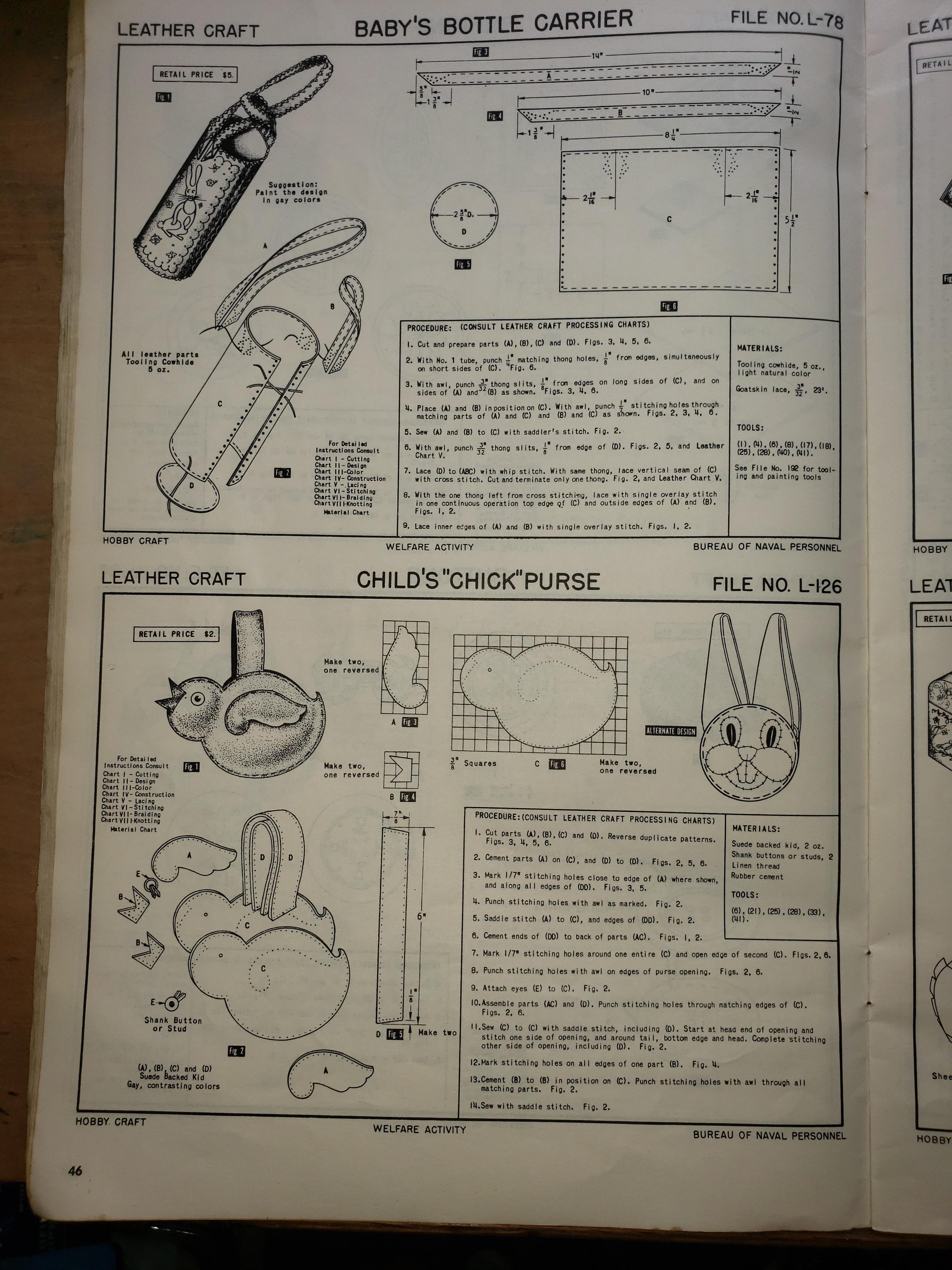

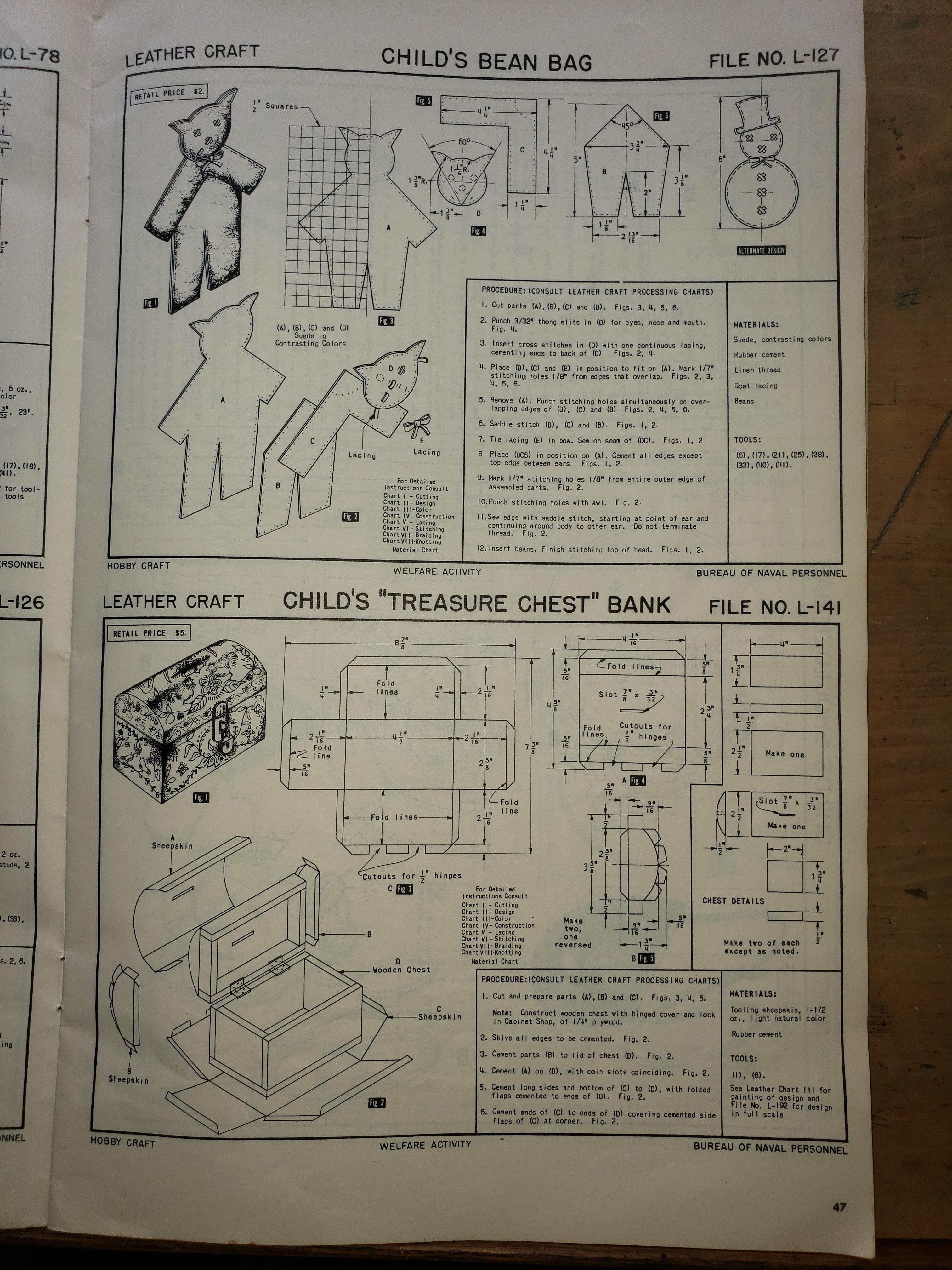

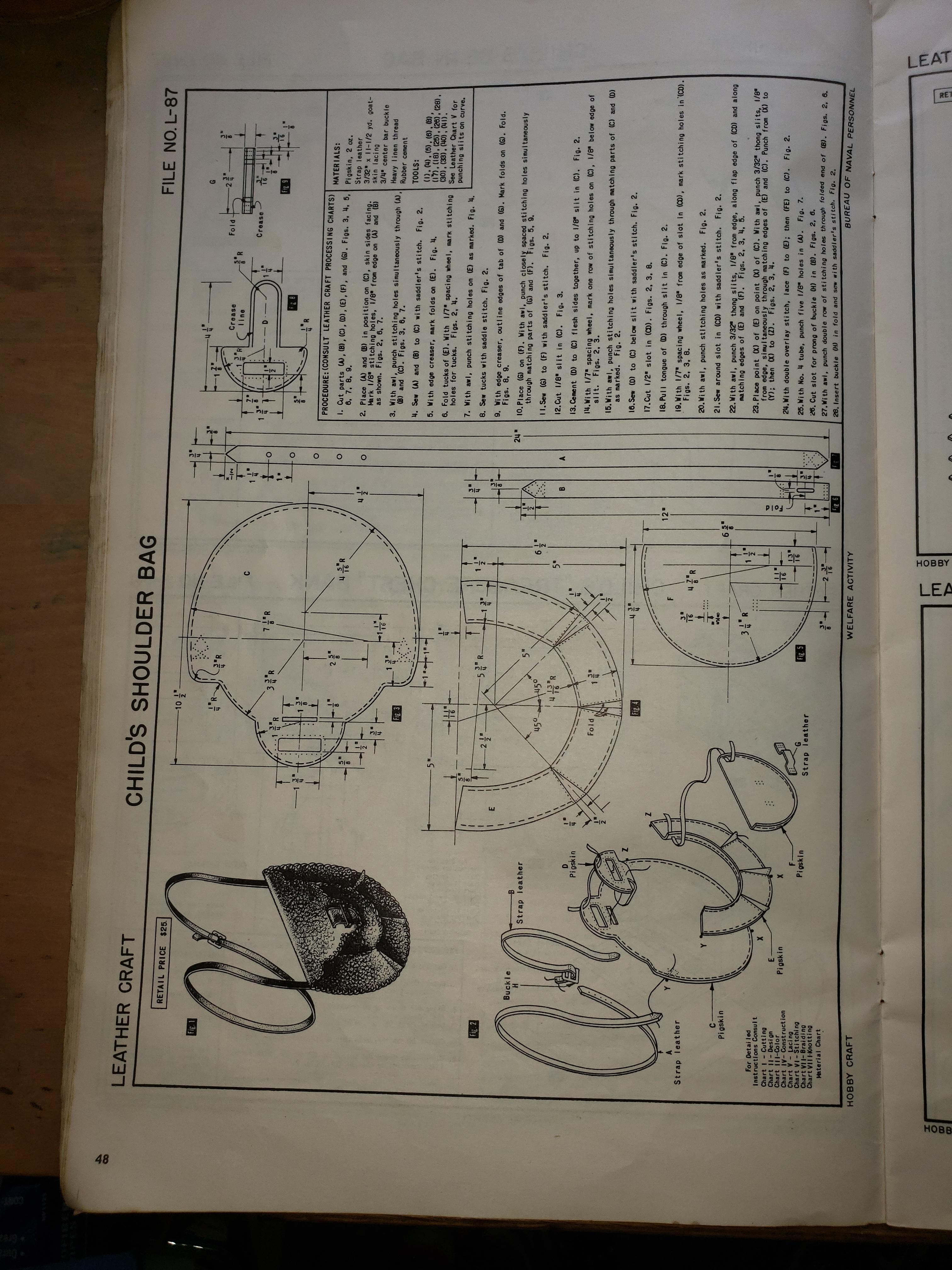

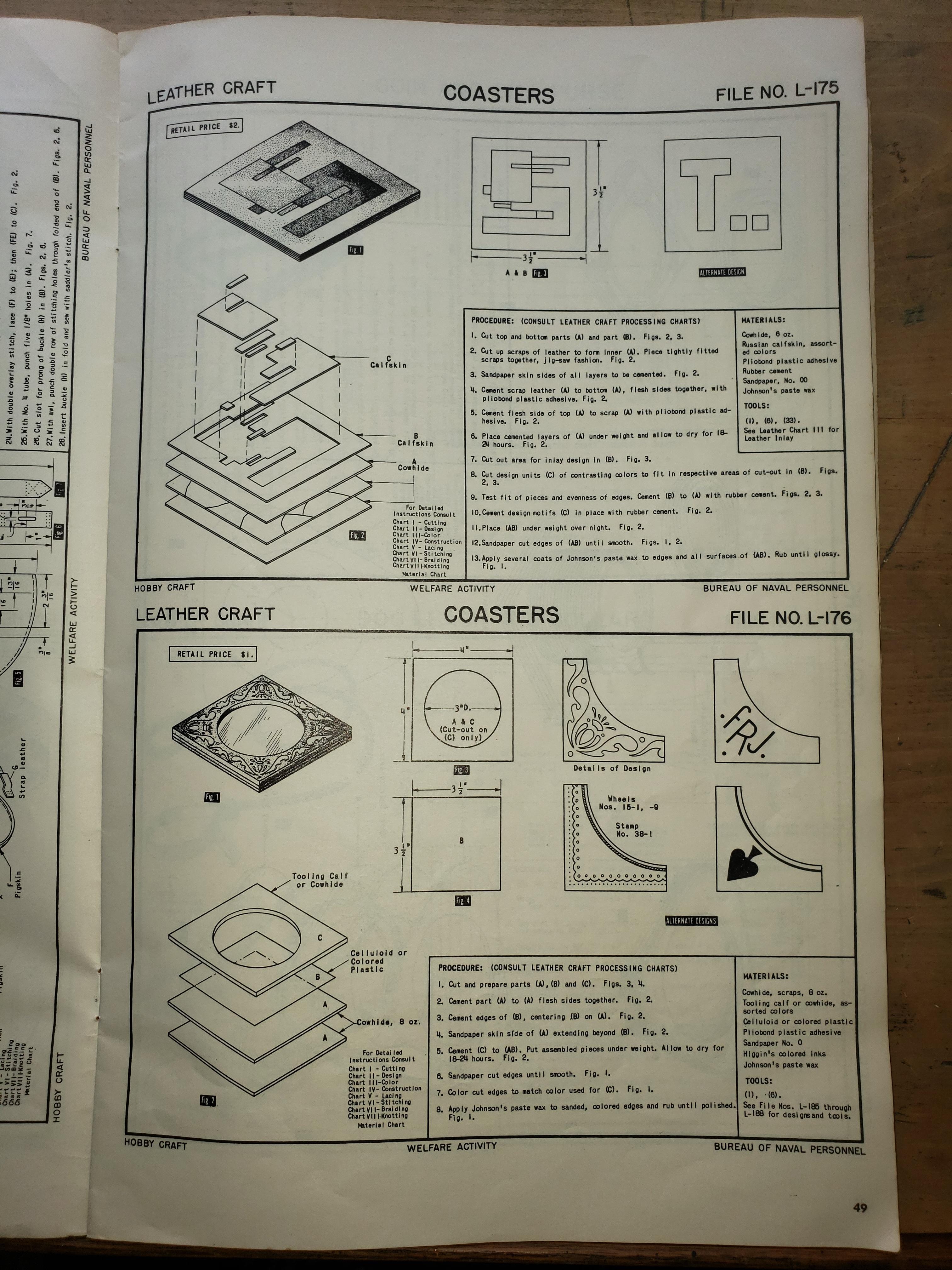

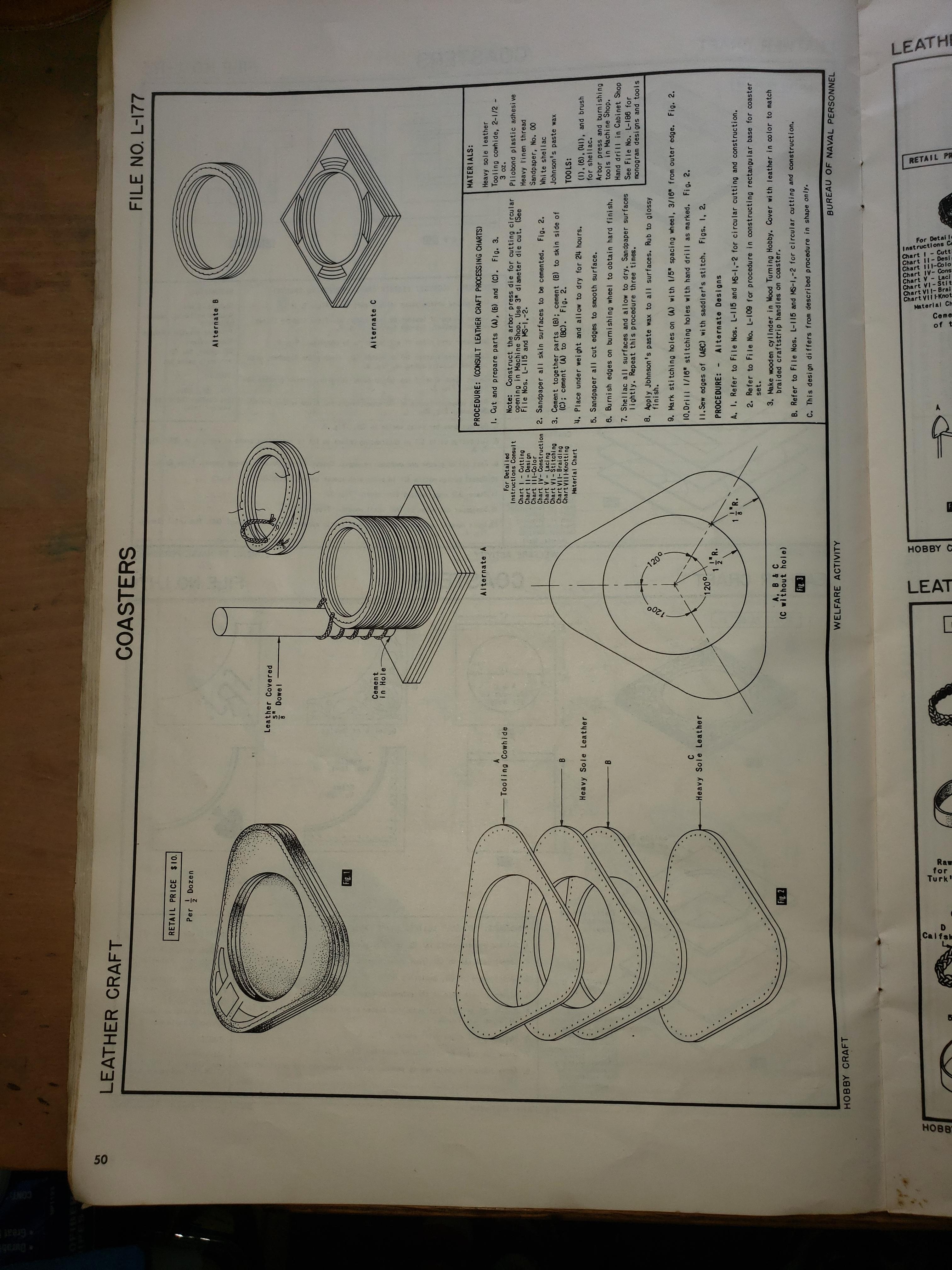

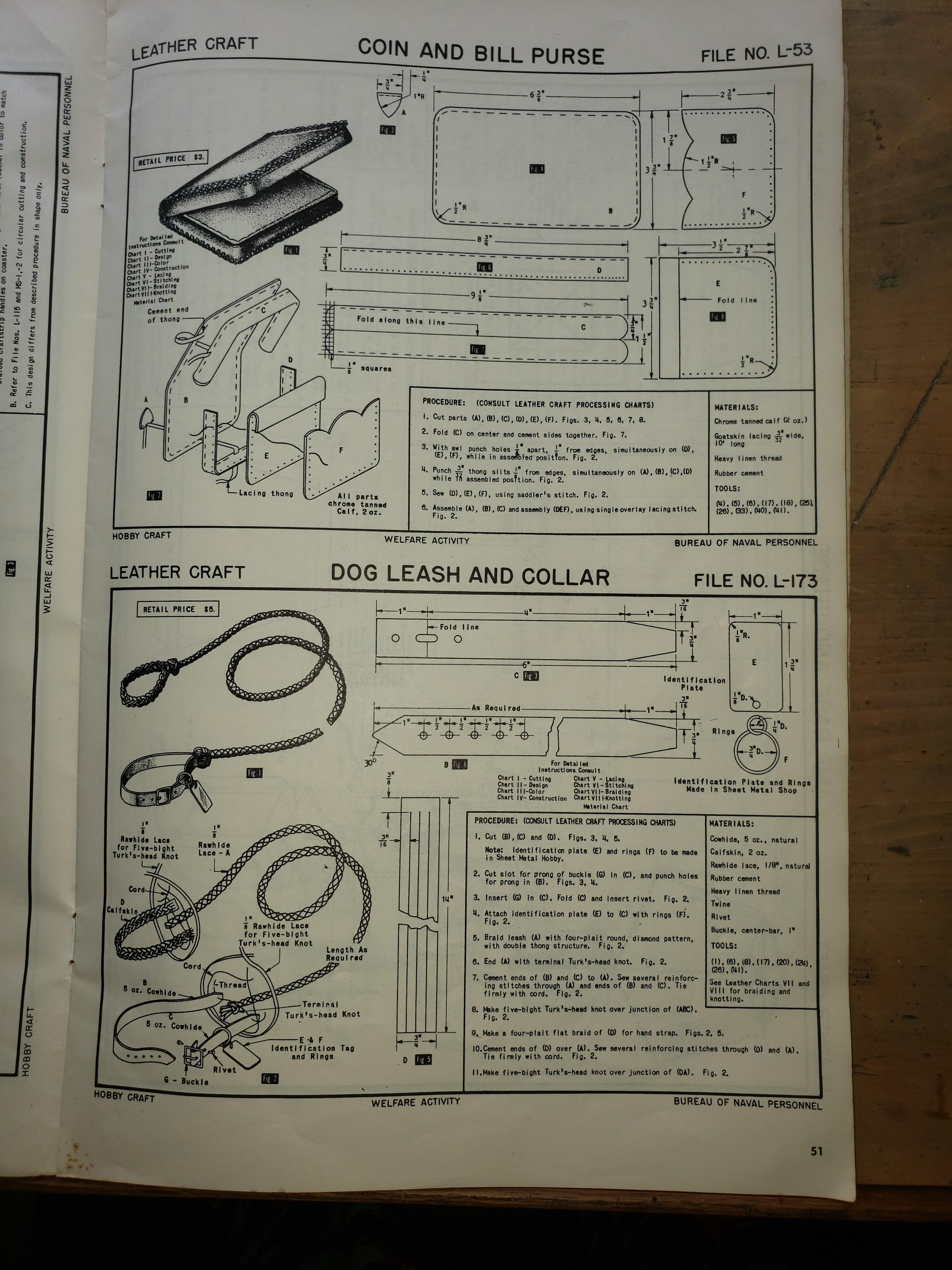

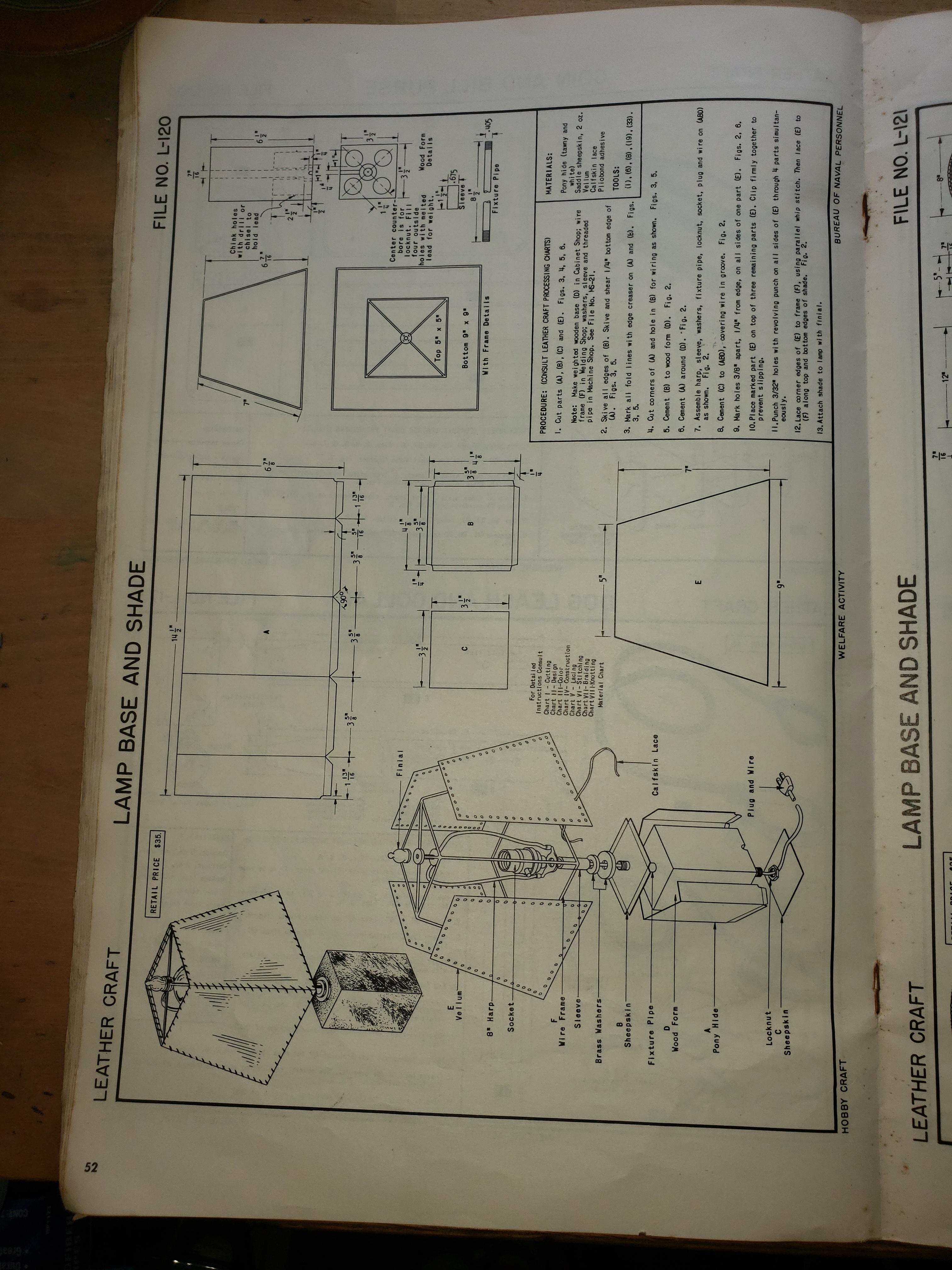

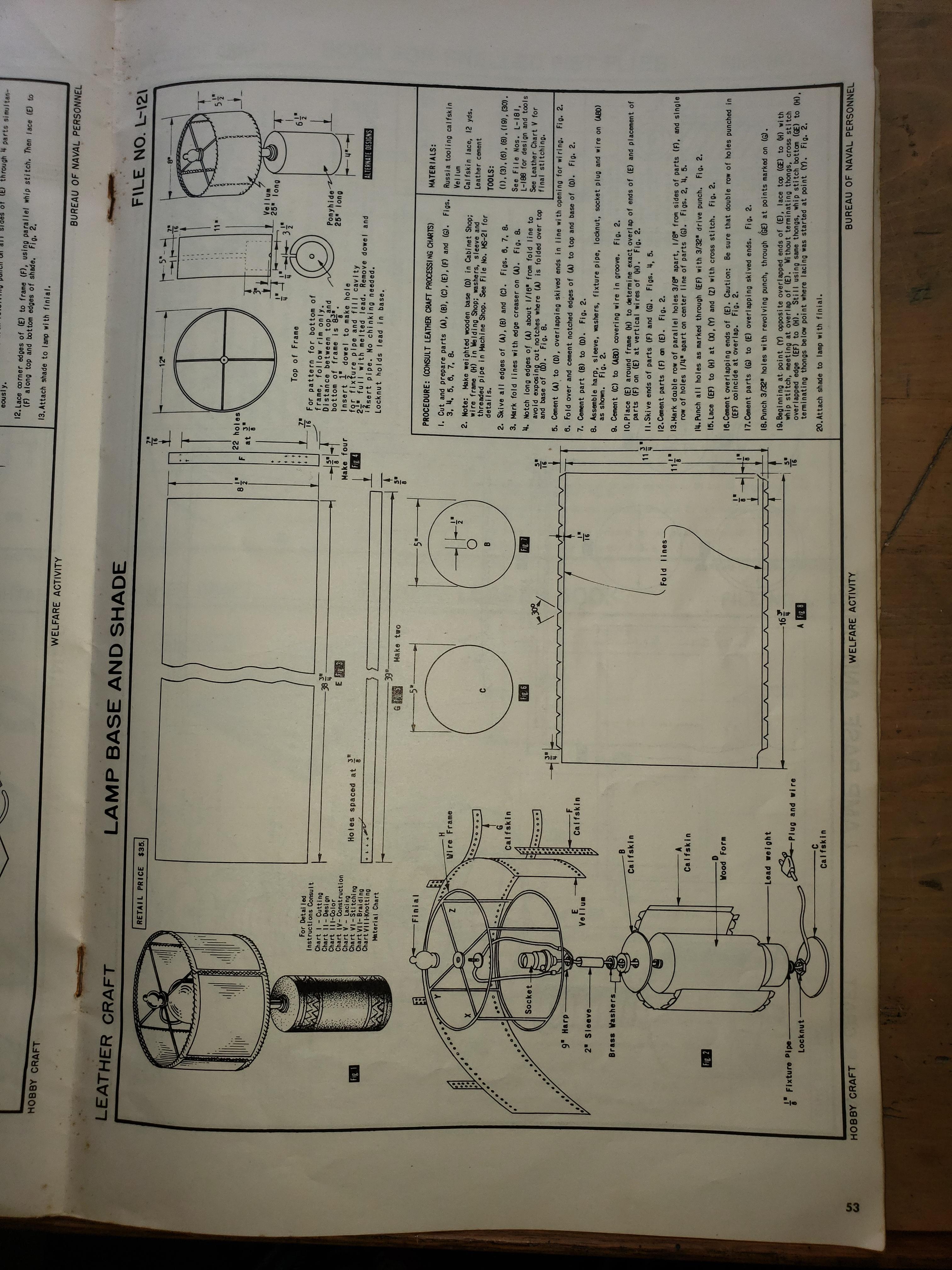

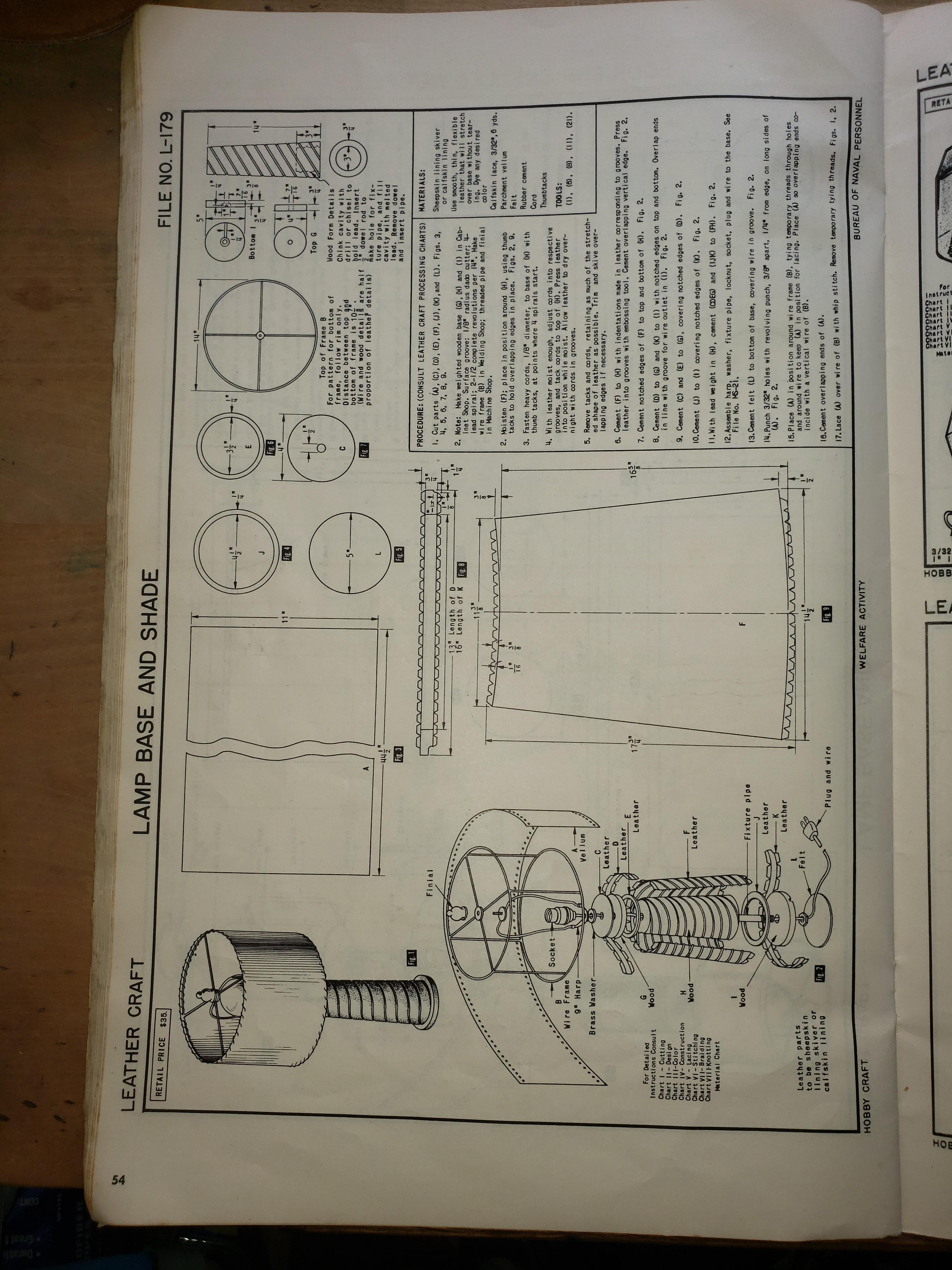

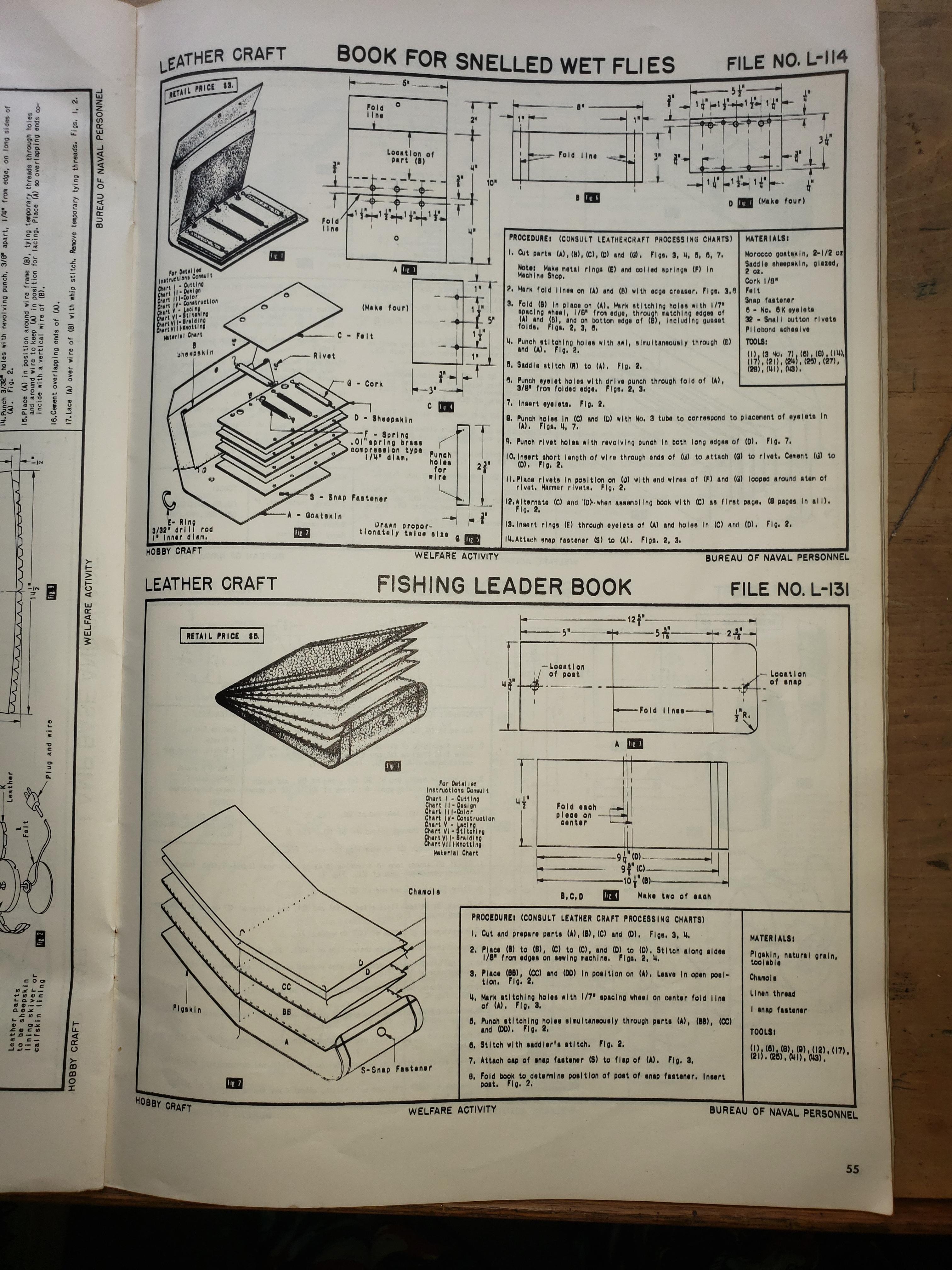

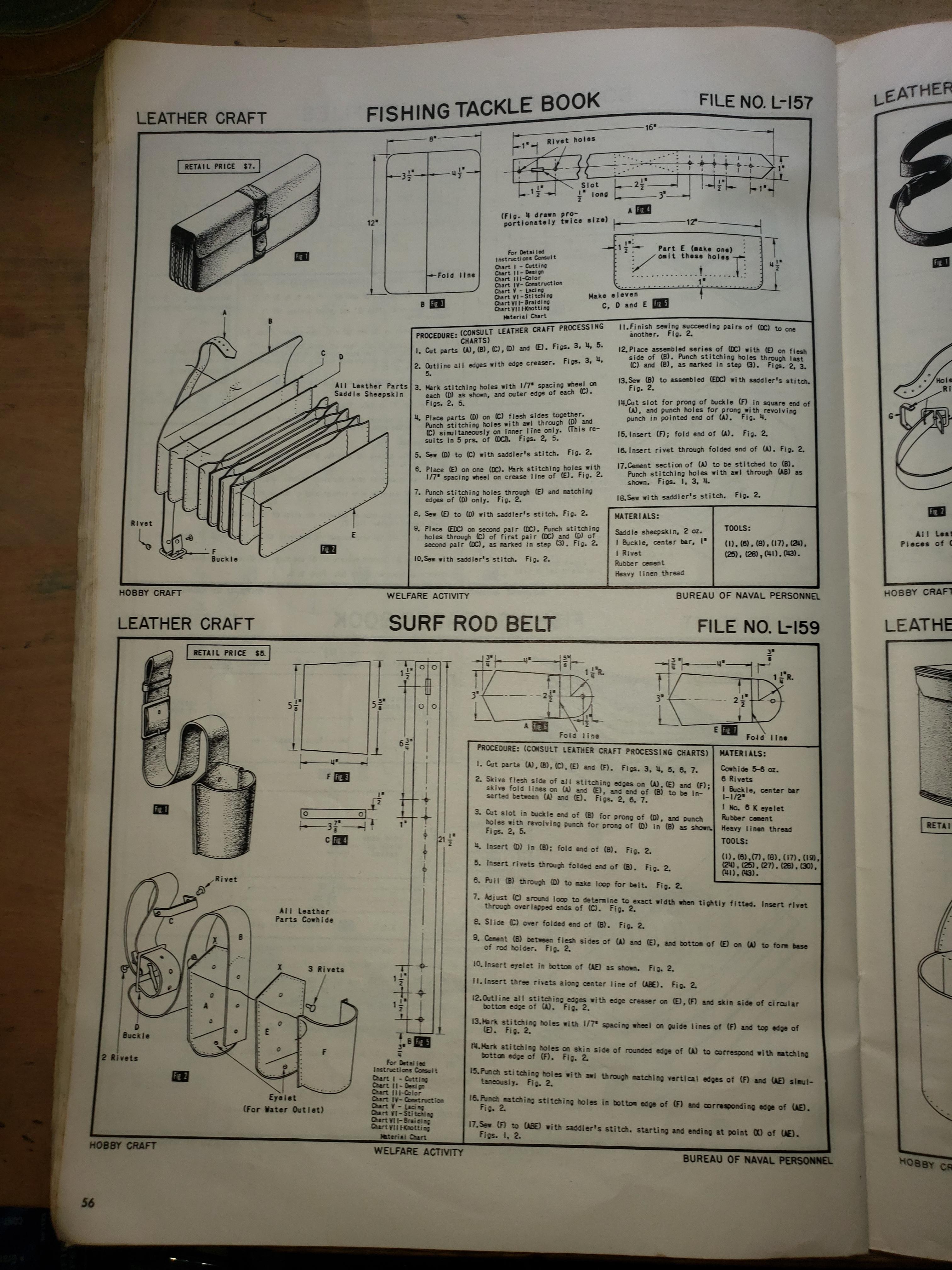

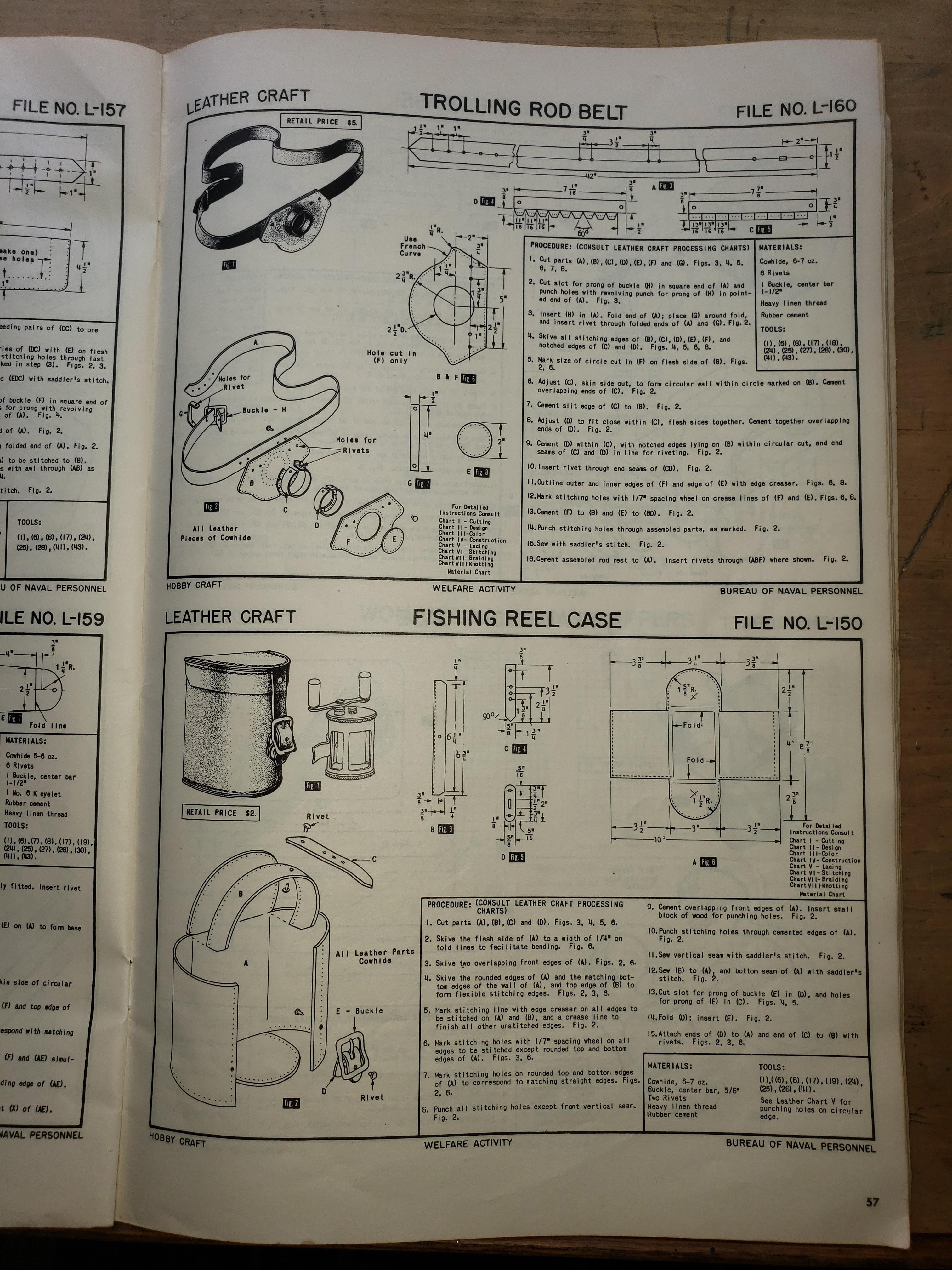

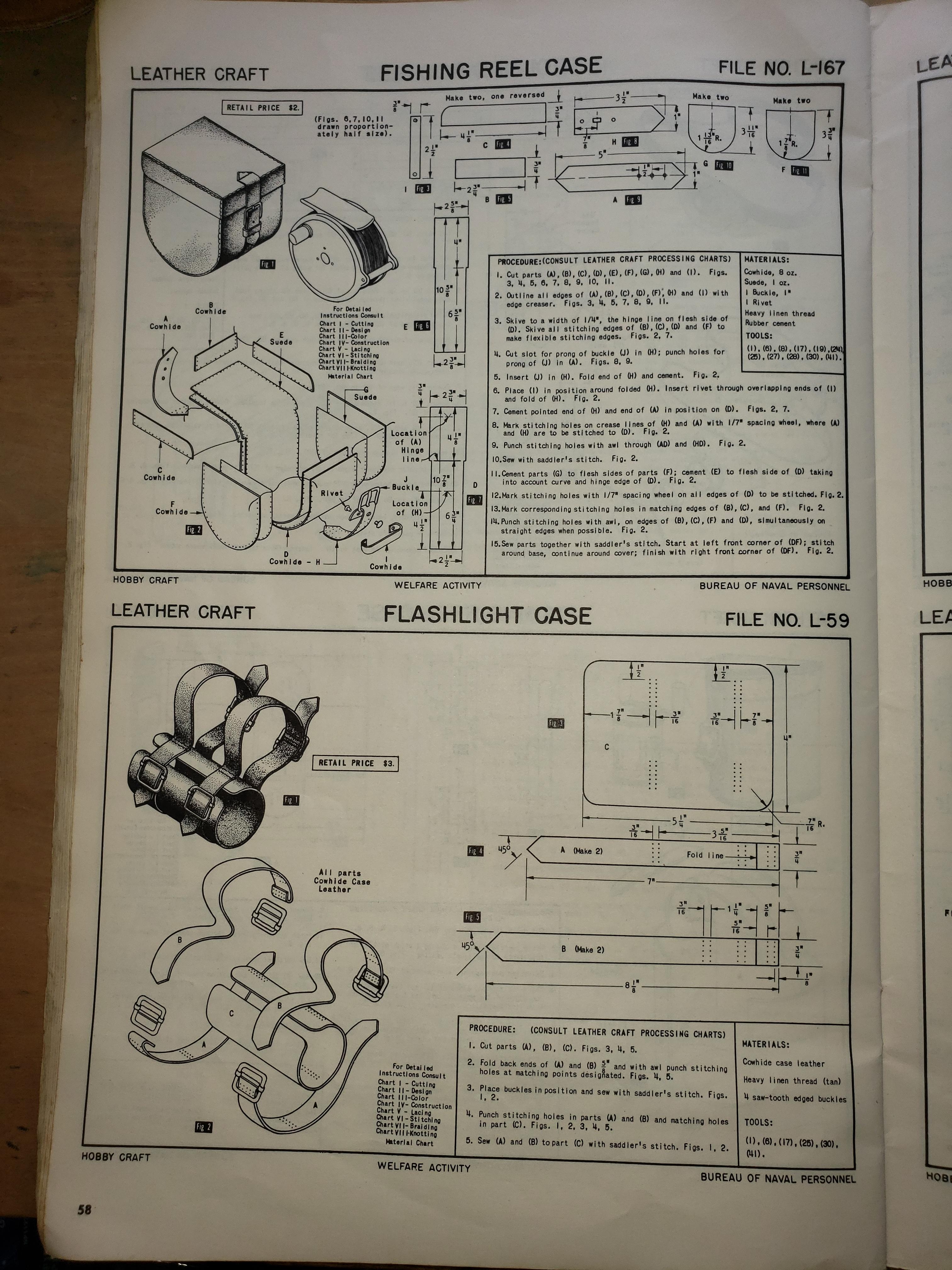

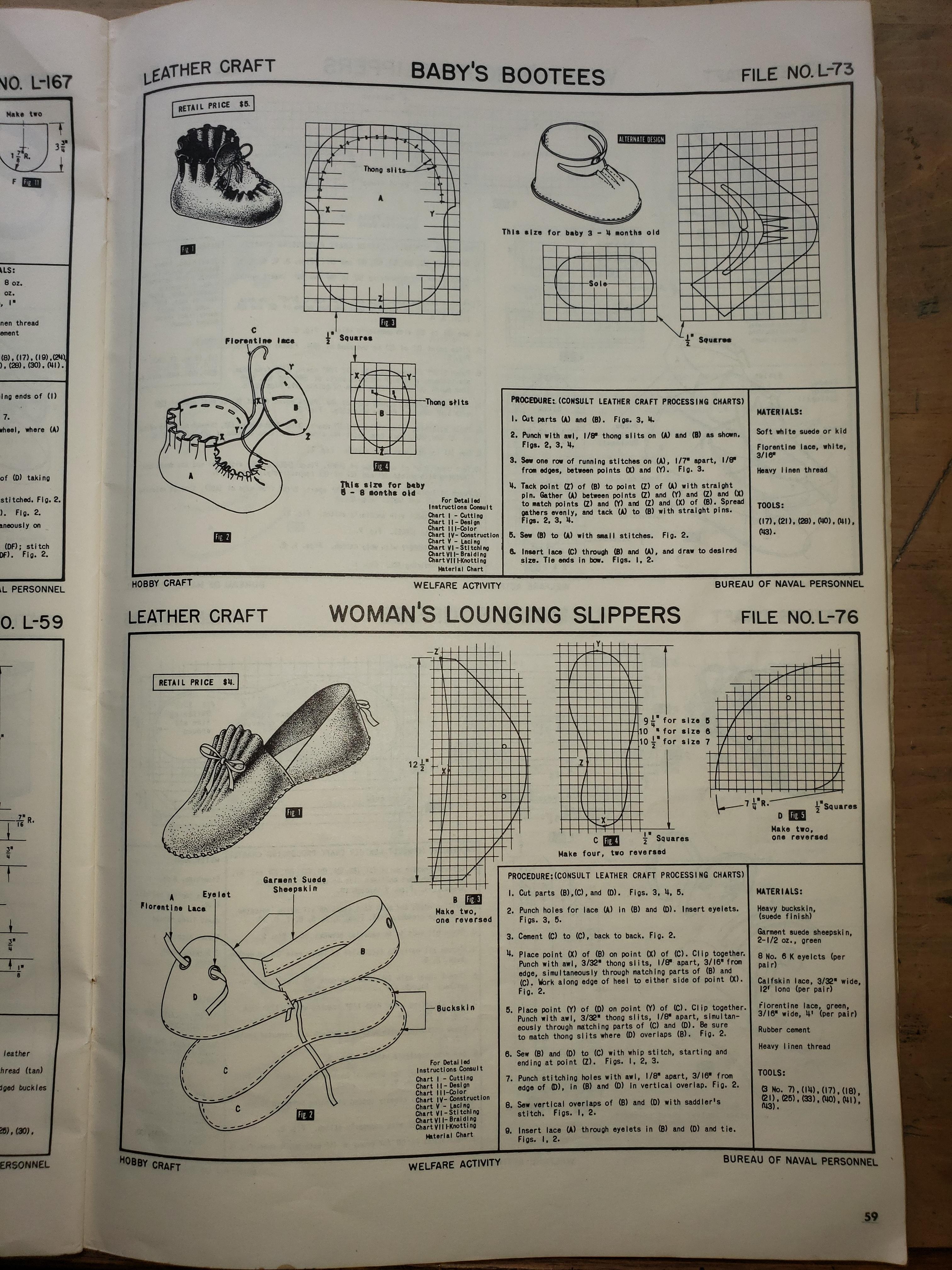

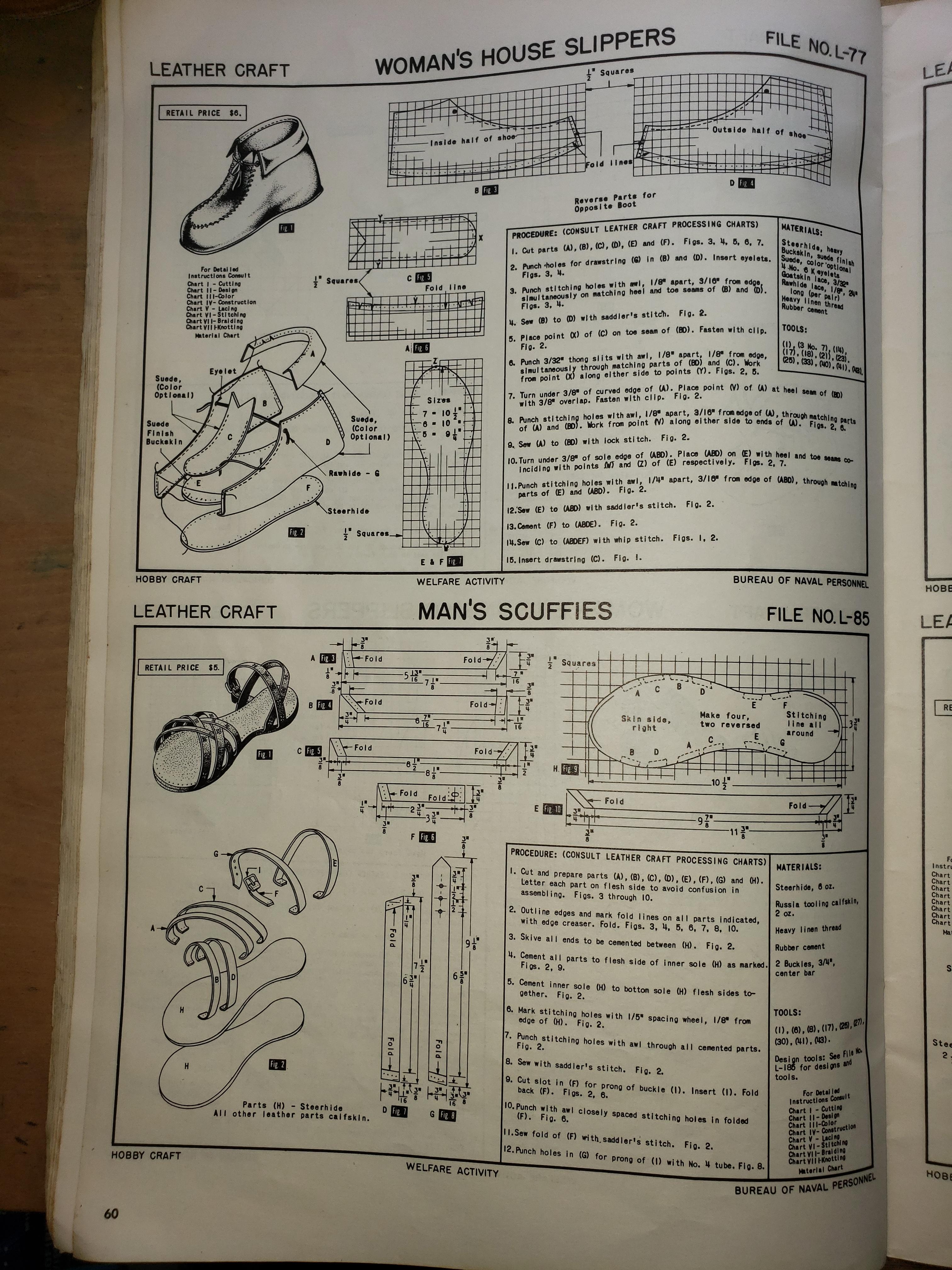

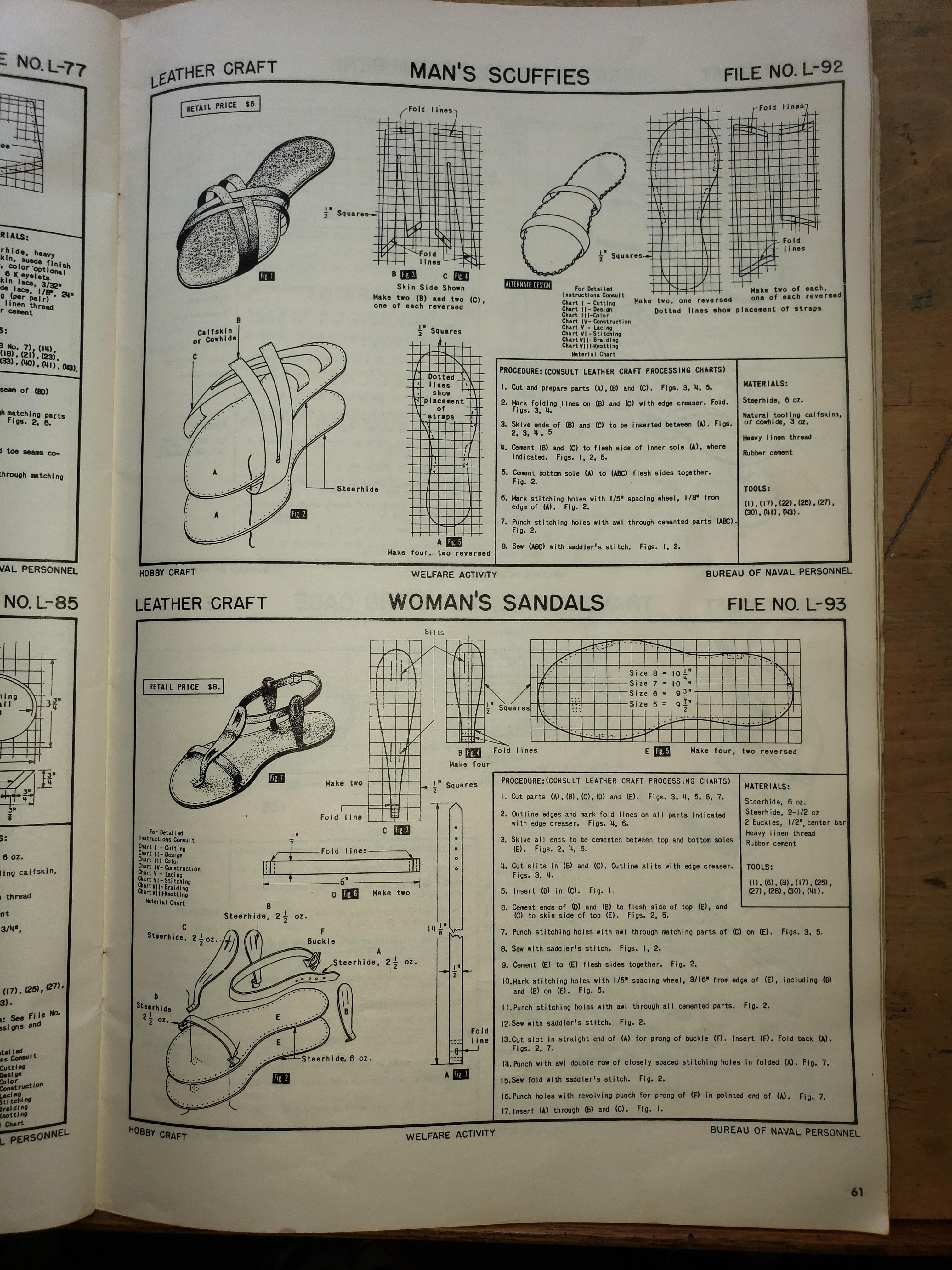

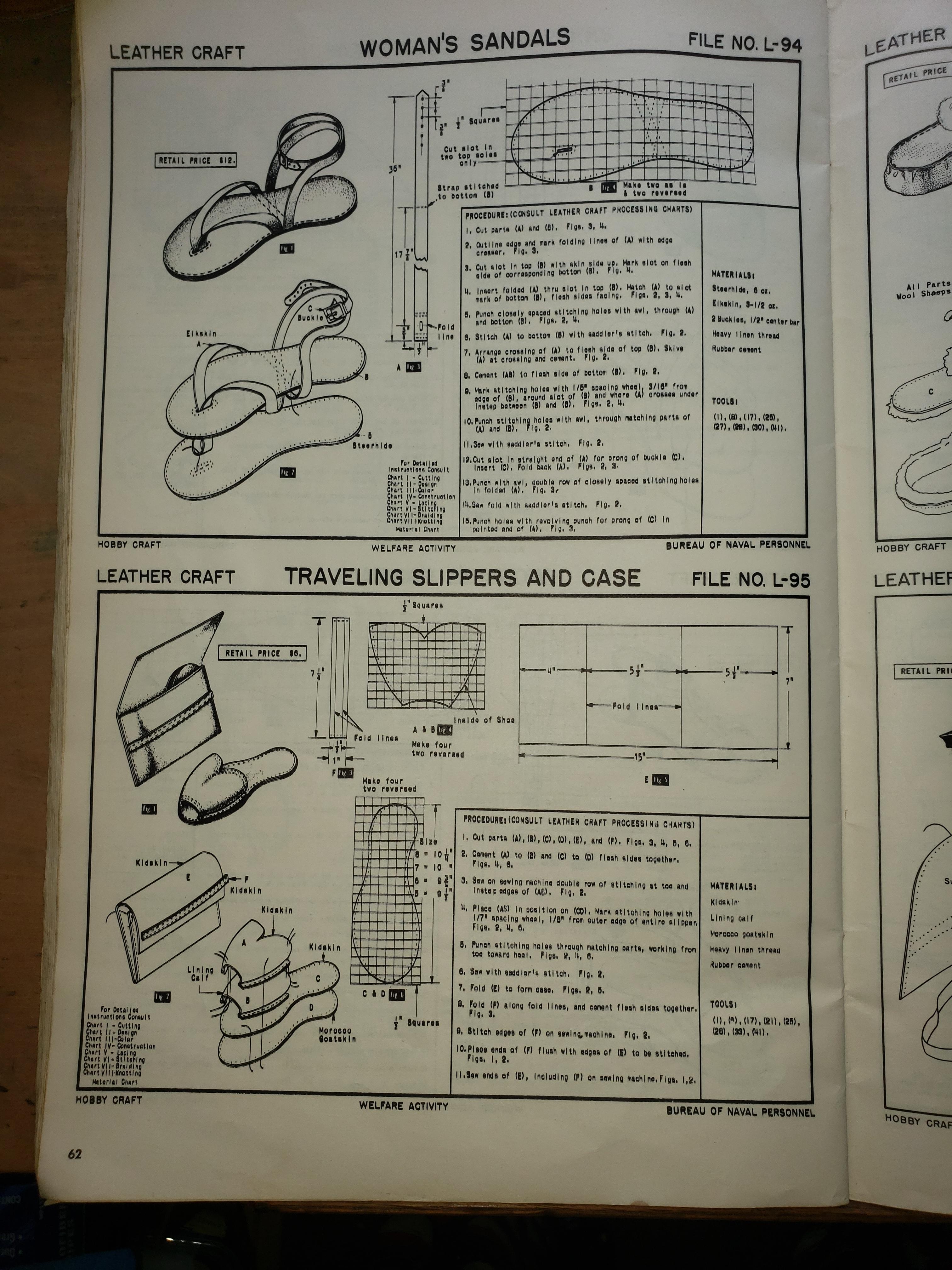

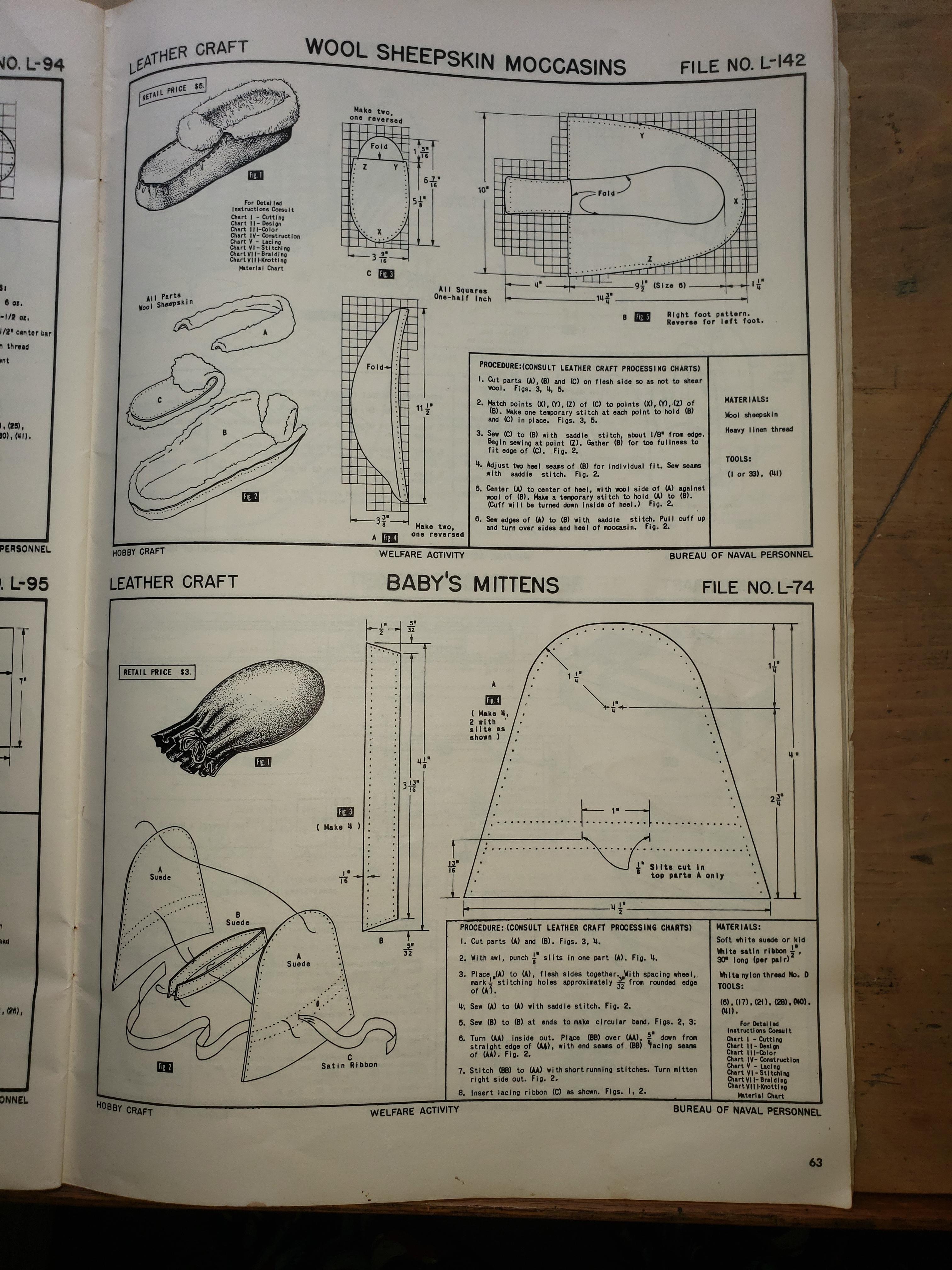

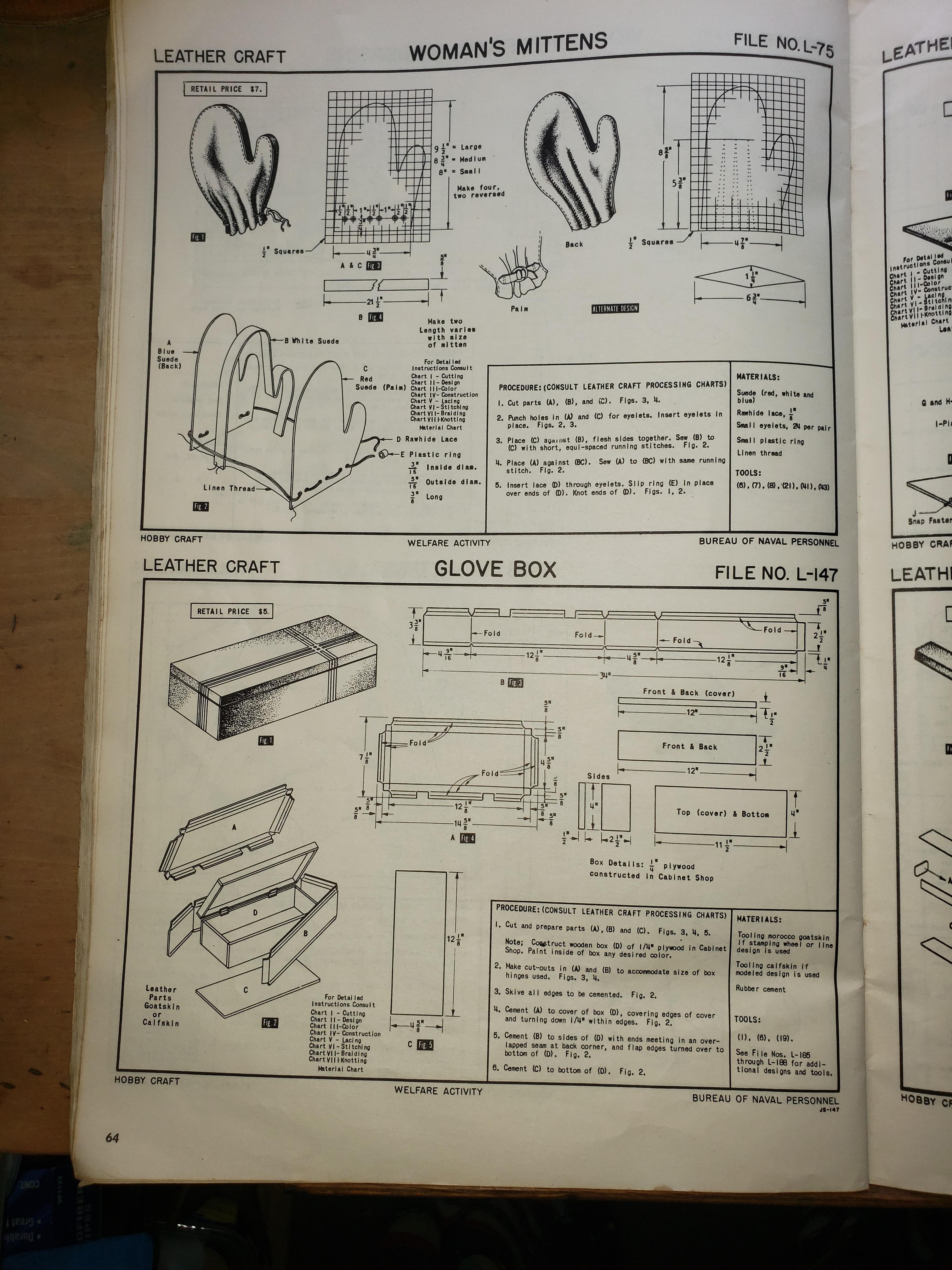

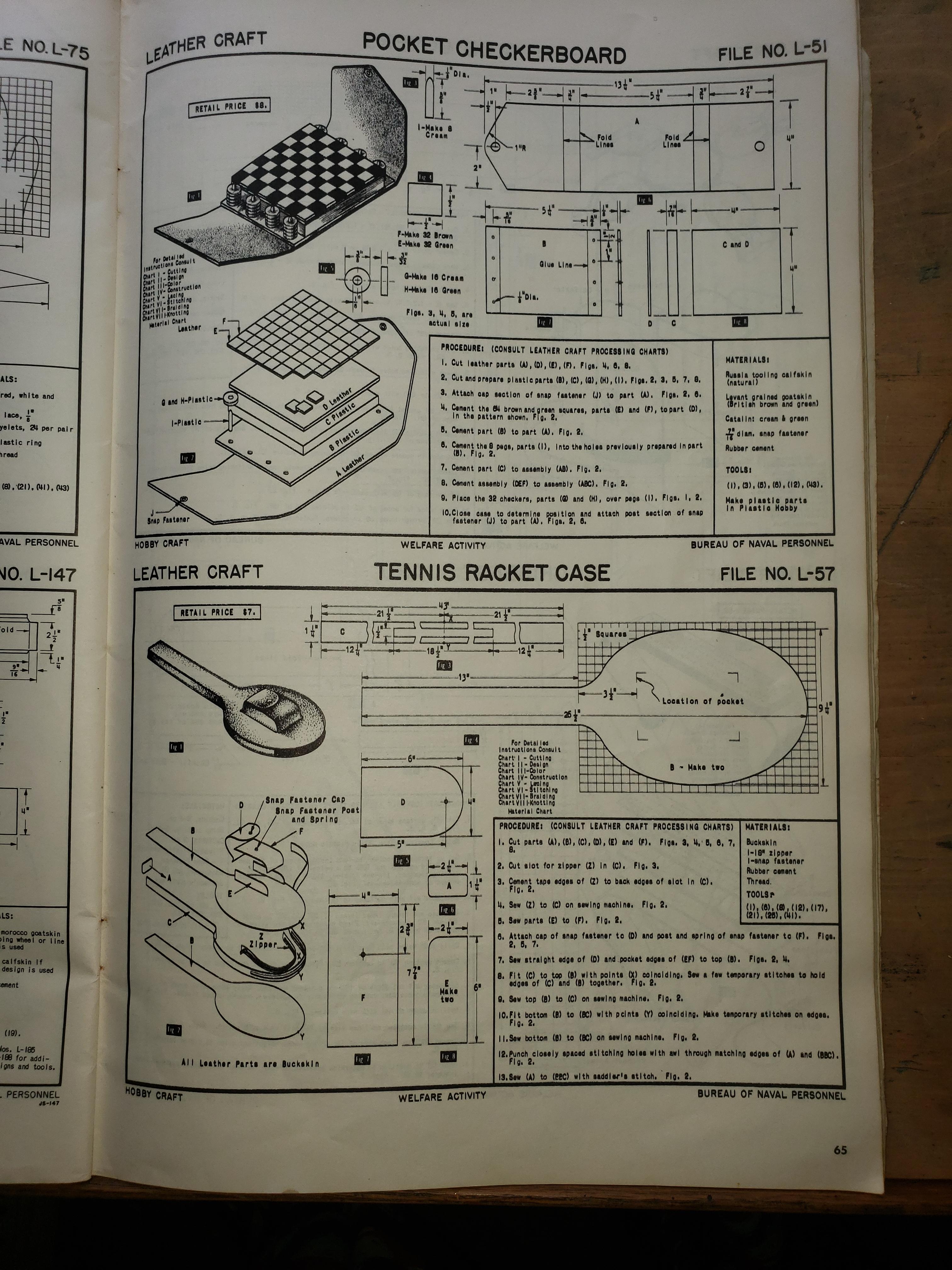

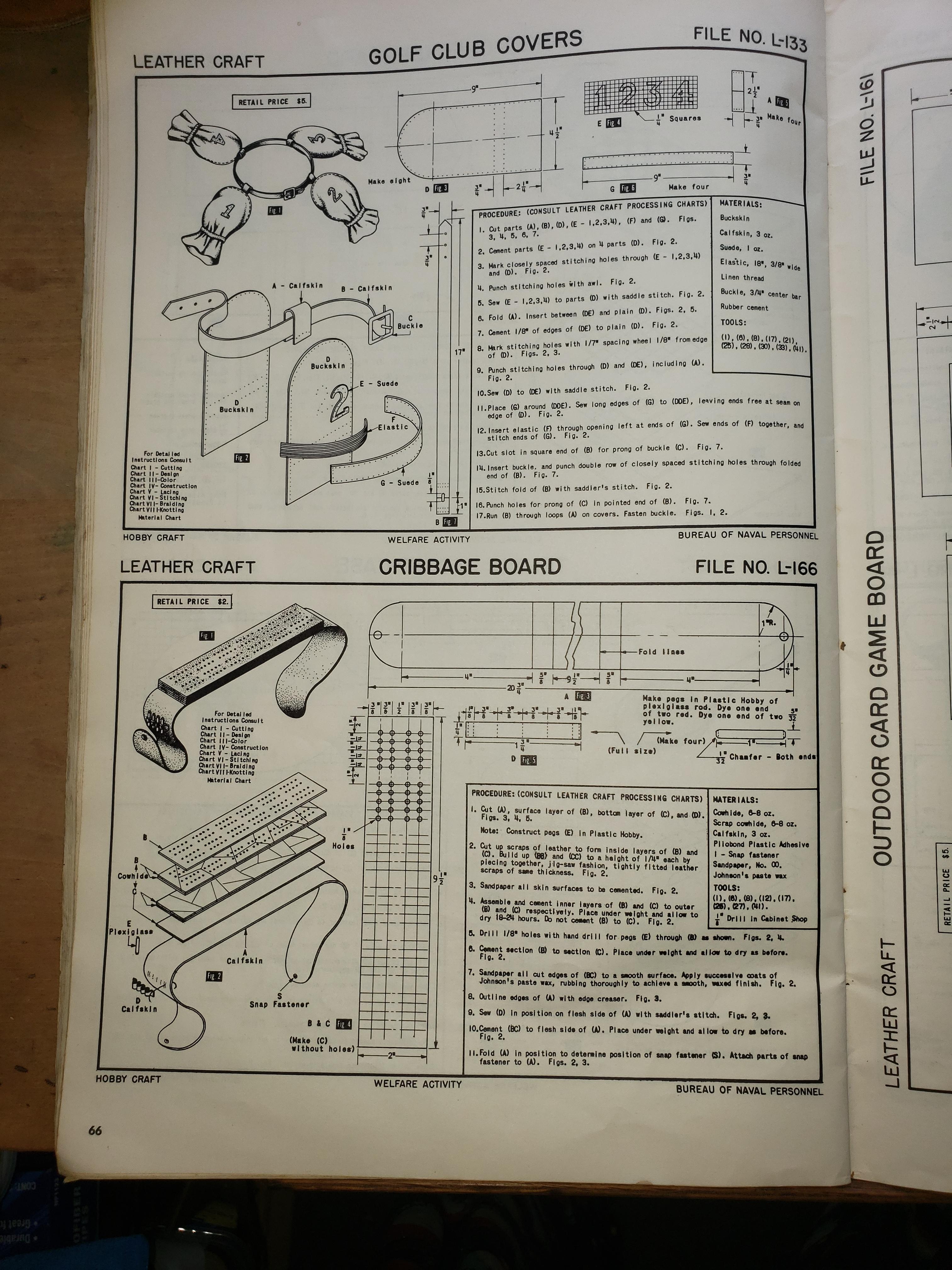

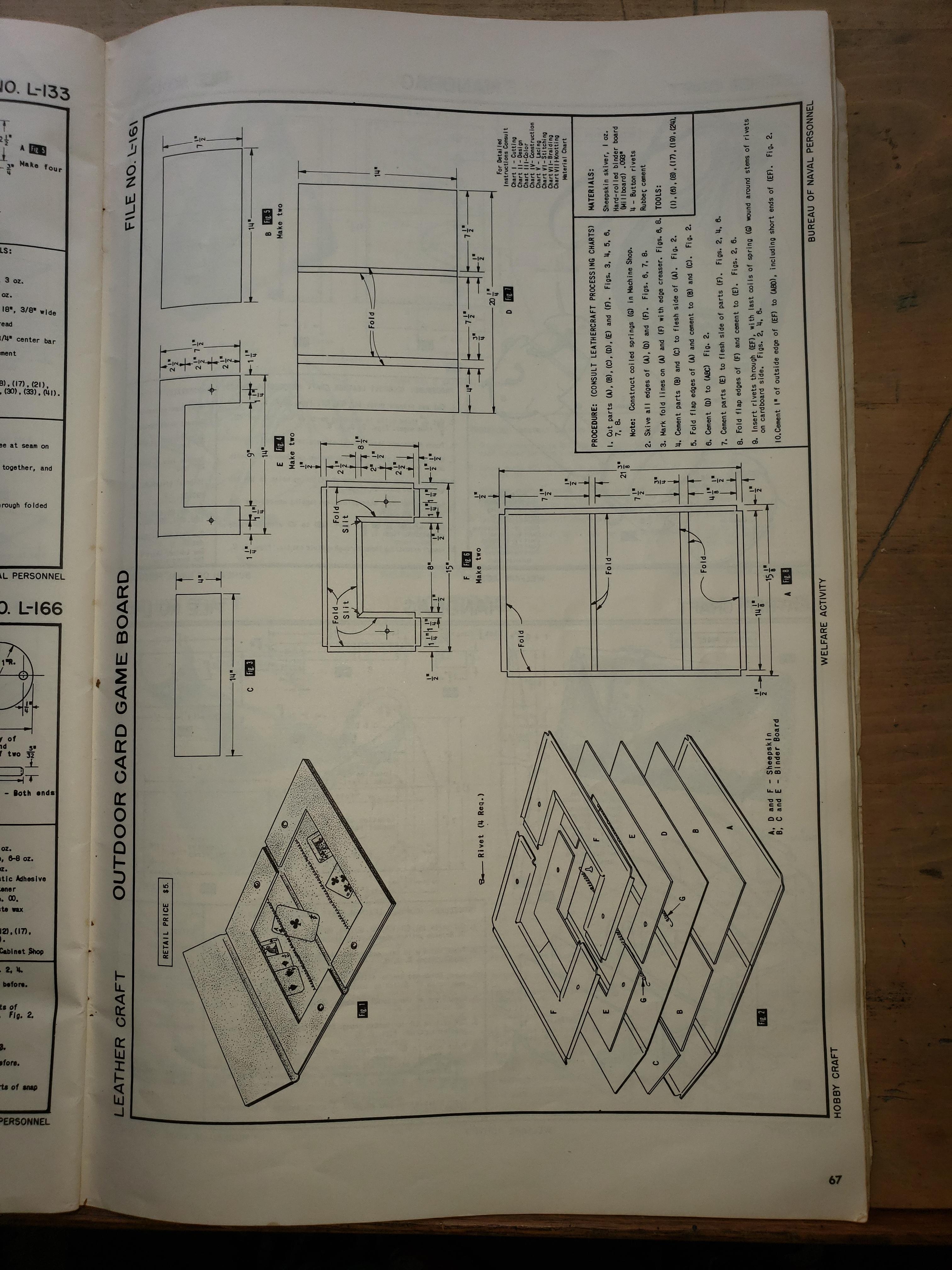

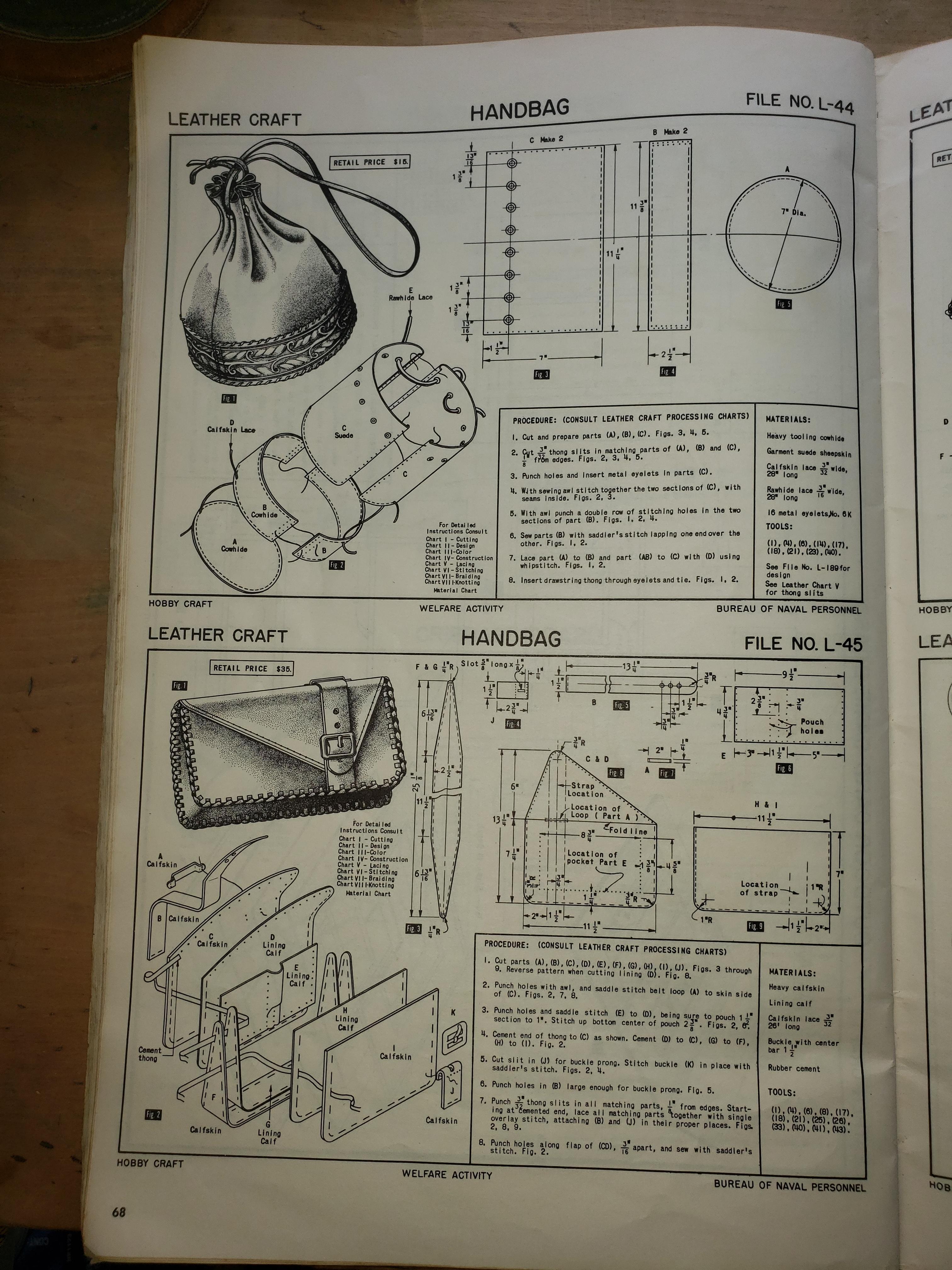

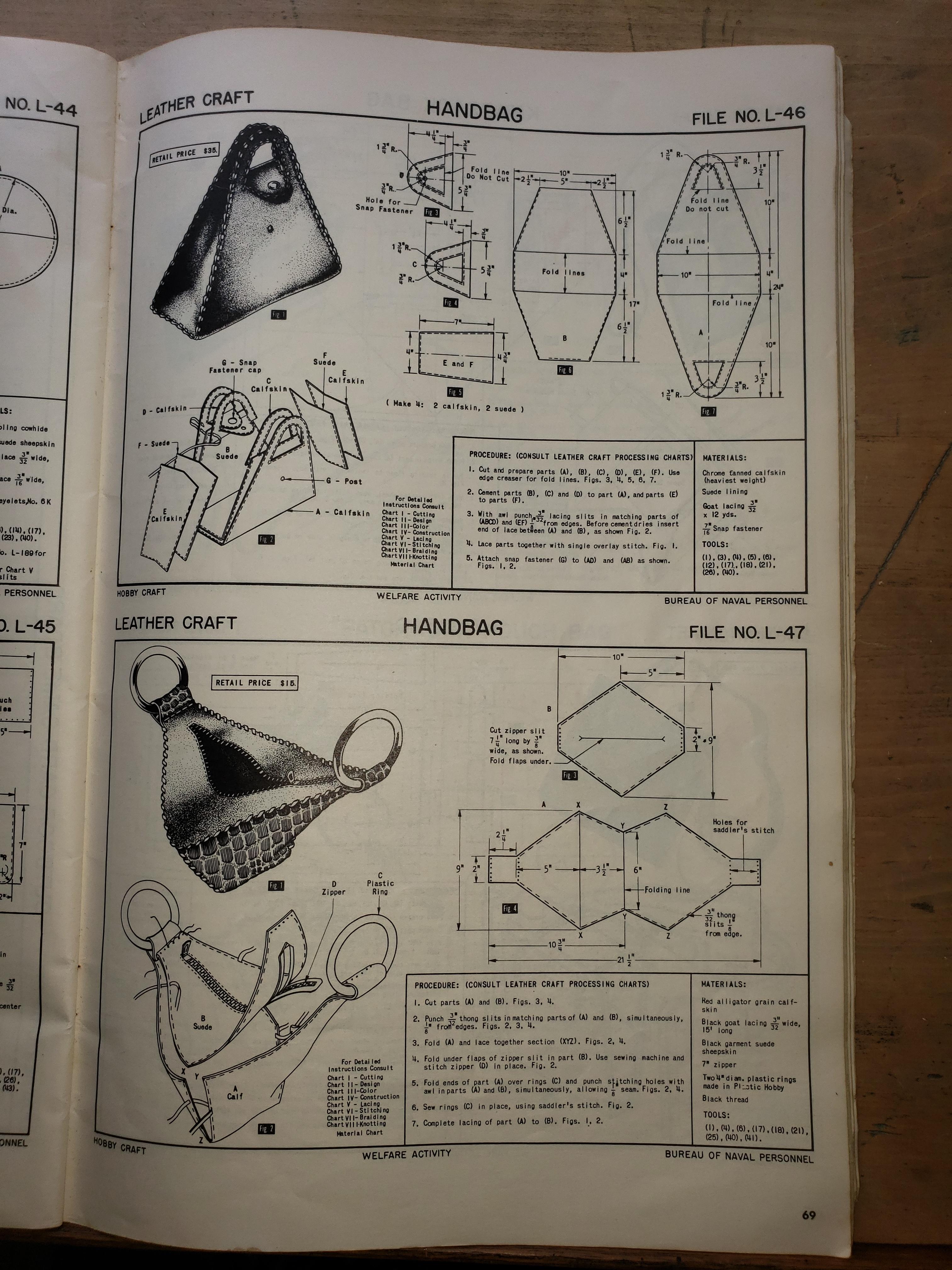

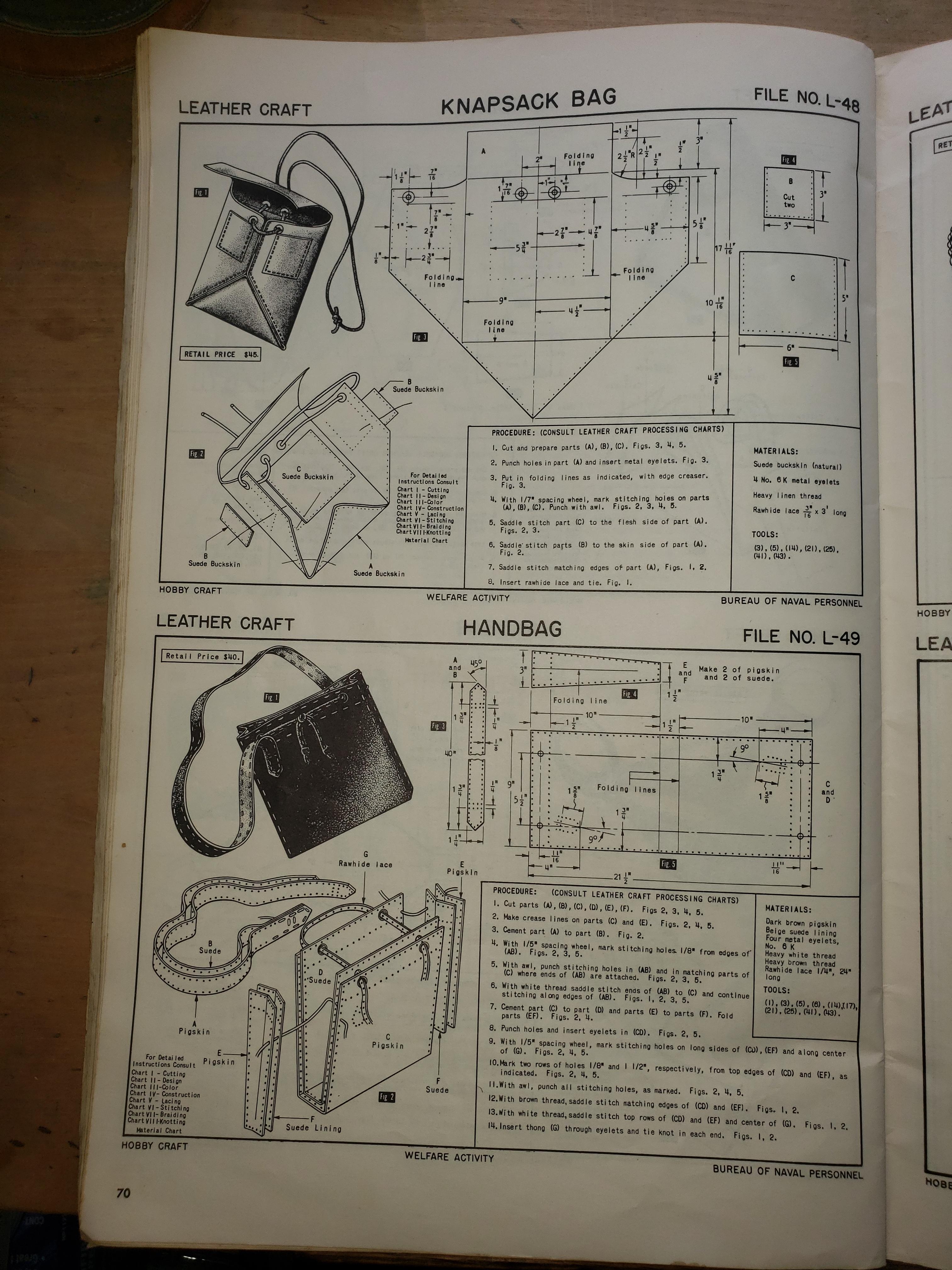

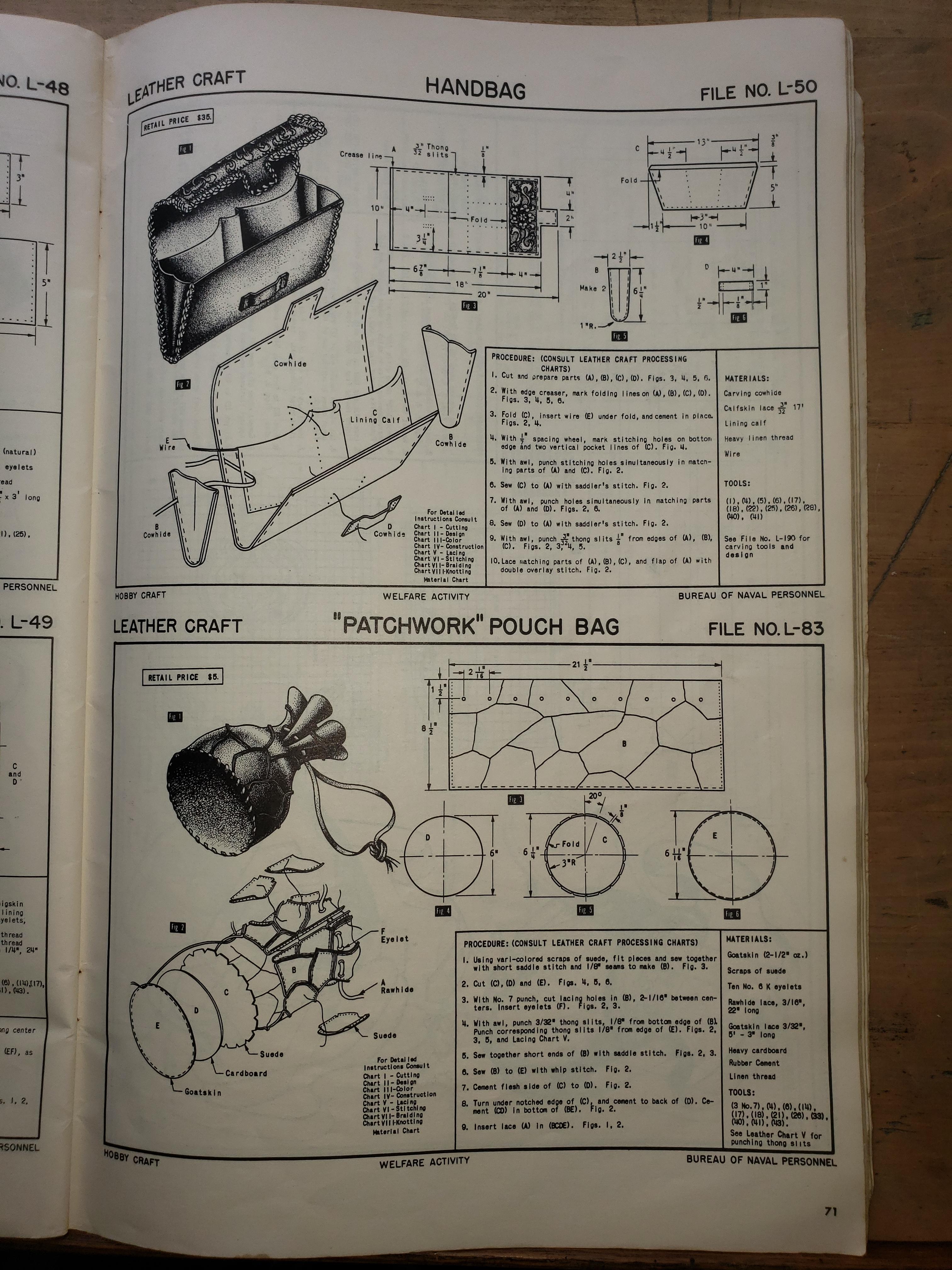

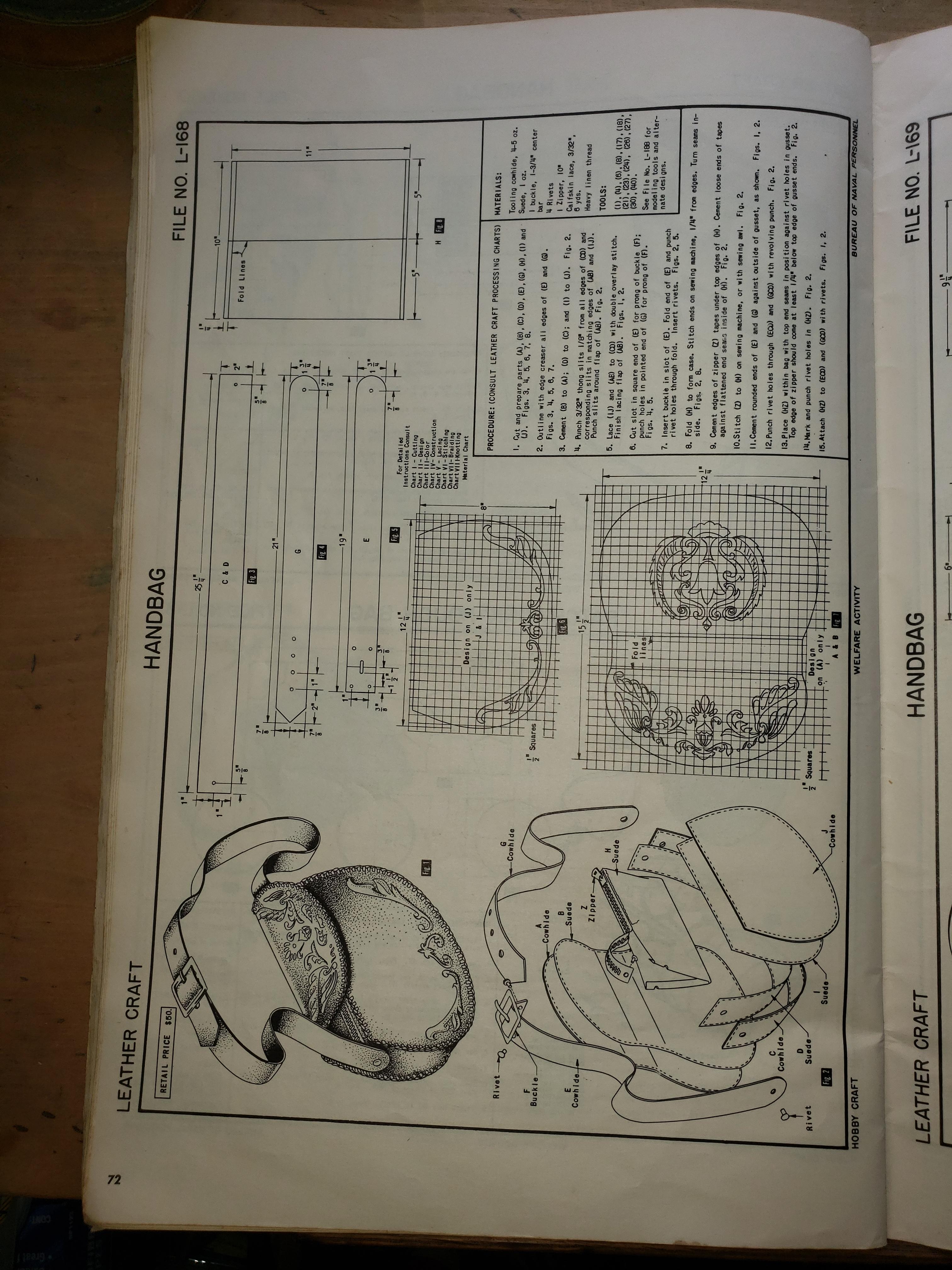

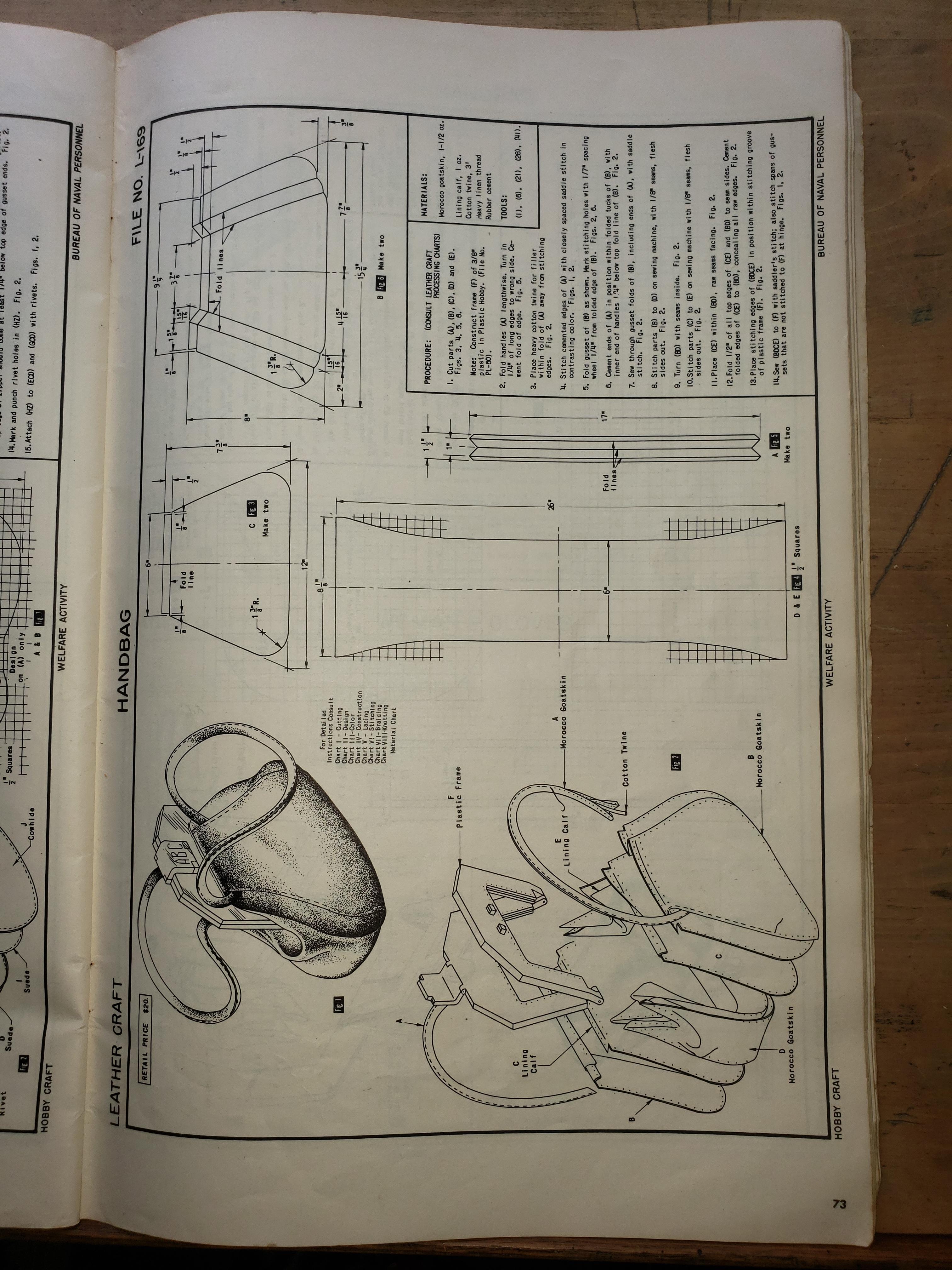

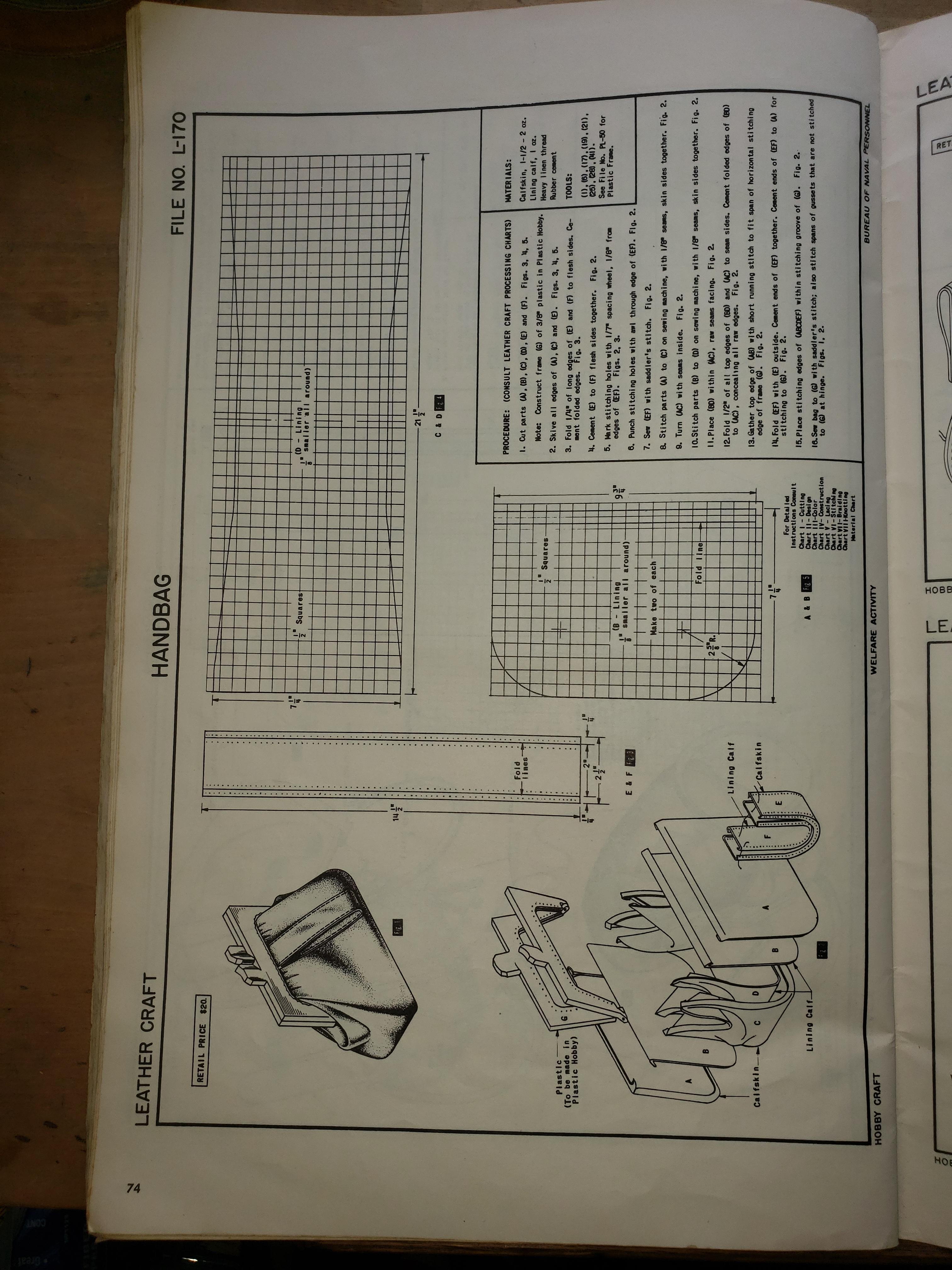

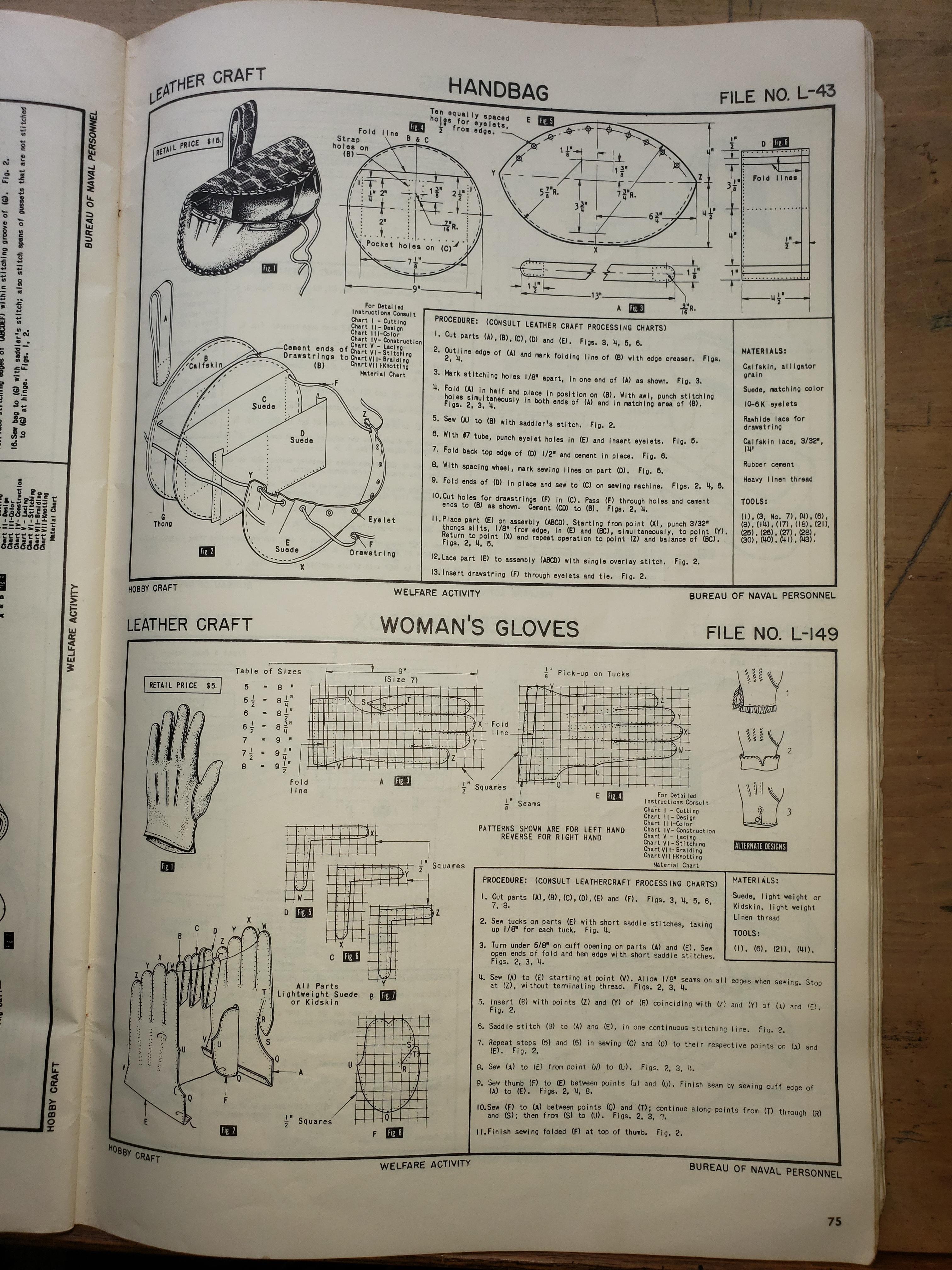

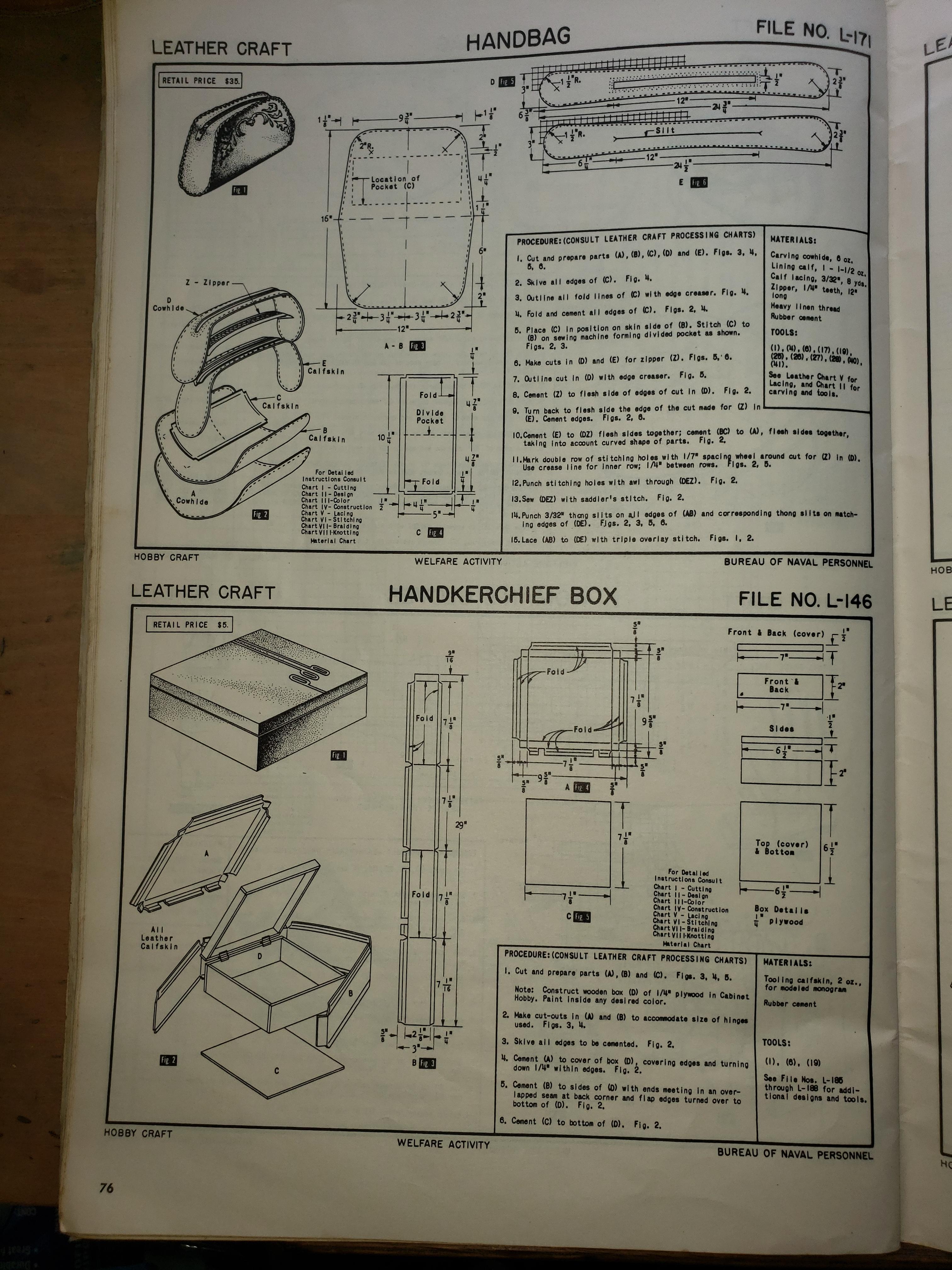

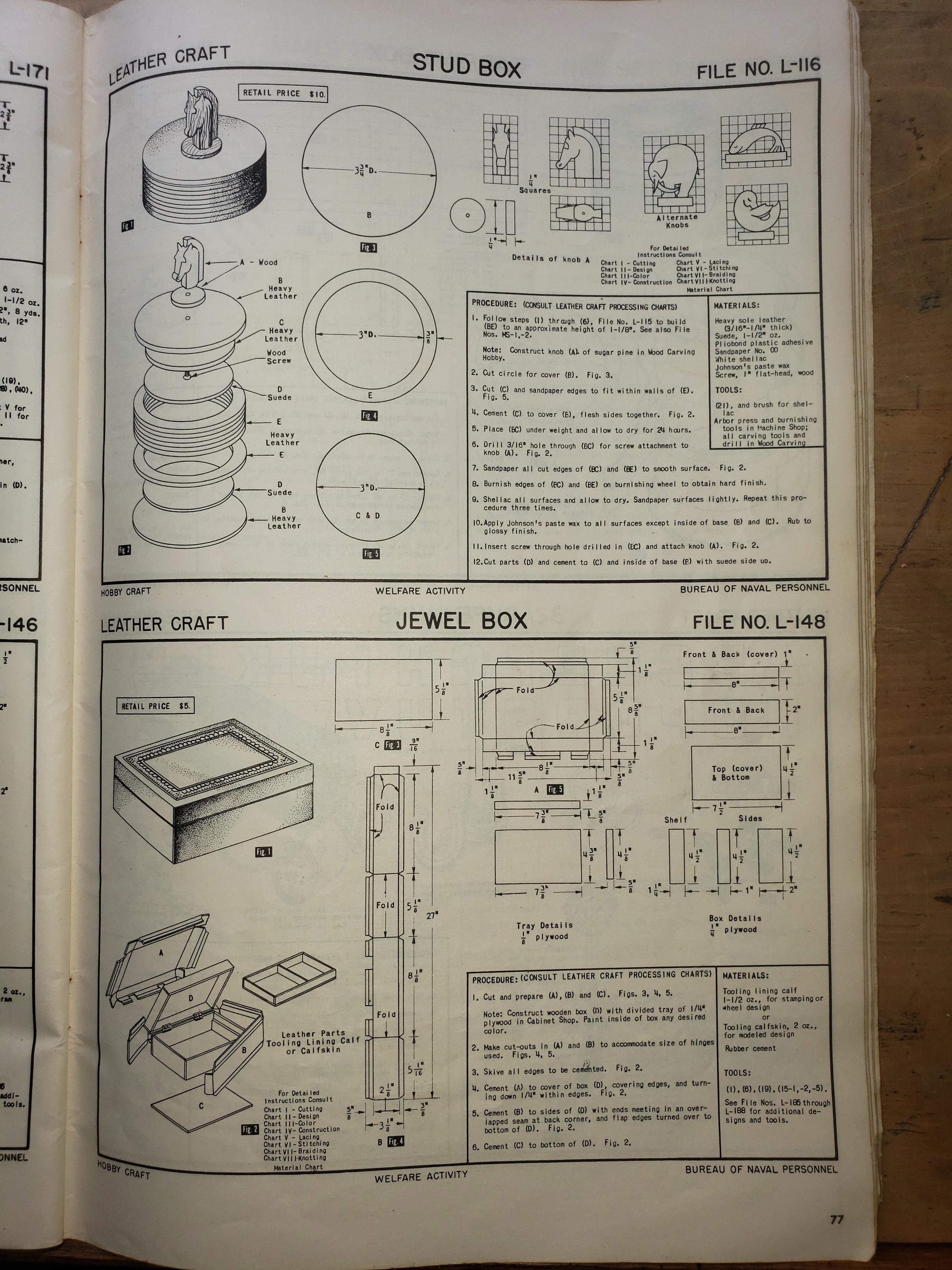

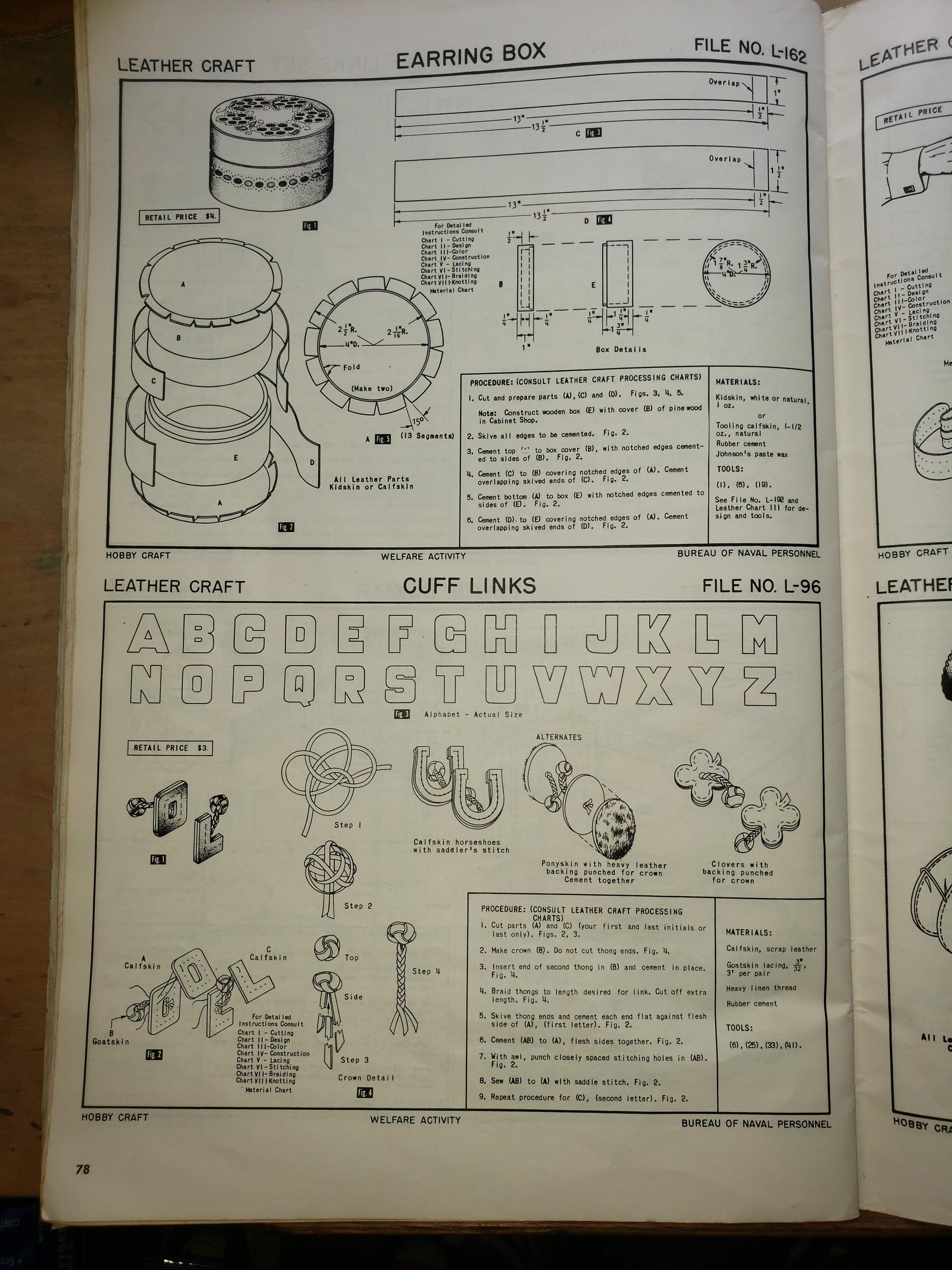

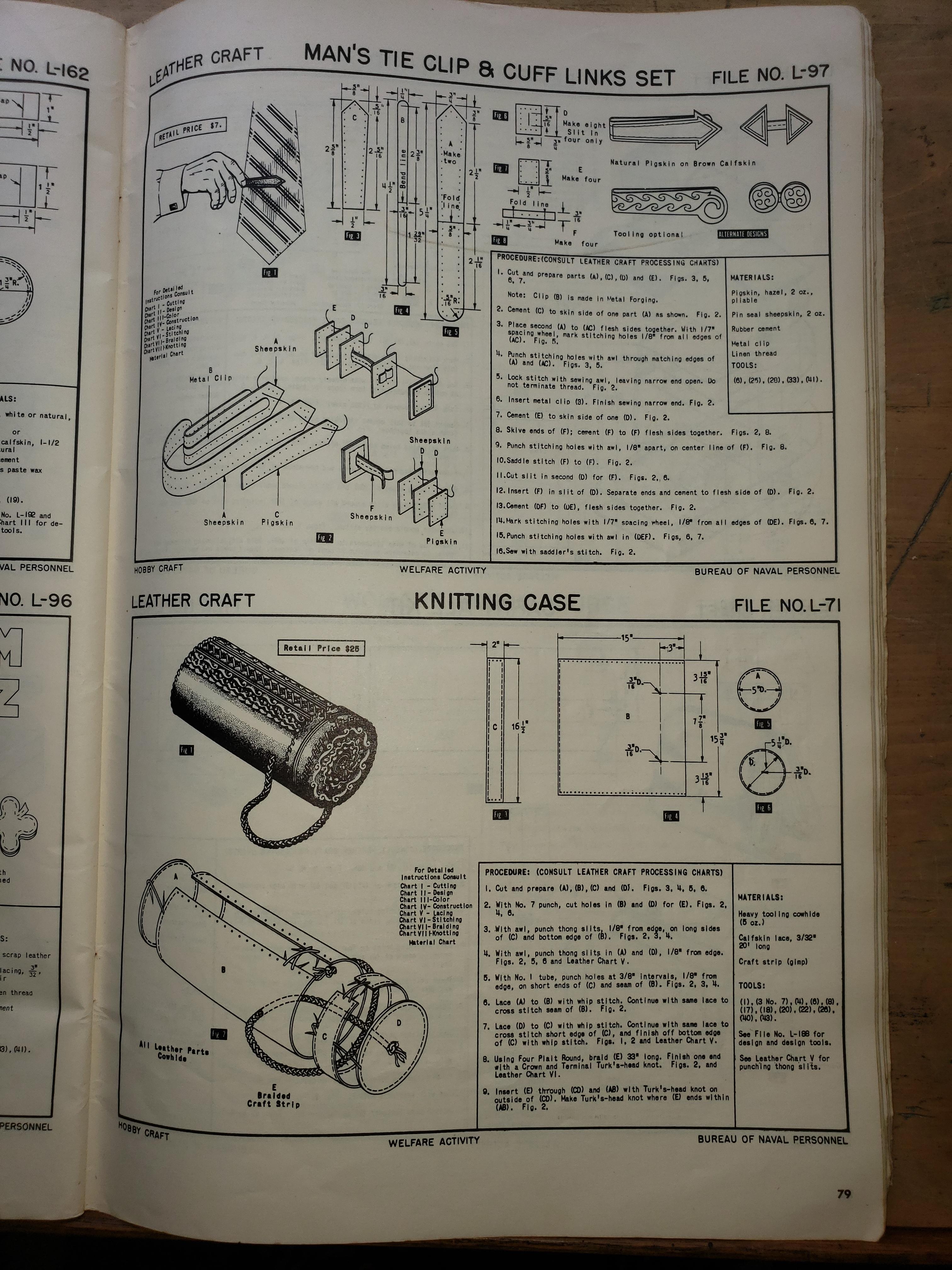

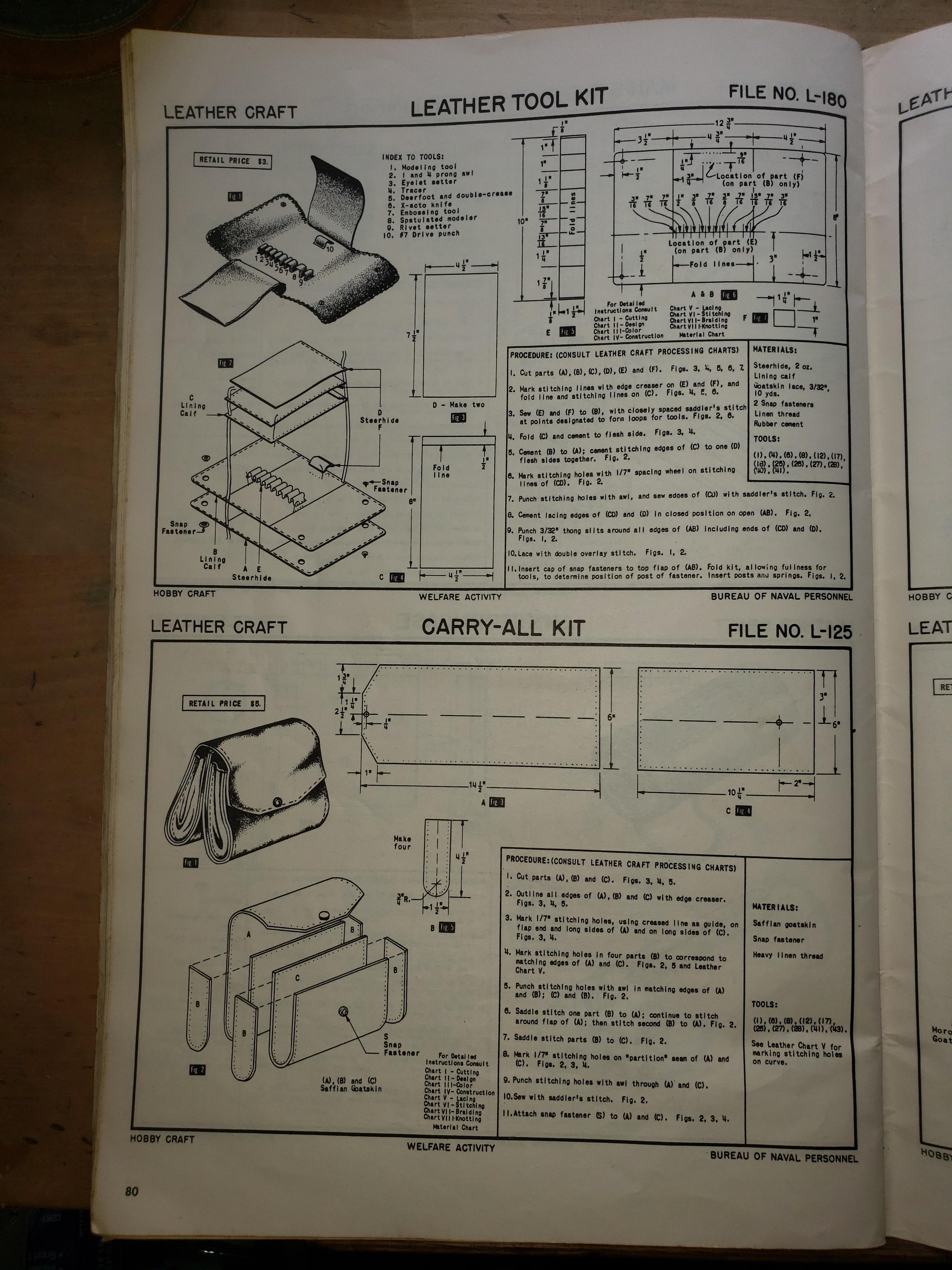

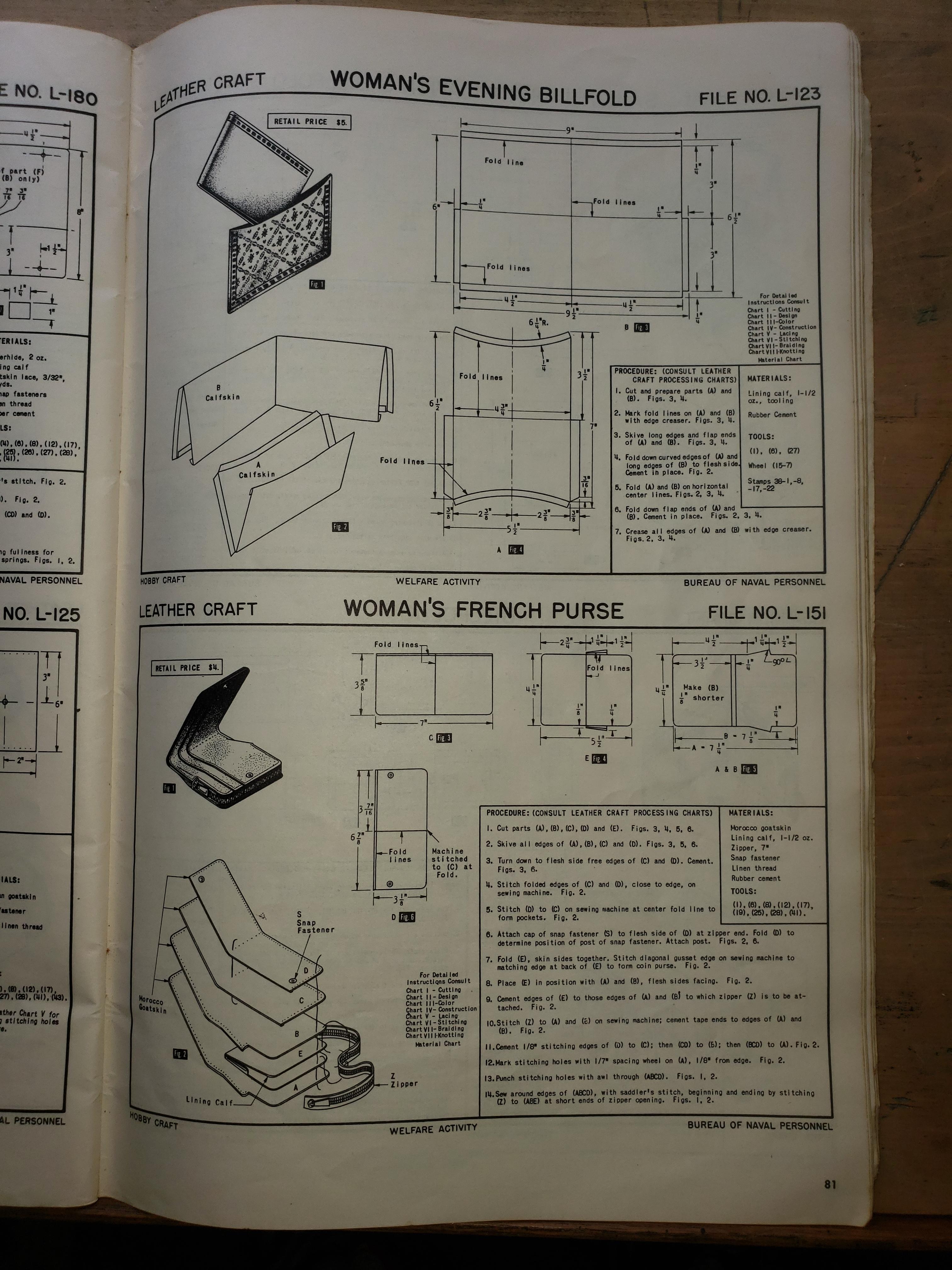

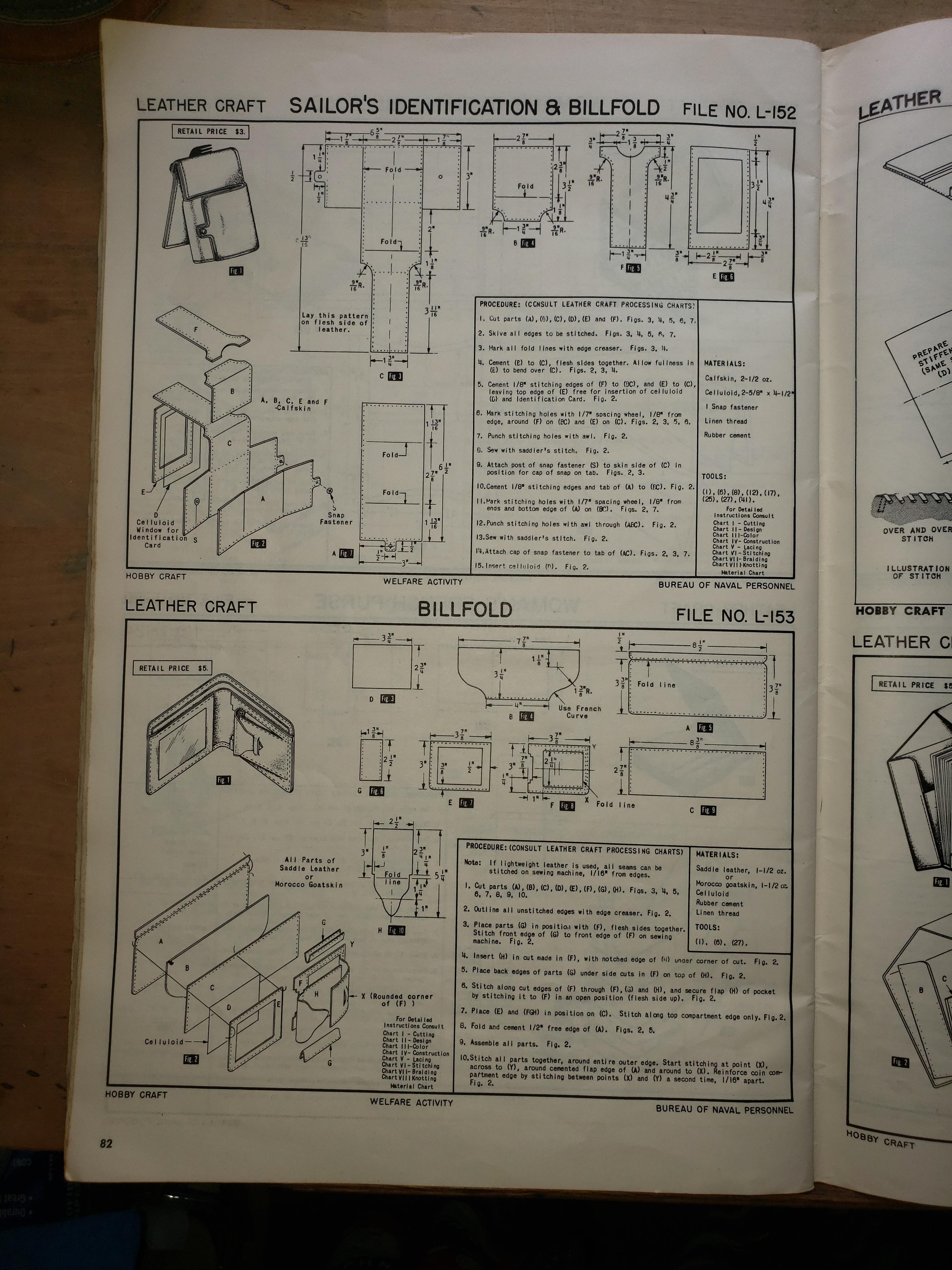

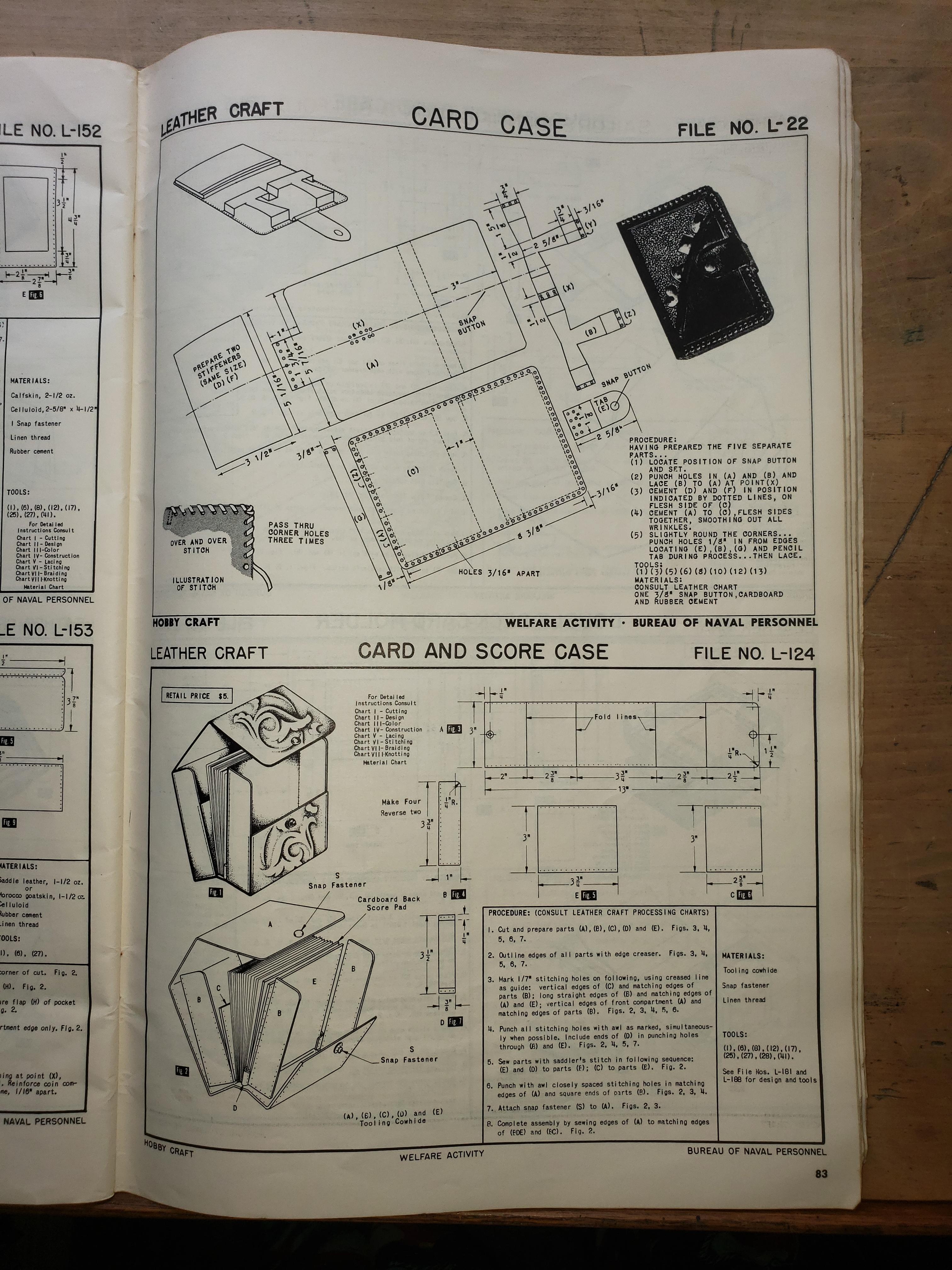

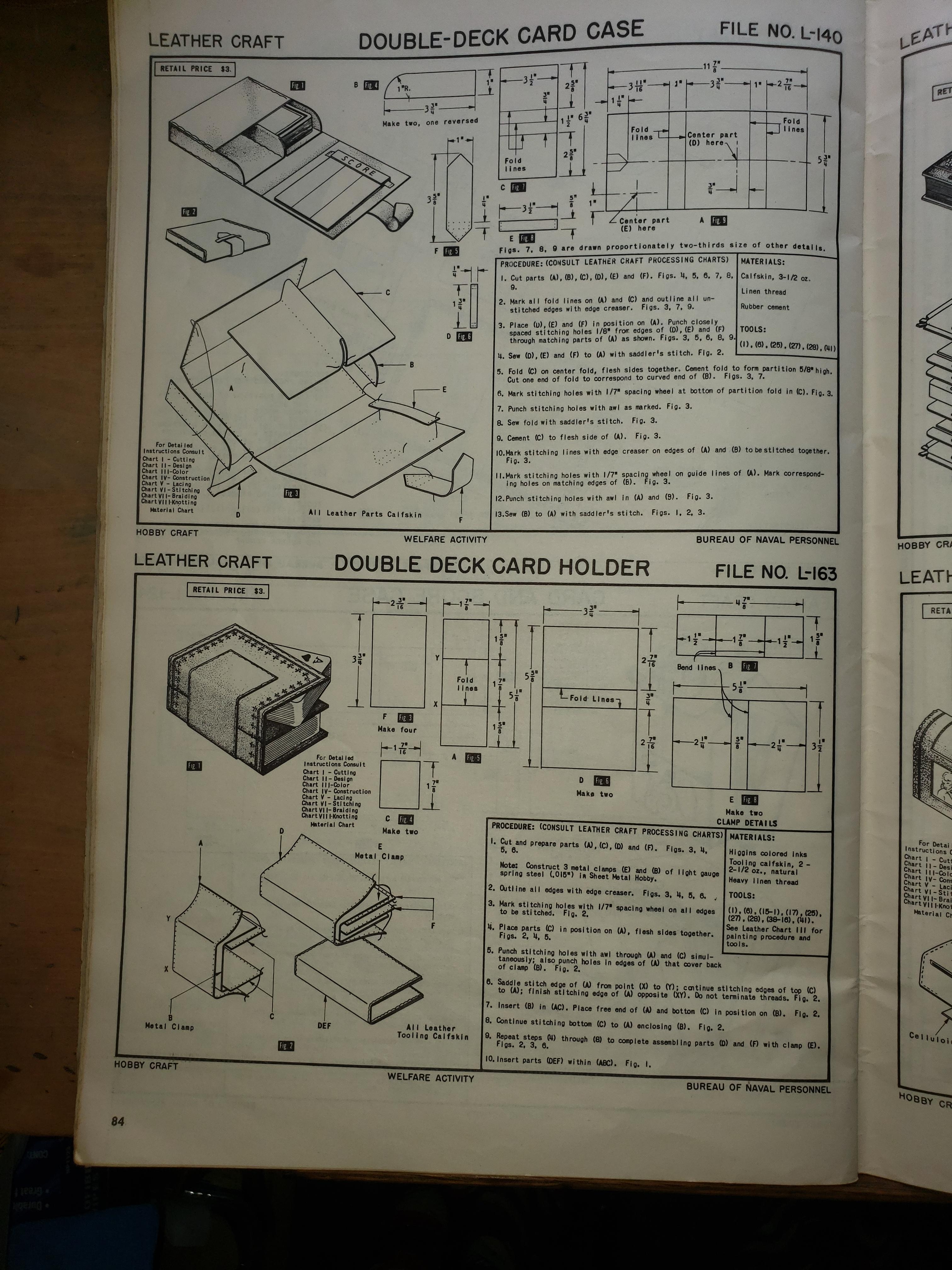

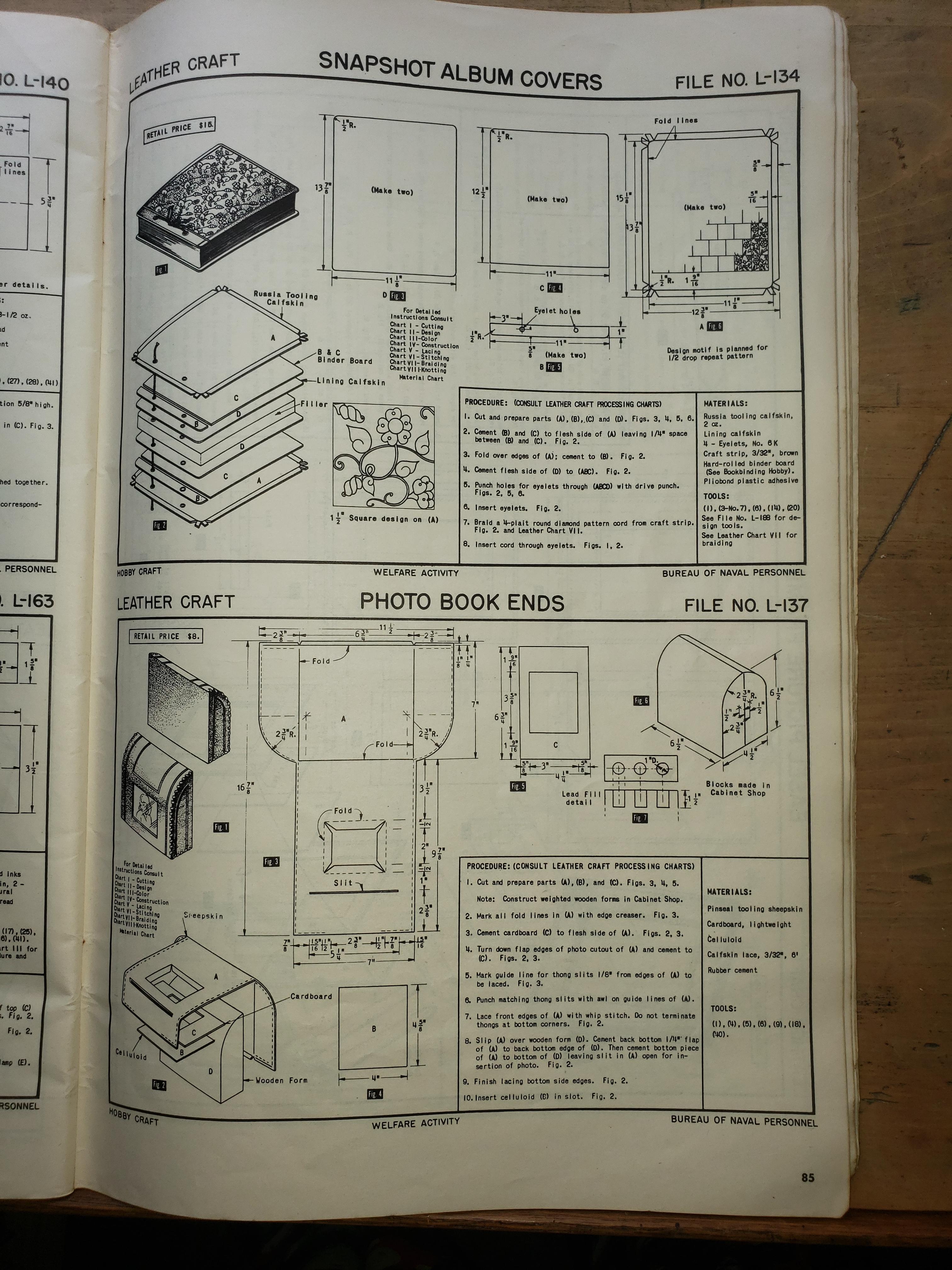

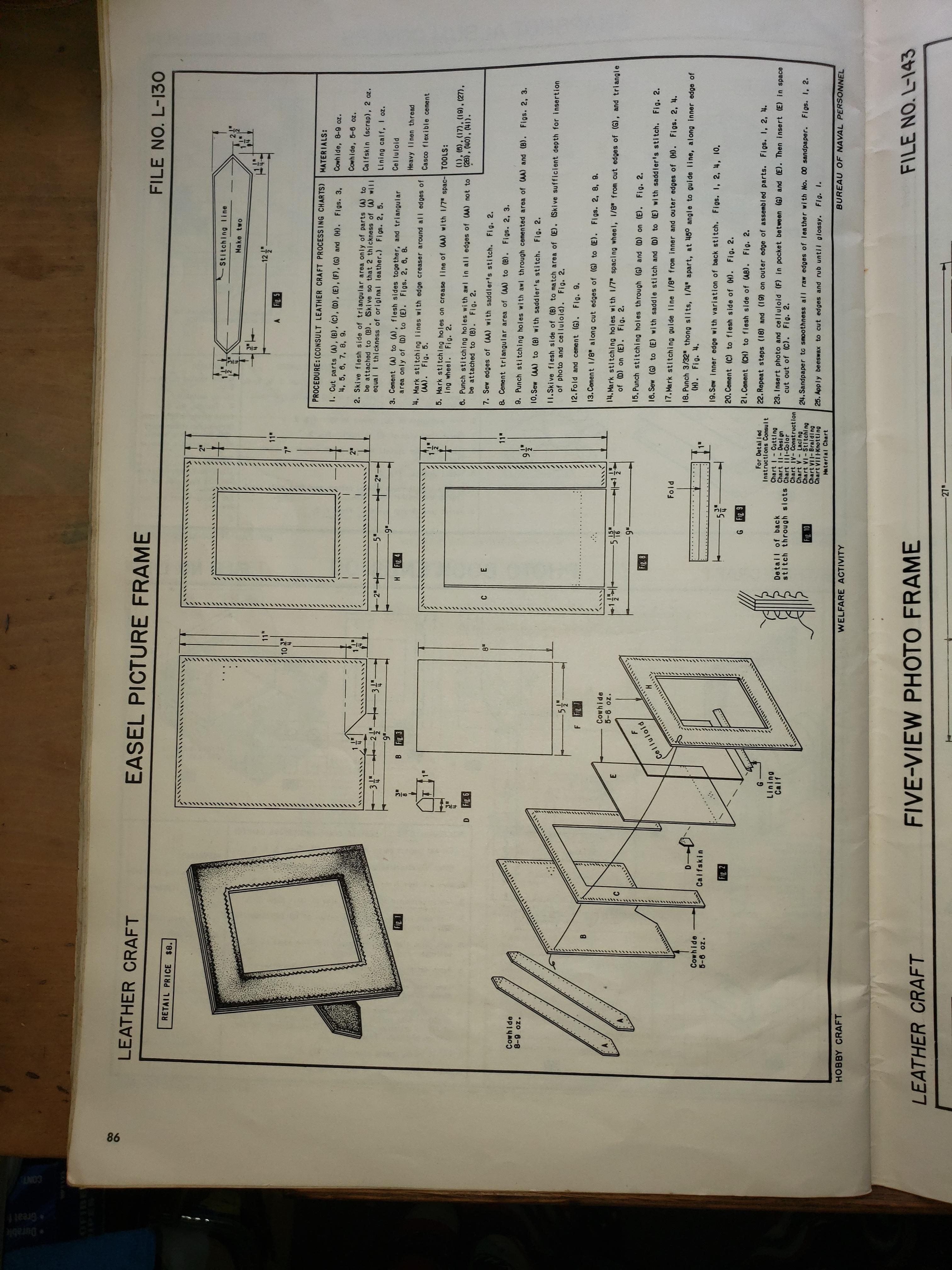

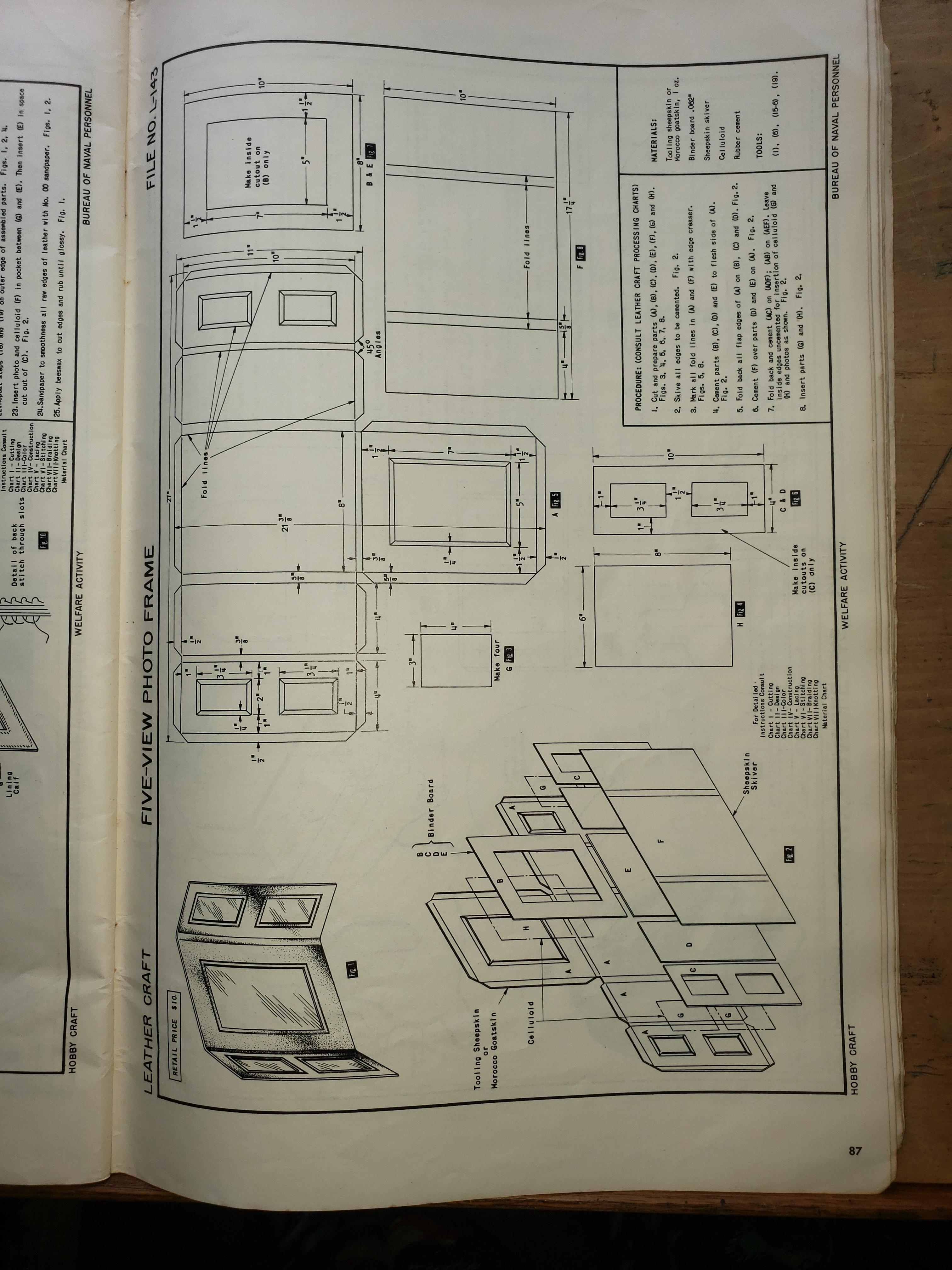

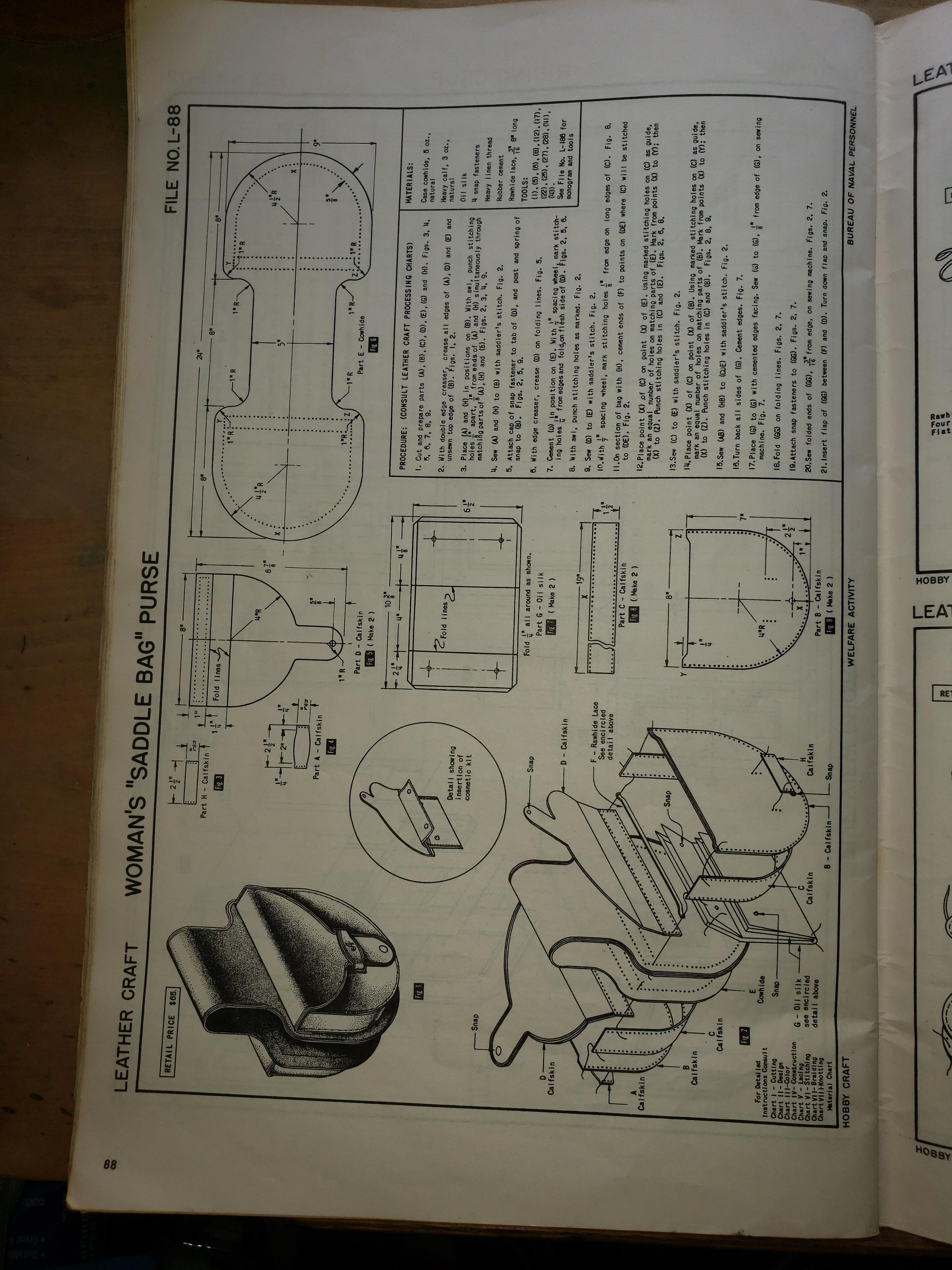

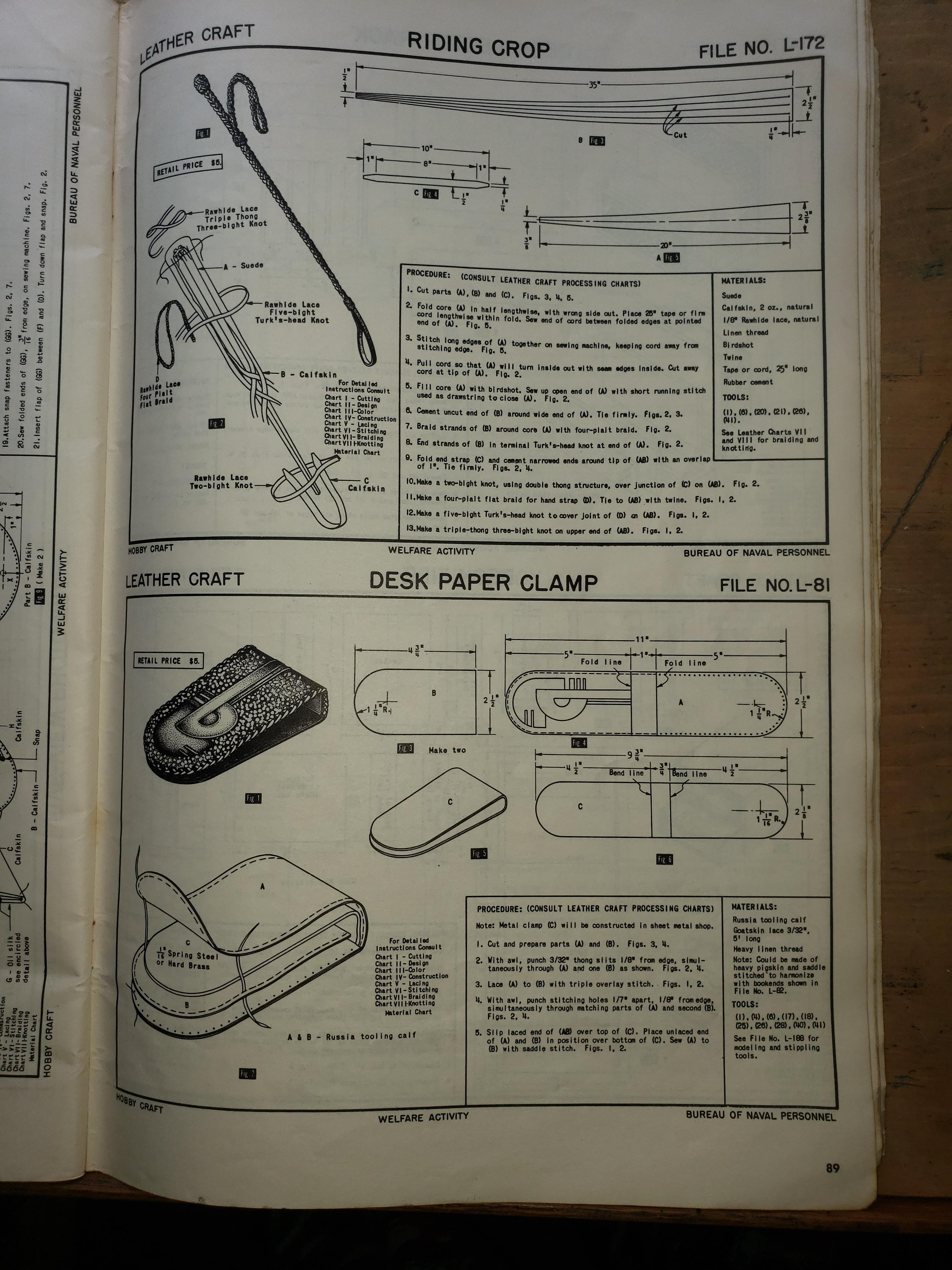

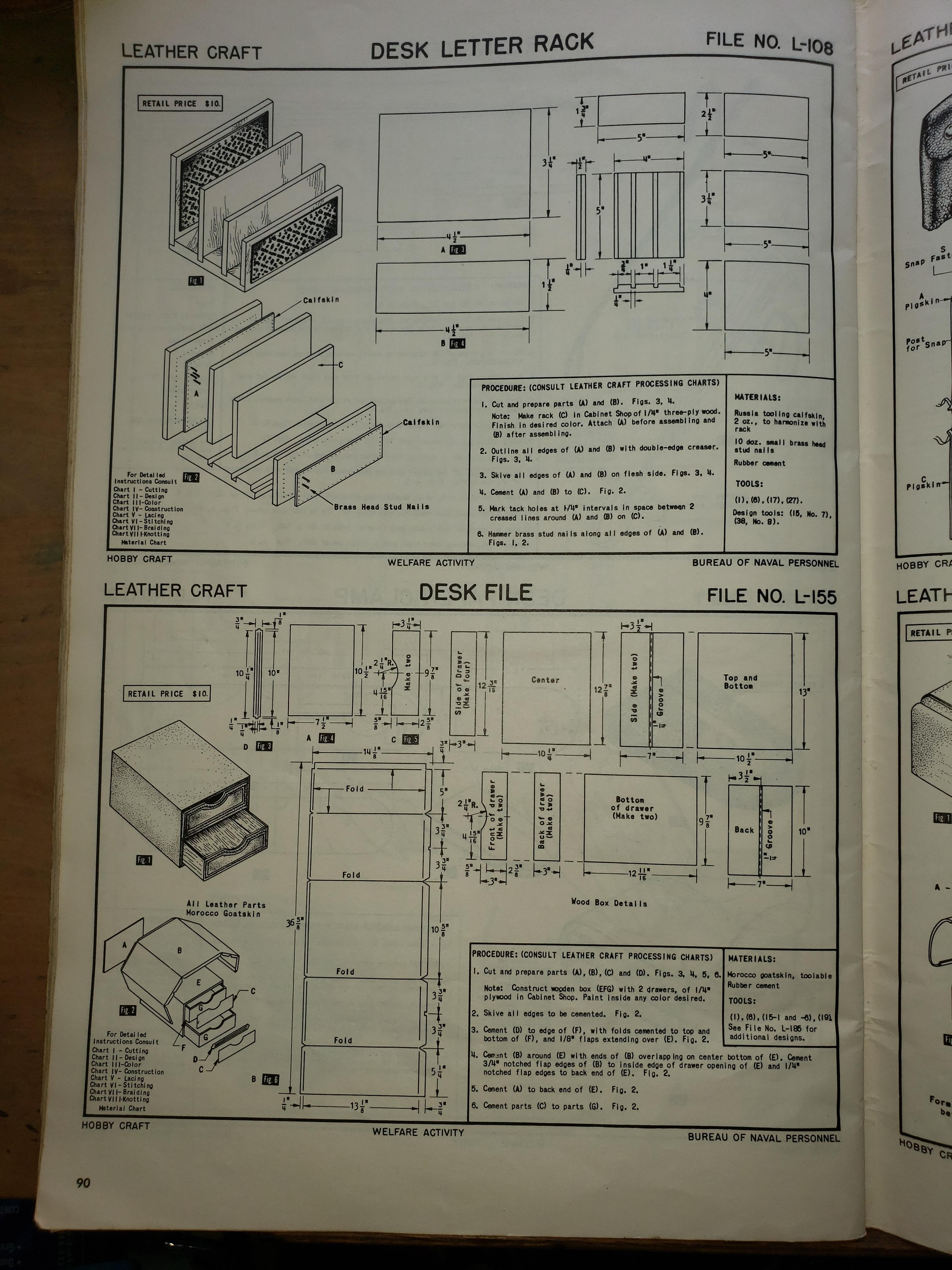

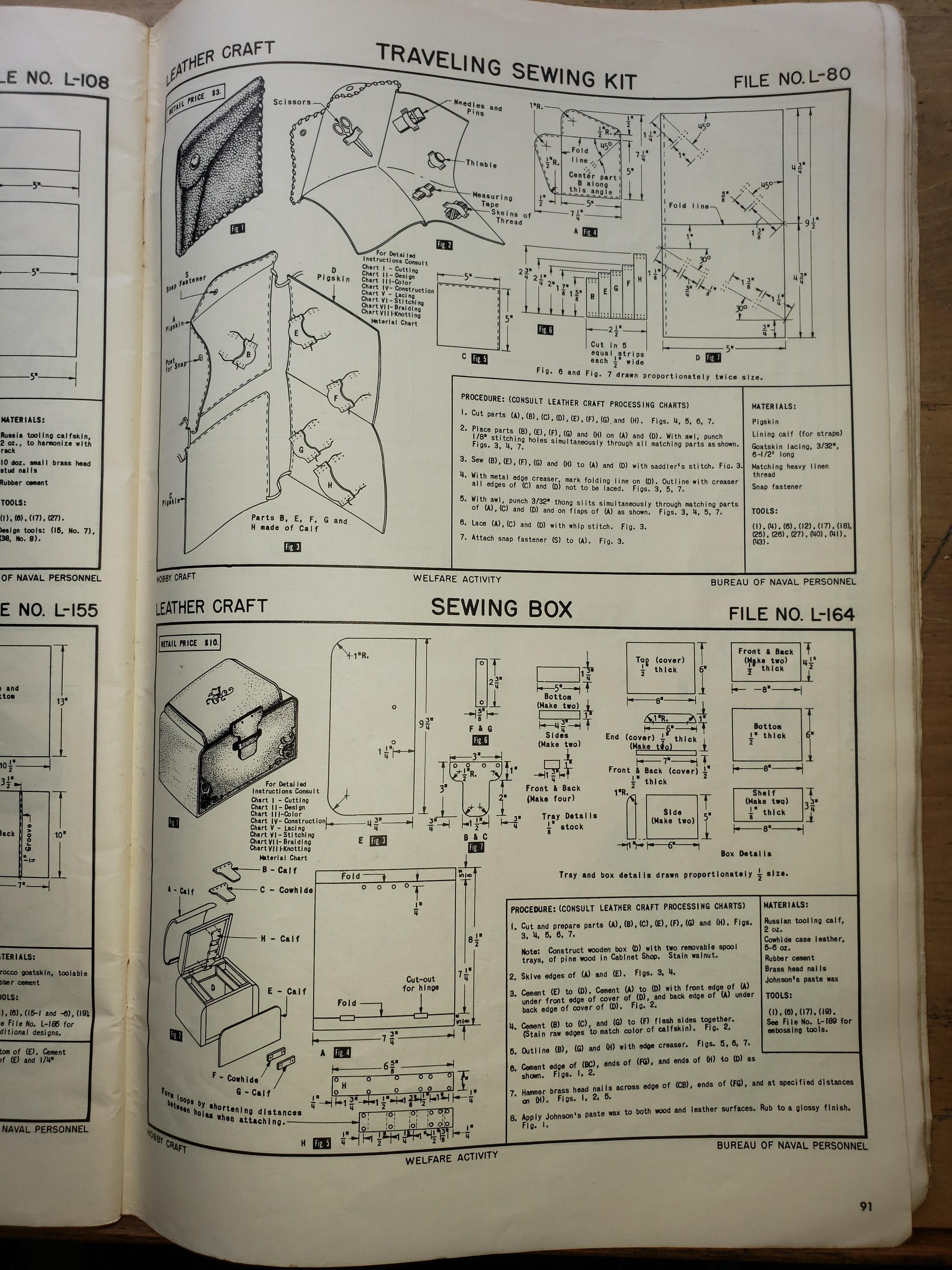

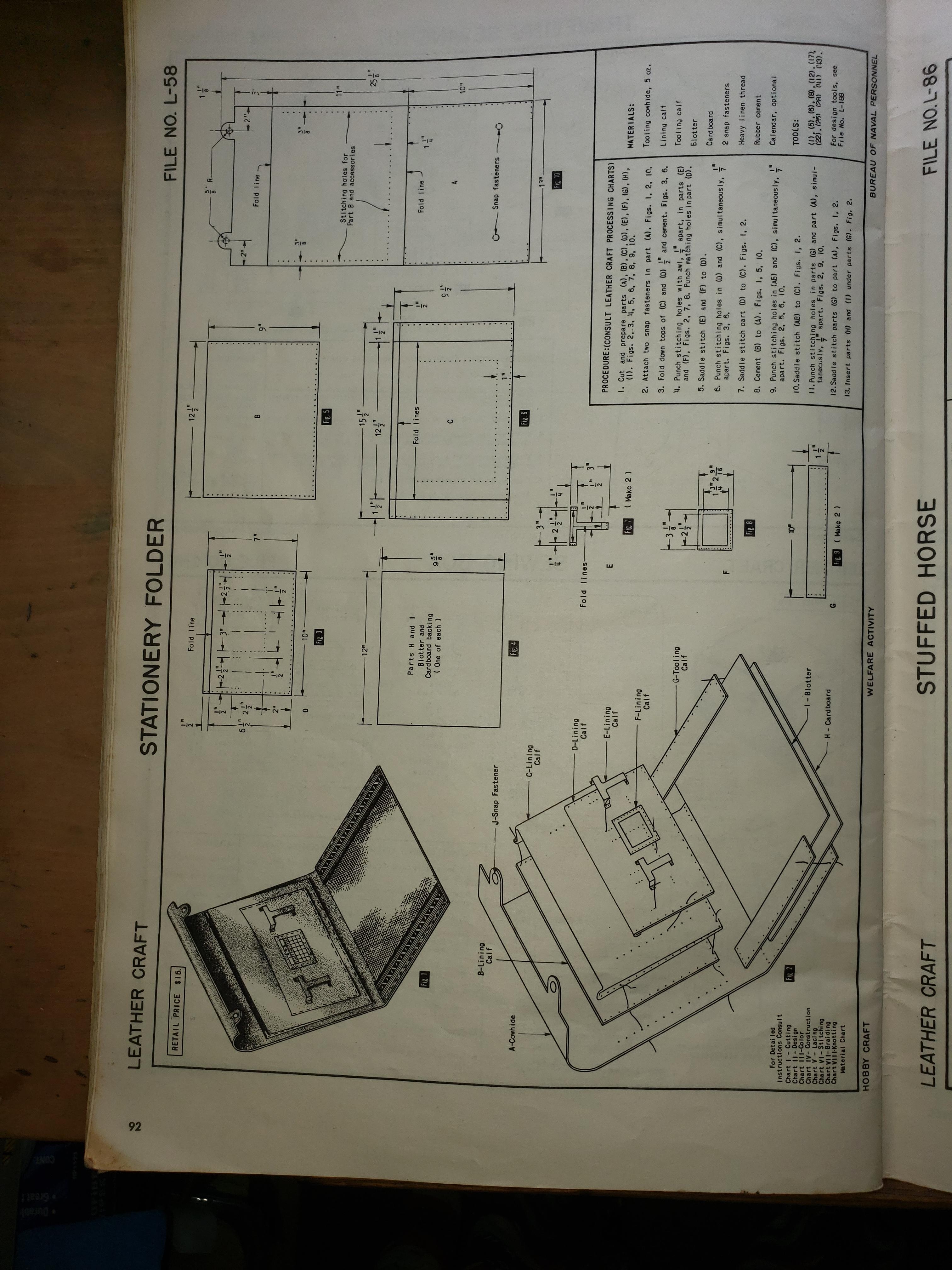

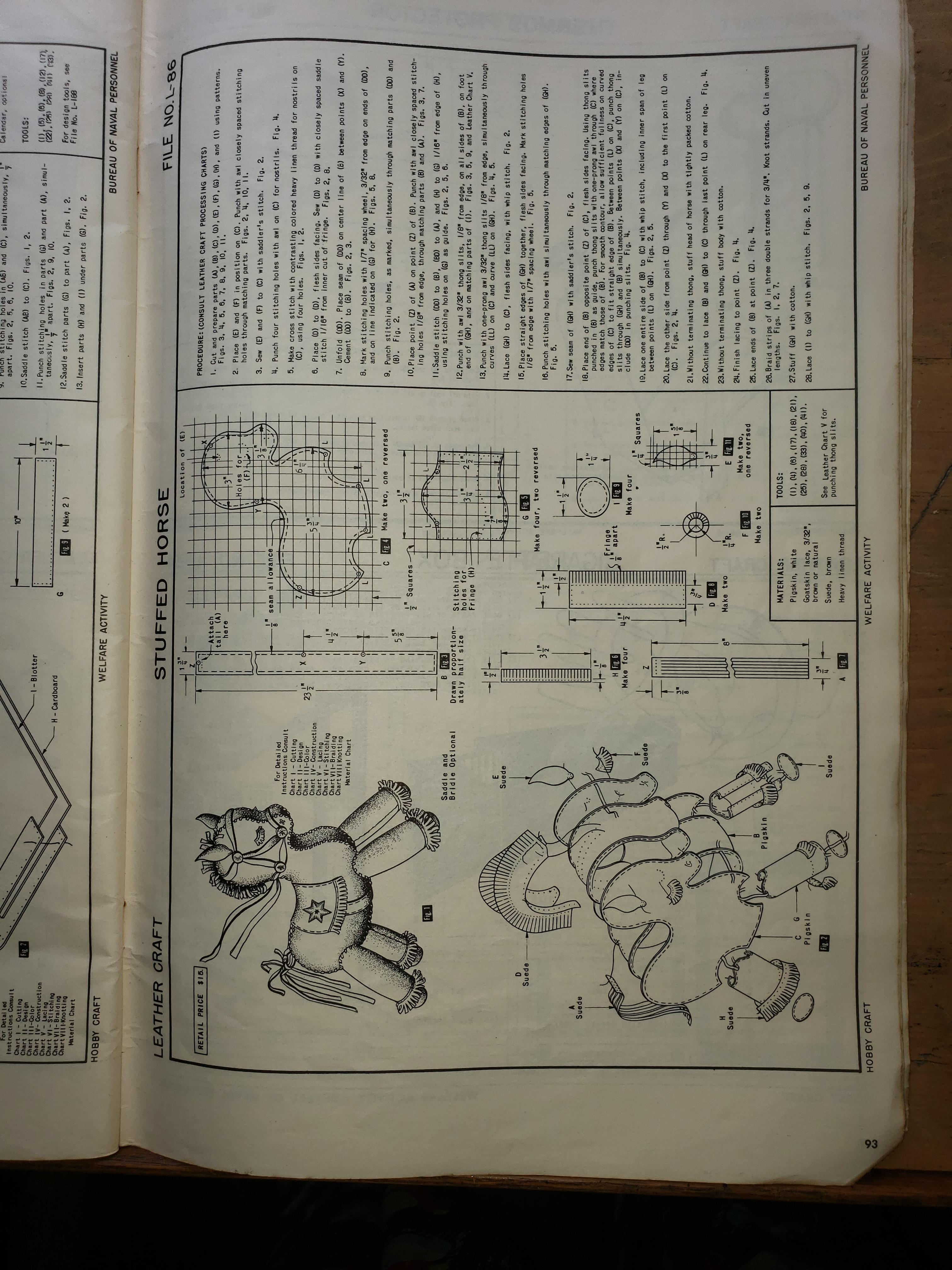

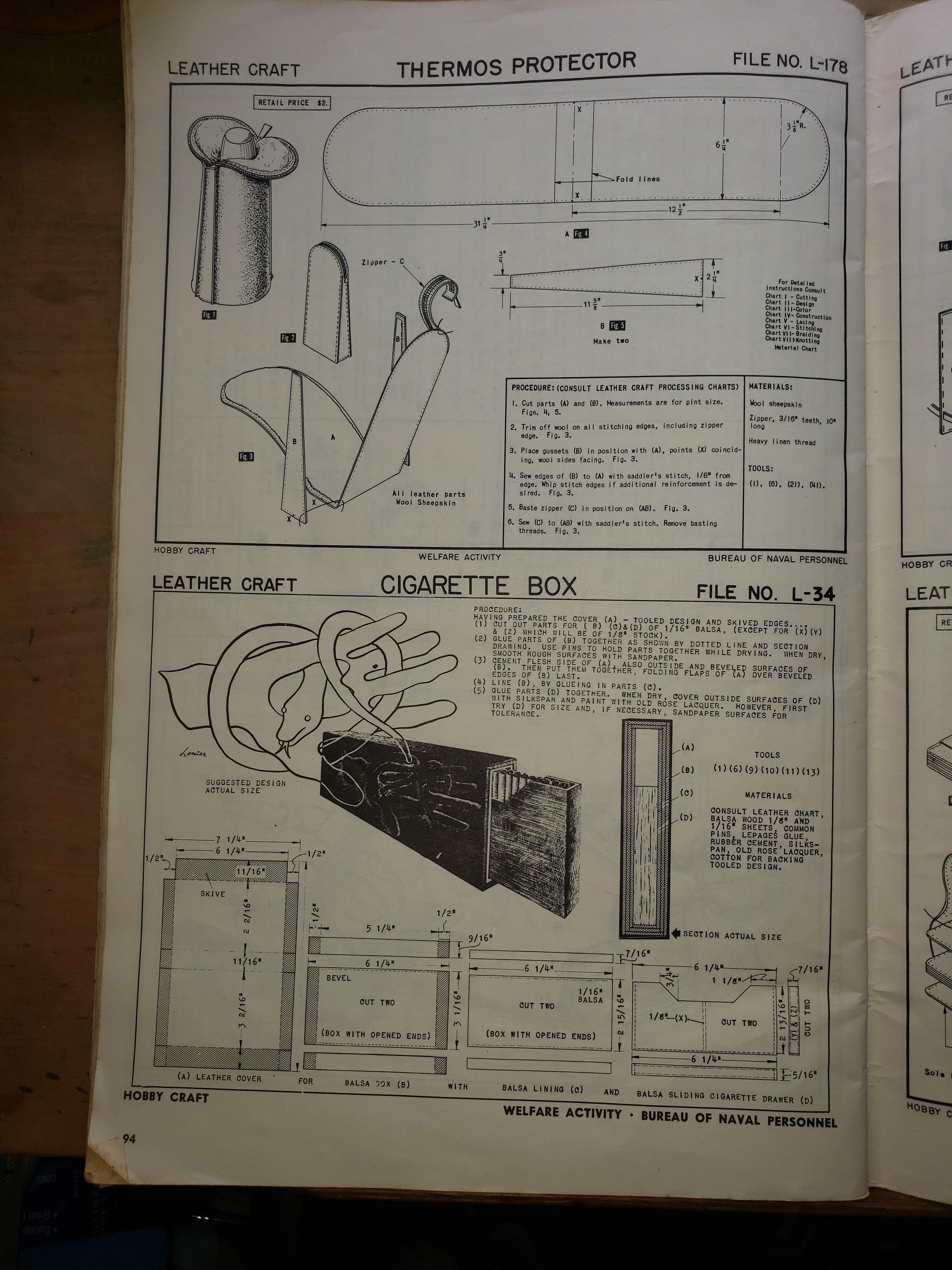

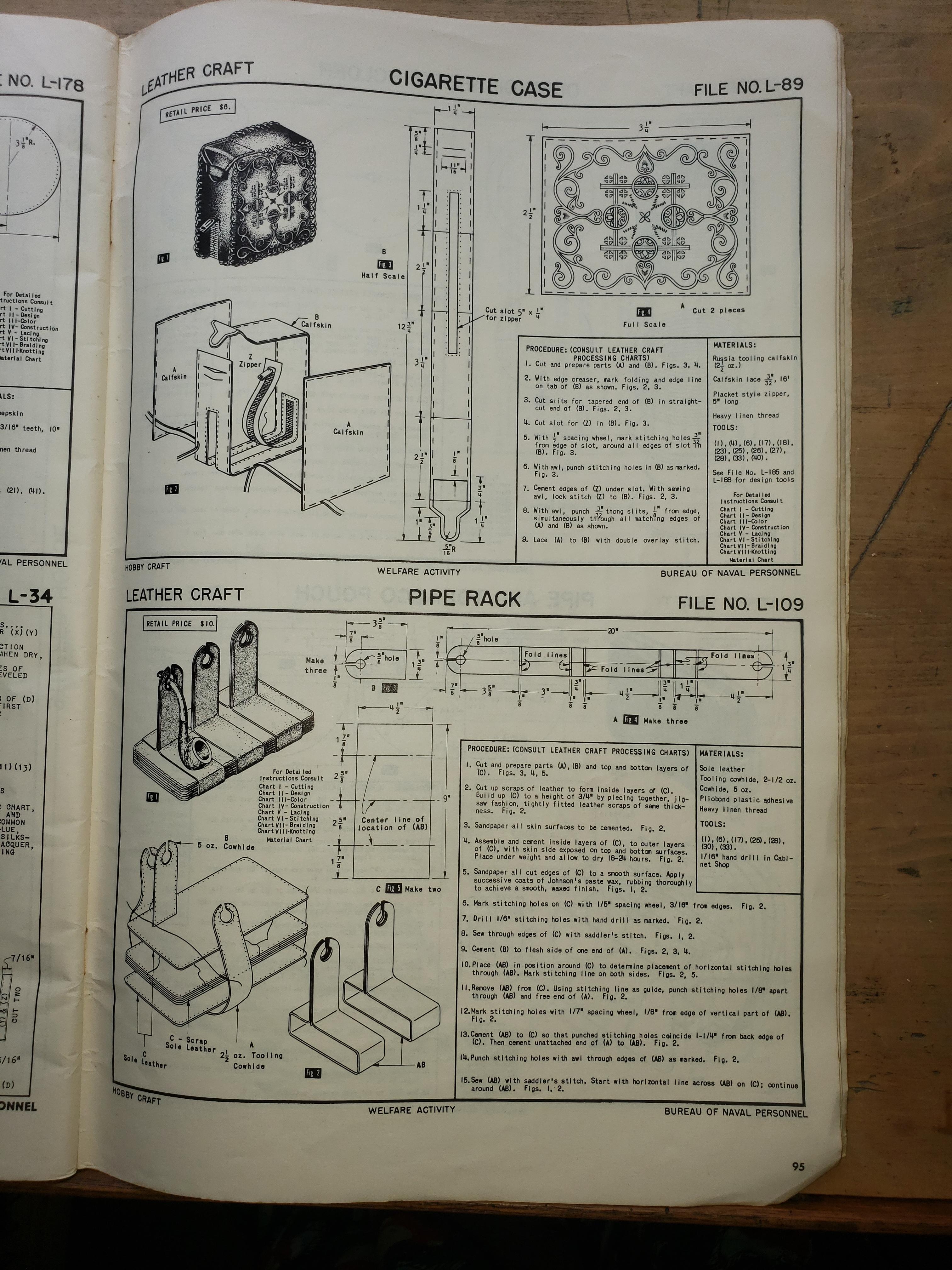

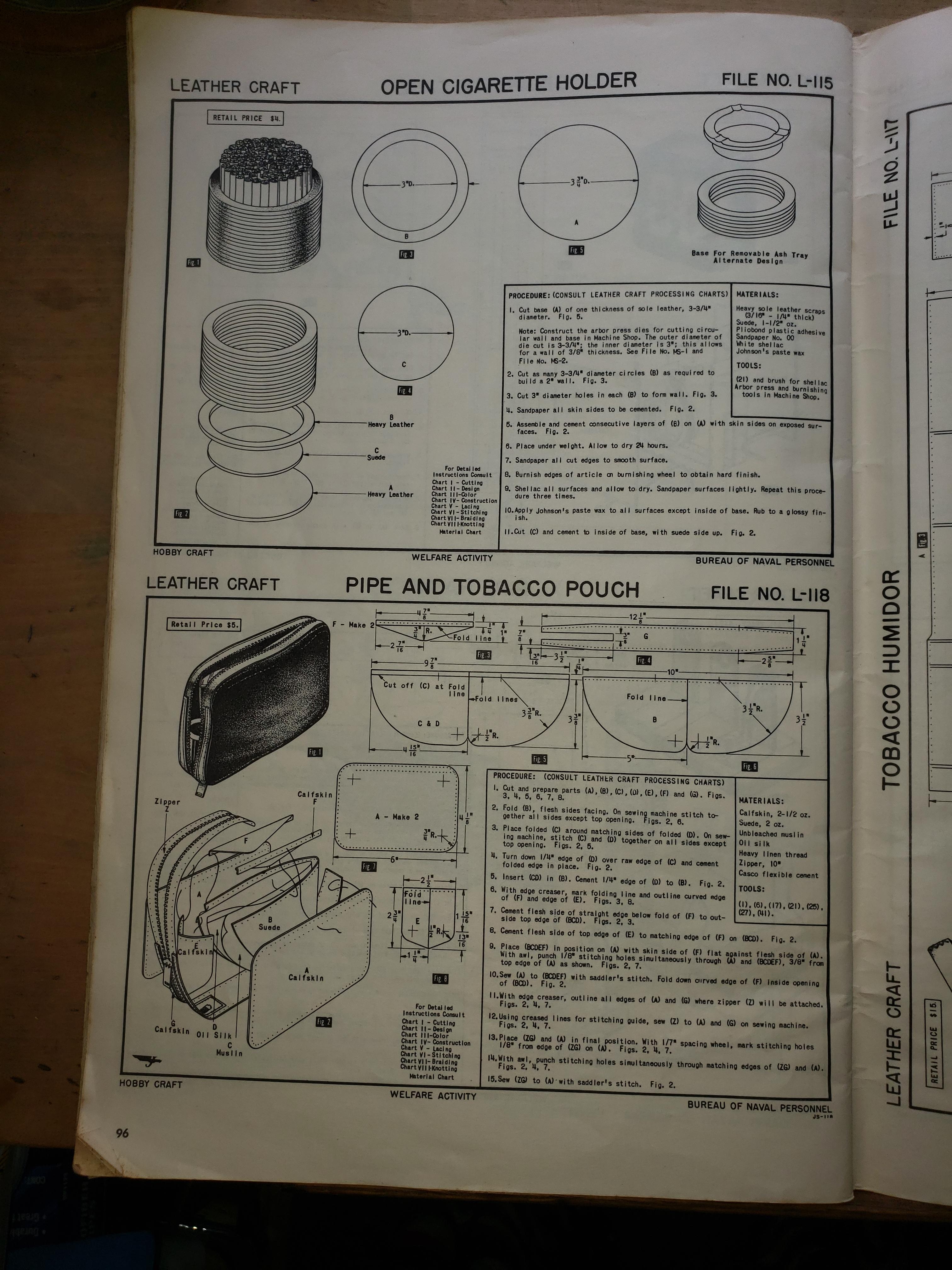

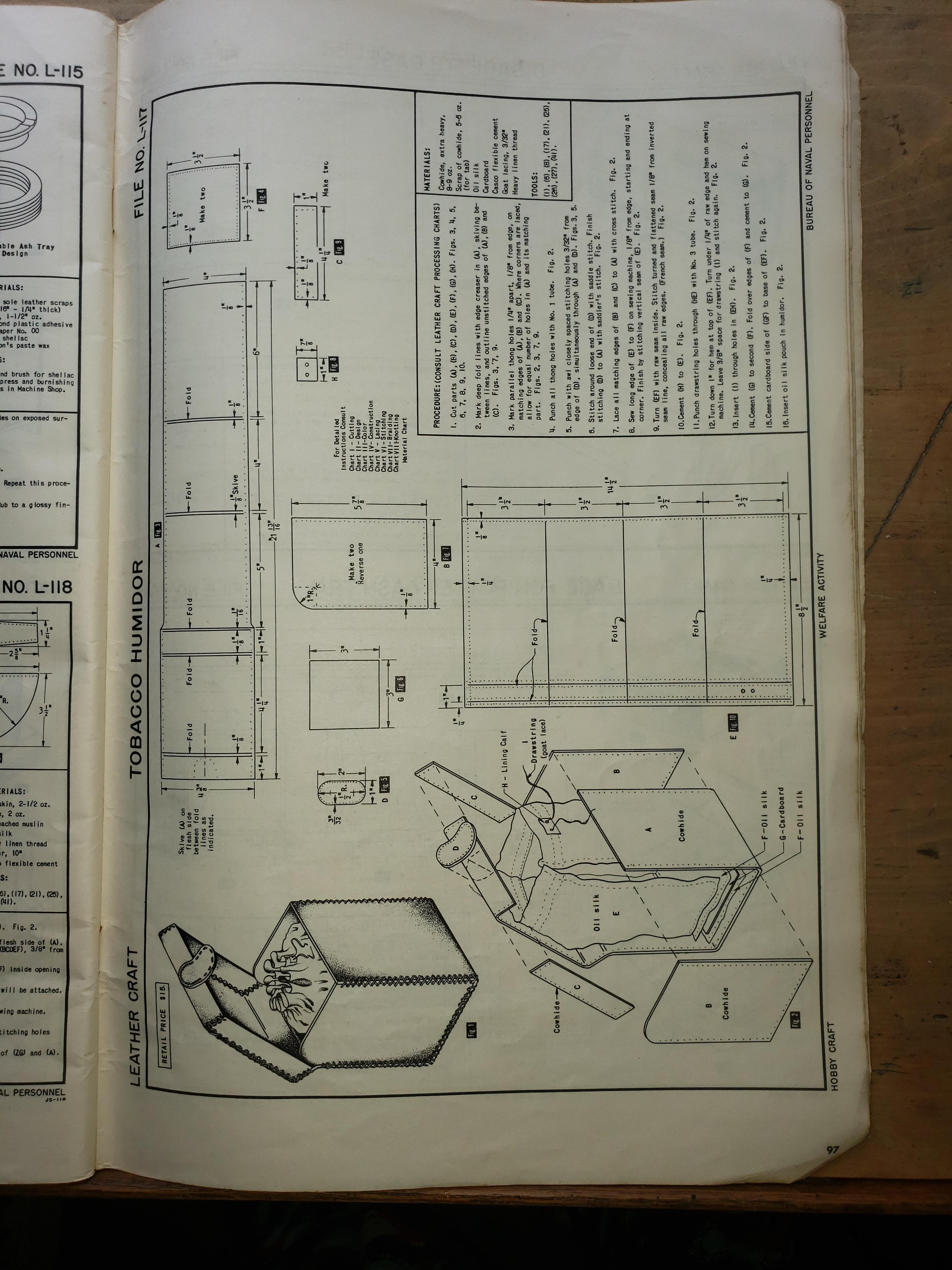

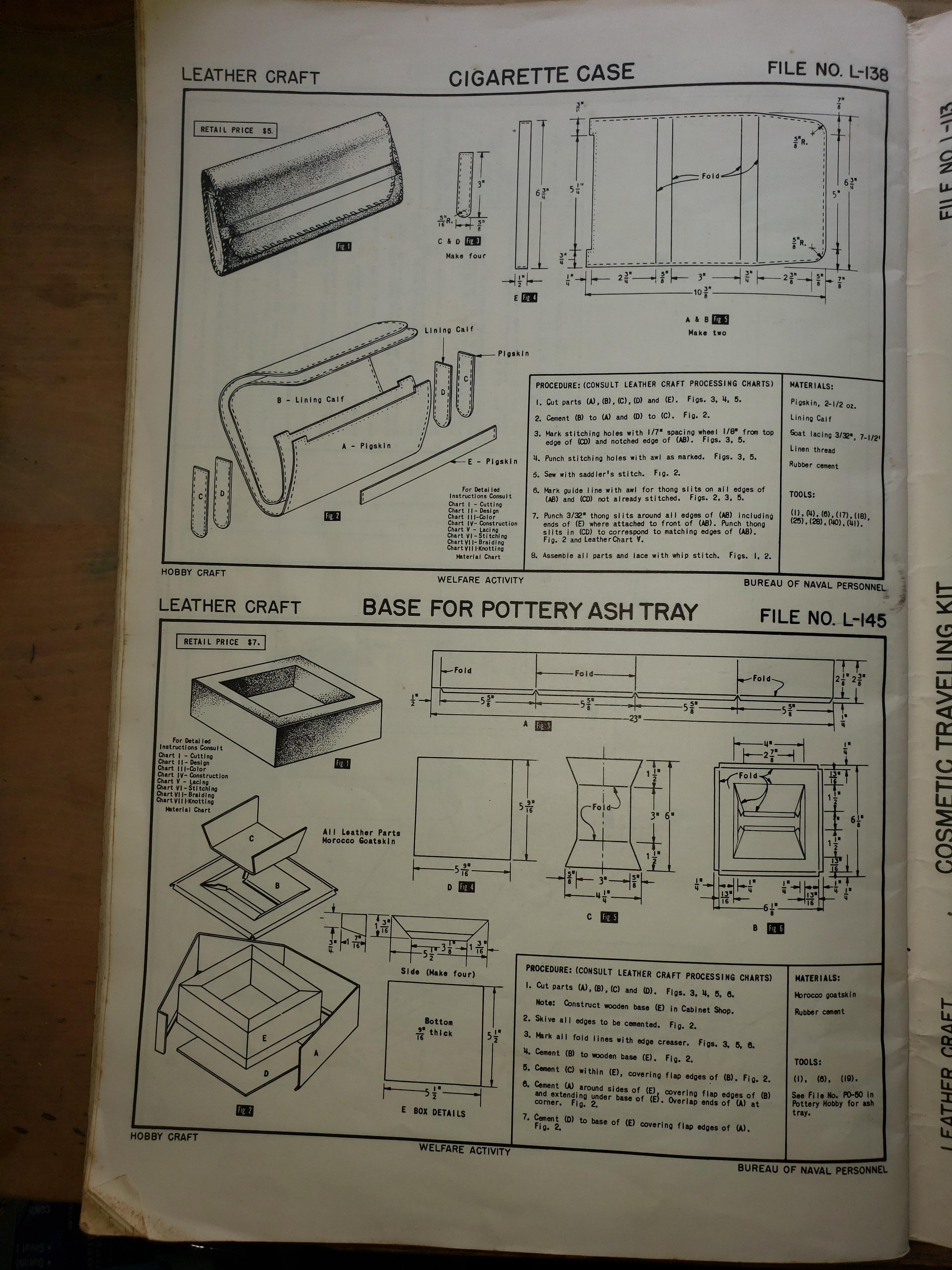

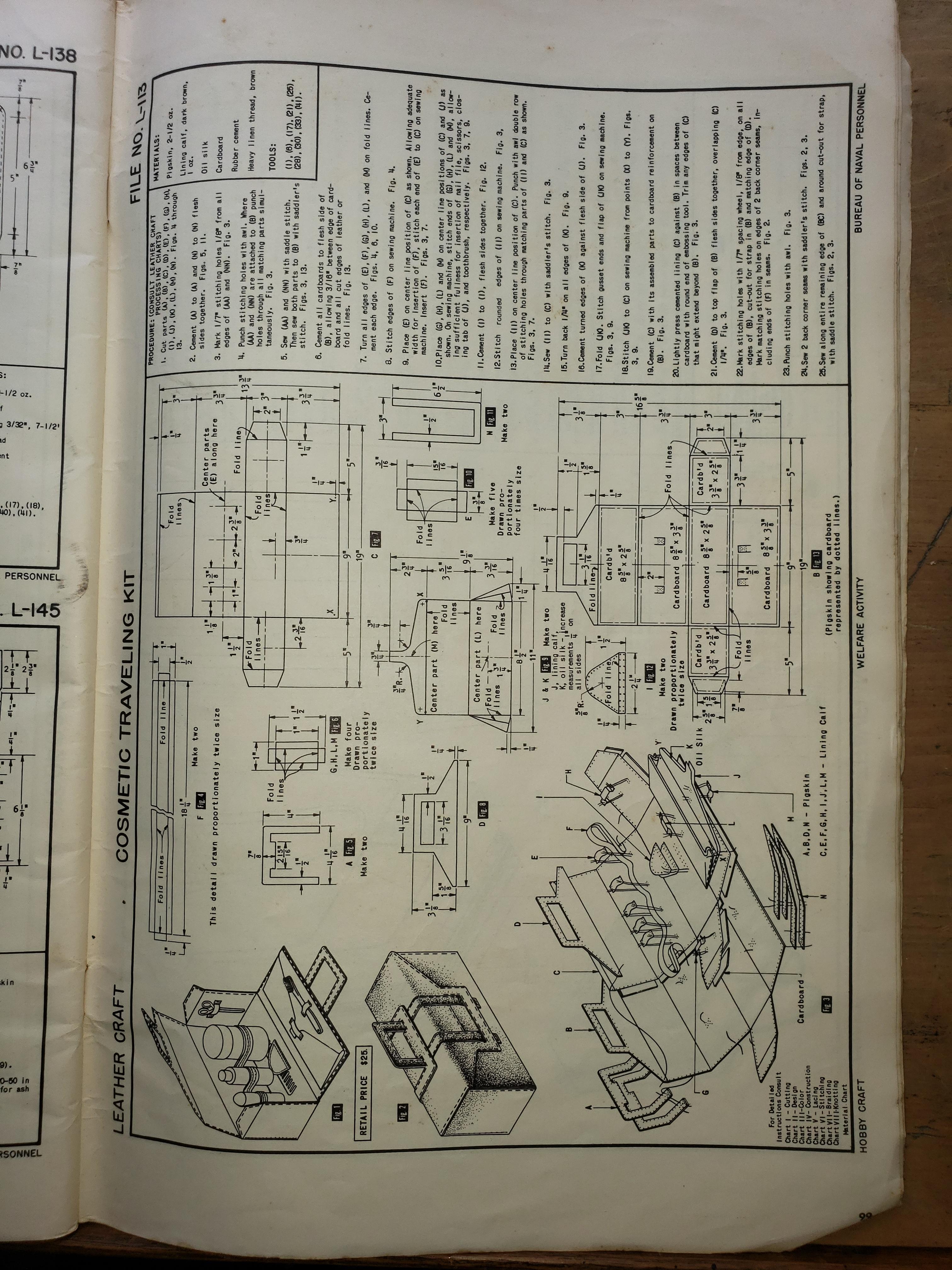

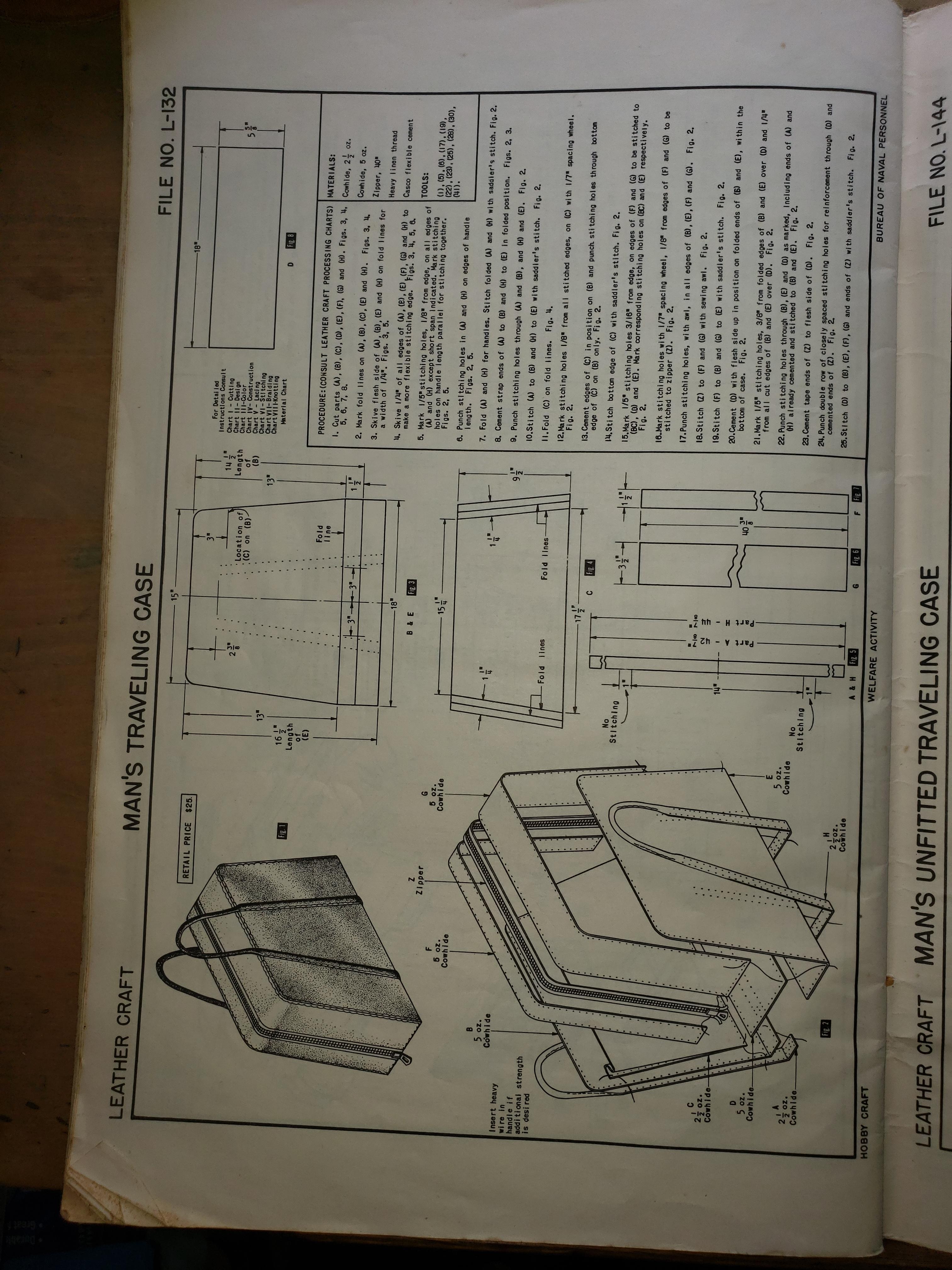

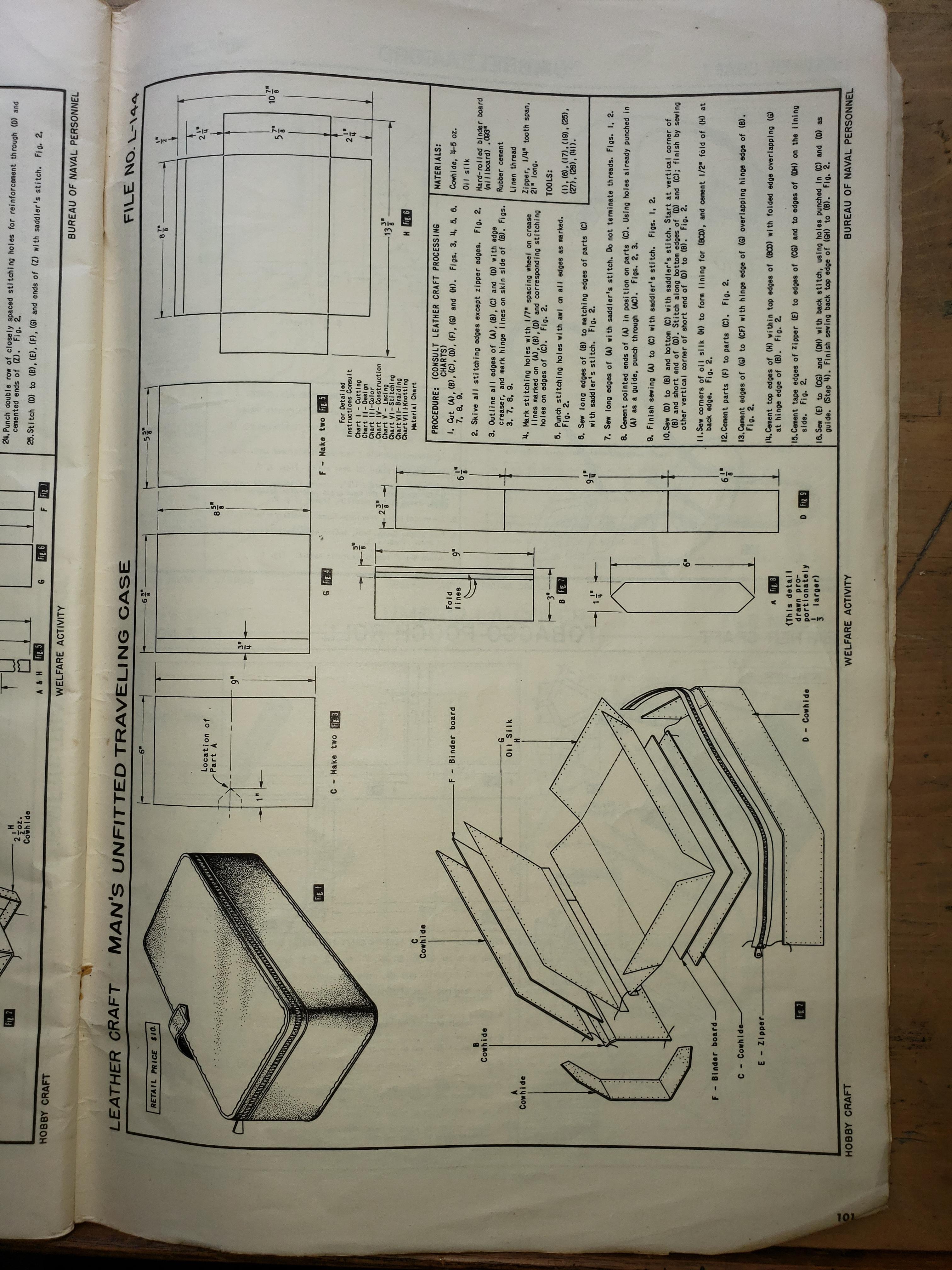

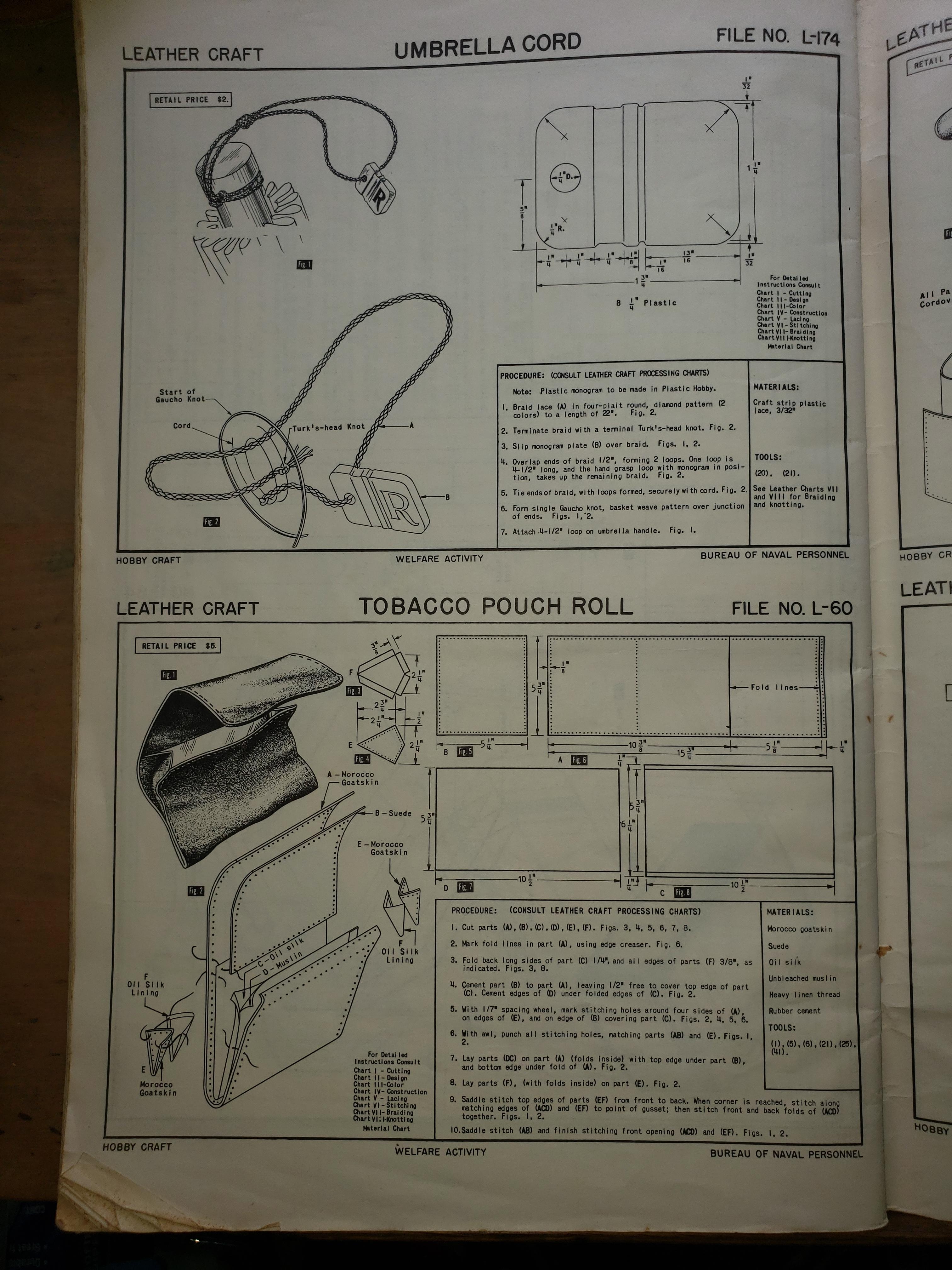

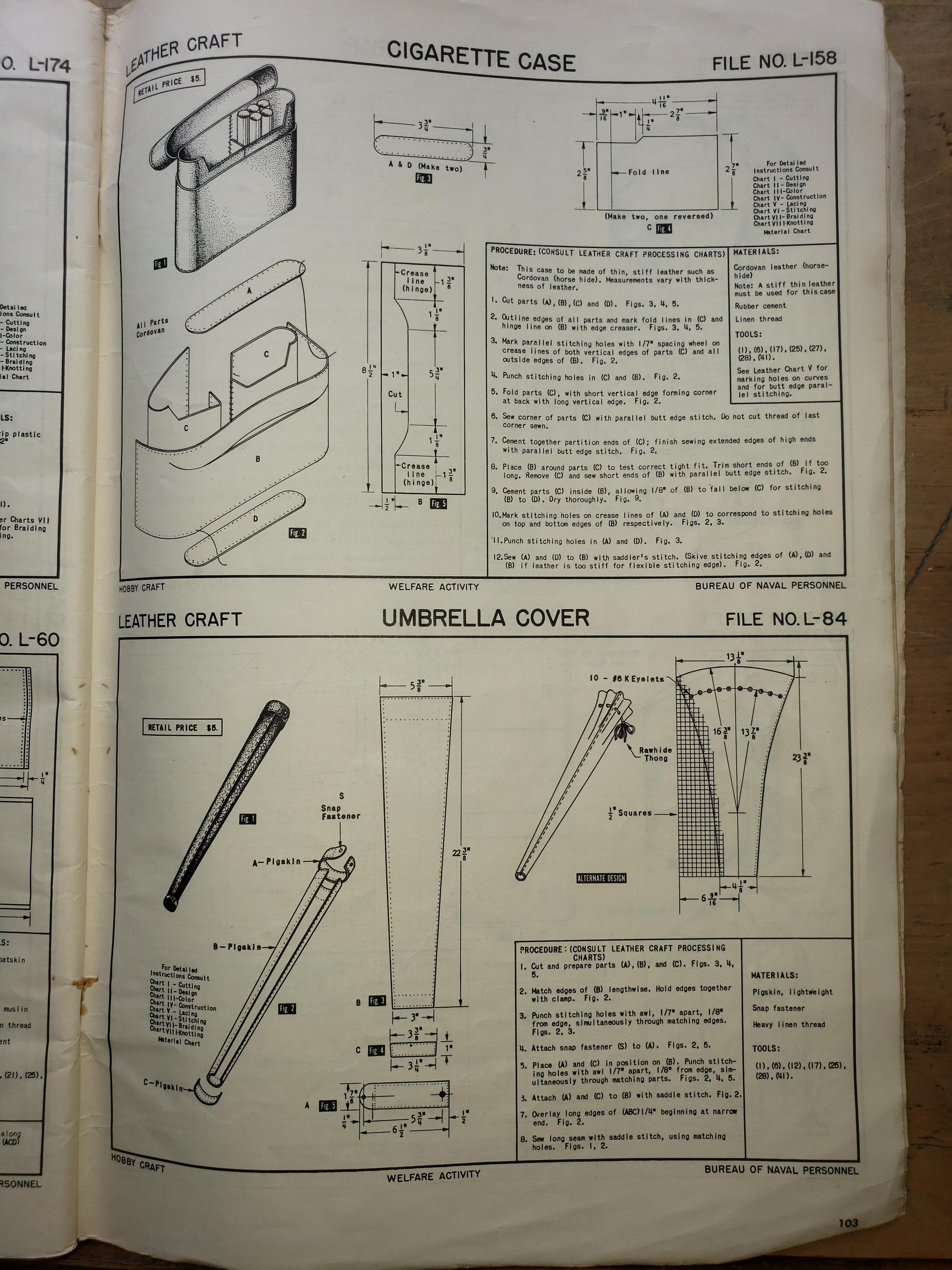

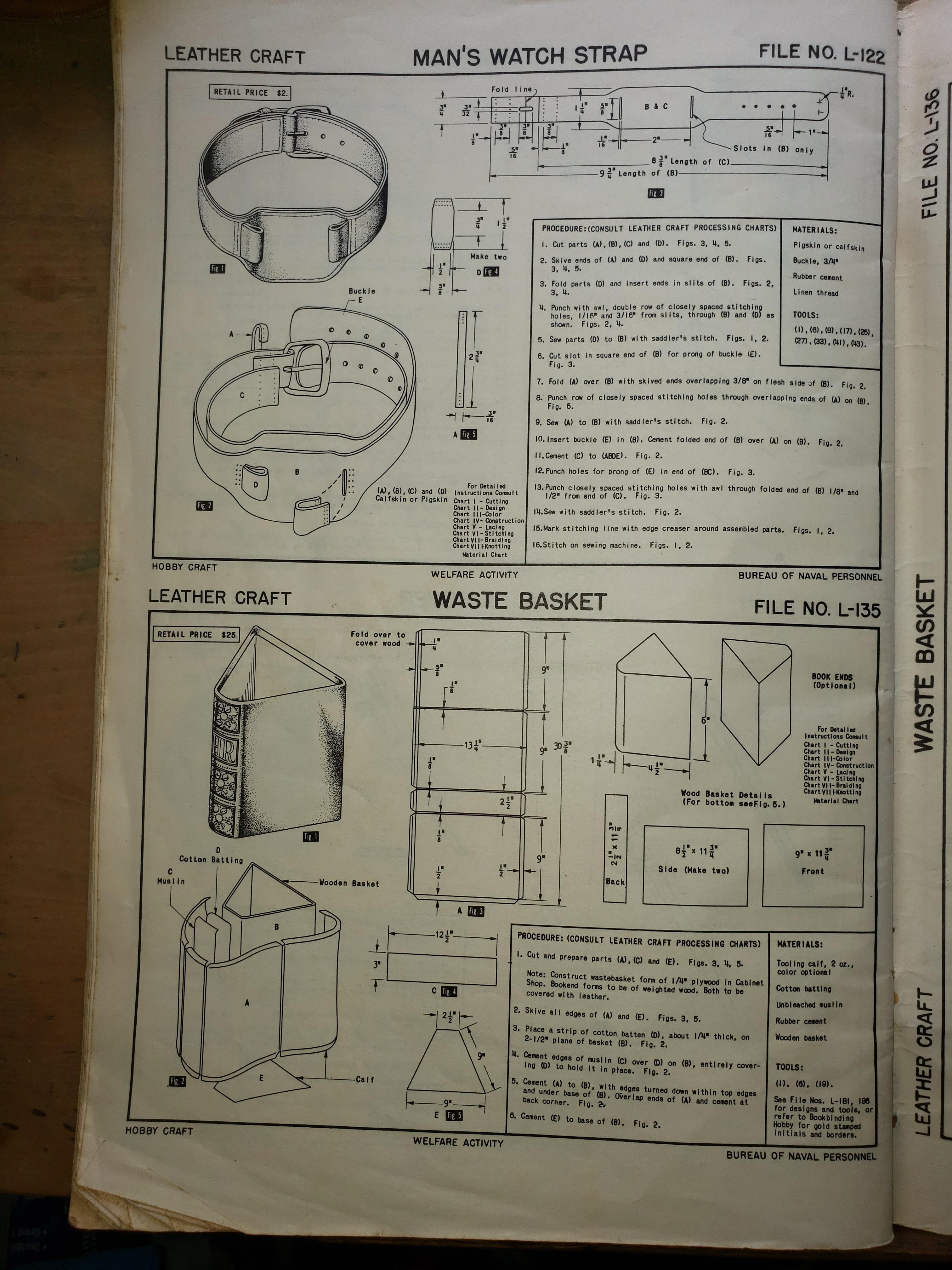

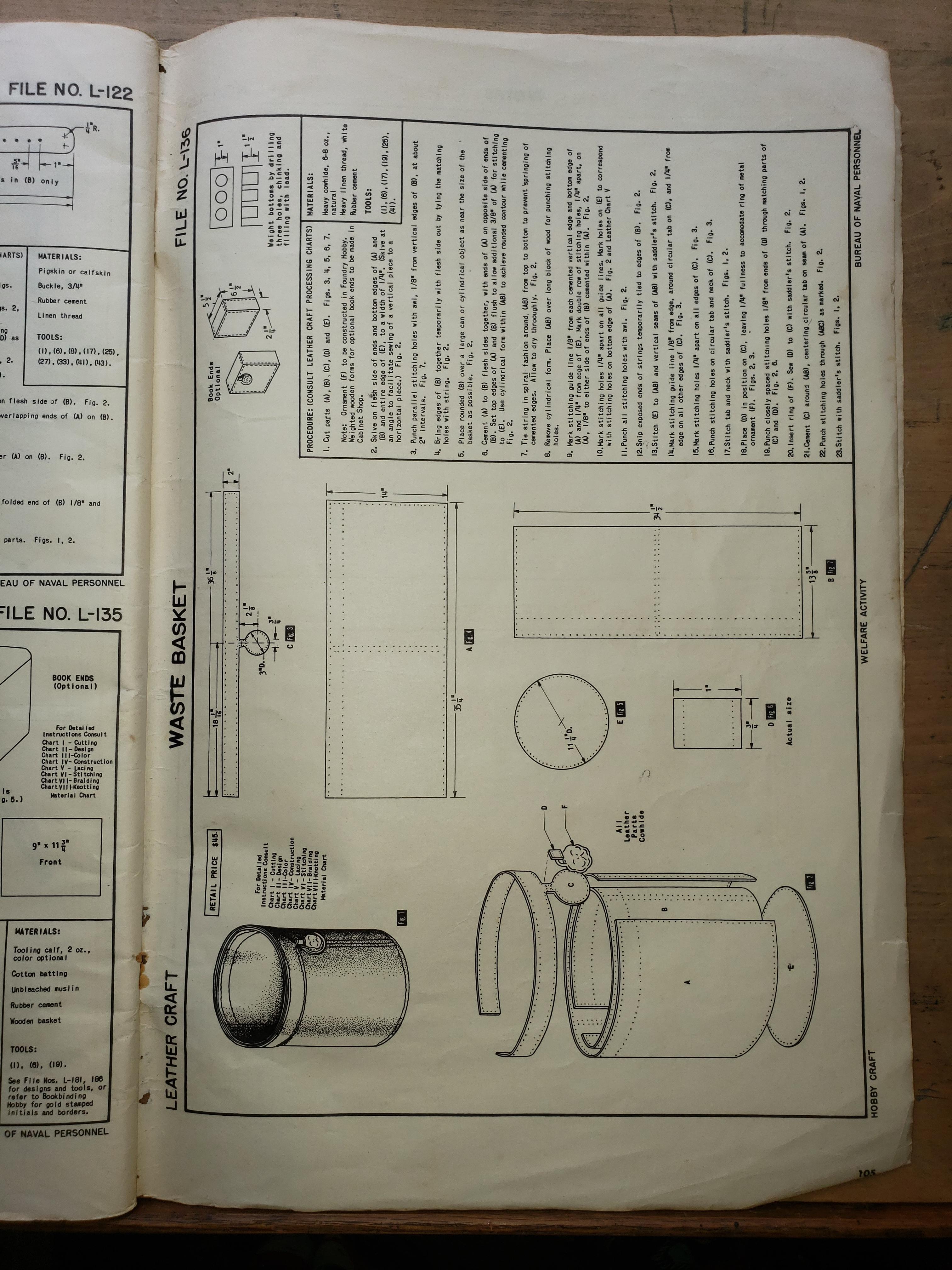

Here are photos of every page of a 1940-1950's era US Navy Leathercraft Manual. It includes patterns, locations to purchase supplies, and much more. I tried to take the best photos I could, if you want a close up of something let me know and I will try to accommodate.

-

Btw, I recently picked up a Coach tote from Coach Bags. It’s beautifully crafted with reinforced seams, and the design might give you some ideas for your project.

-

For the gussets, stitching them on the inside can give the bag a cleaner look, but stitching on the outside might add more durability if you're carrying something heavy like your music binder. Using a flap at the bottom to reinforce the seam is a great idea, definitely smart to avoid an outer seam at the bottom where wear and tear are most likely.

-

I just checked out your videos, really cool to see the stamping/tooling process in action! Regarding angles, maybe consider using a few different camera setups if possible, to give viewers multiple perspectives overhead, side, and maybe a close-up on the details. Adding music and subtitles is a great touch for engagement and clarity.

- 31 replies